If you've ever considered part exchange when selling your development, now is the perfect time. It’s been hard for prospective buyers to acquire properties in recent months, with an average home purchase taking 135 days between instruction and completion; this has affected the sales process, making it long, unstable and difficult to track due to multiple parties involved. External part exchange can be a great way to speed up the process and increase your return on investment. In this piece, with the help of experts The PX Partnership, we explain how it can be used to benefit developers.

Advantages of part exchangeThe part exchange system has been around for many years and is mostly used by volume housebuilders. A dedicated pool of funds allows them to offer in-house part exchange services. Faster sales, no chains or re-negotiations, and quicker completion are some of the many benefits.

Many SMEs, on the other hand, are yet to experience these benefits, and can turn to the solution to achieve the same results. Developers who use part exchange effectively can sell their sites more quickly and move on to new ones sooner. The benefits are greatly improved cash flow, return on capital and profit.

Introducing the PX Partnership

Whether you are a national developer selling hundreds of properties a month or just a small local developer building a few homes per year, the PX Partnership (PXP) offers a professional and effective part exchange service to house builders and developers throughout England and Wales. A flexible part exchange scheme allows builders that don't offer part exchange to do so, but it can also enhance a developer's own in-house scheme, providing an opportunity to consider additional properties and give them greater purchasing power.

How does it work?

PXP purchases the buyer's property directly, providing the developer with all of the benefits of a part exchange scheme but without having to operate one themselves. It enables developers to achieve a guaranteed sale of their plot with no risk and no funding requirement.

As part of their comprehensive part exchange service to builders & developers, PXP have developed a bespoke, user-friendly online system which enables housebuilders to track the progress of each part exchange property PXP are dealing with on their behalf.

The system allows the developer to follow a case through from start to finish with notifications sent to them at key points throughout the process, for example when they are carrying out the Home Visit, when the PX offer has been made and legal updates throughout the purchase process.

New PX requests are submitted through the system using the easy-to-complete form, similarly the developer can also notify PXP online when a PX offer accepts, providing them with all the information needed for the purchase such as solicitors details, target exchange and completion dates etc. all at the click of a button. Below shows how you can follow PXP’s step-by-step process.

The PX Partnership Process:

- Once registered with PXP, fill out an online application form with information about your buyer and their property.

- Then, PX Partnership will carry out a free home visit so they can view your buyer's property and arrange part exchange valuations with local estate agents.

- After the valuations have been received, they examine the information including comparable evidence and the local market conditions.

- The PX Partnership will then make the part exchange offer directly to you, subject to survey and contract.

- After you get an offer, you can develop a bespoke package to suit your buyer's specific needs so they'll be able to accept the PX offer and buy your home. The PX offer package is presented by you to your buyer, providing continuity and allowing you to keep the relationship during negotiations.

- An RICS survey will be ordered for the property if the PX offer package is accepted. In the event the offer is declined, the file will be closed. There is no charge to the developer, or their buyer.

- After your offer has been accepted, your solicitor will act in accordance with the terms of the agreement between you and your buyer for the exchange of contracts and completion.

Modeling the part exchange process

Although the concept of part exchange is straightforward, the process can contain many elements that need to be broken down in the calculation and sales process. However, with the help of Aprao’s financial modelling tool and the PX Partnership’s step-by-step process, any housebuilder can apply part exchange into their business model.

In the sections below, we illustrate how an SME housebuilder can use Aprao’s financial modeling tool to analyse each individual part exchange deal and make better evidence-based decisions.

Evidence-based decisions with Aprao

Each part exchange opportunity received needs to be assessed in terms of its impact on the sales timeline and profitability.

When deciding what financial package to put together, a housebuilder needs the right tool to analyse and compare the scenario with and without part exchange. The PX offer will be lower than market value (typically 90%-92%), so the buyer usually needs a few more incentives from the housebuilder before accepting the offer.

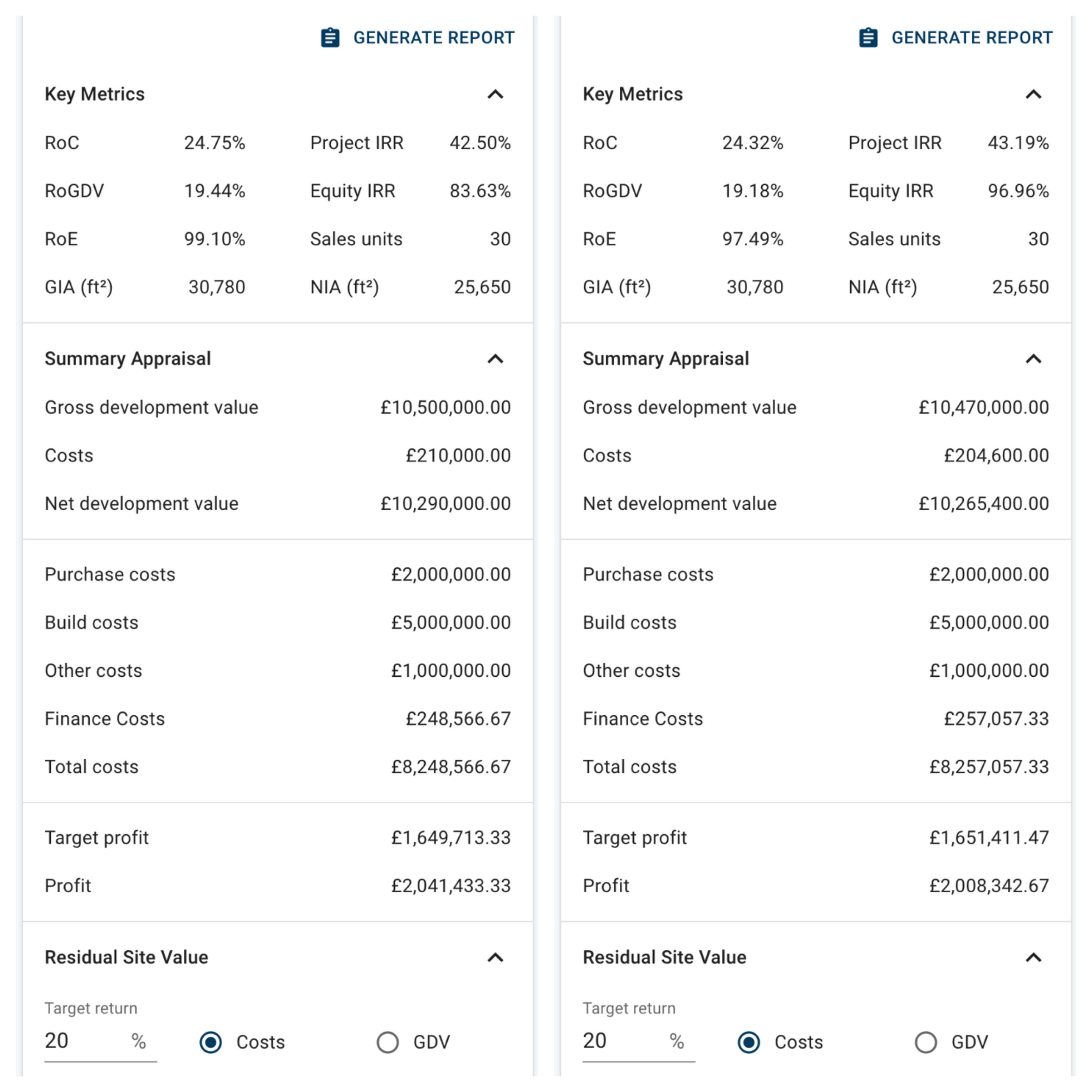

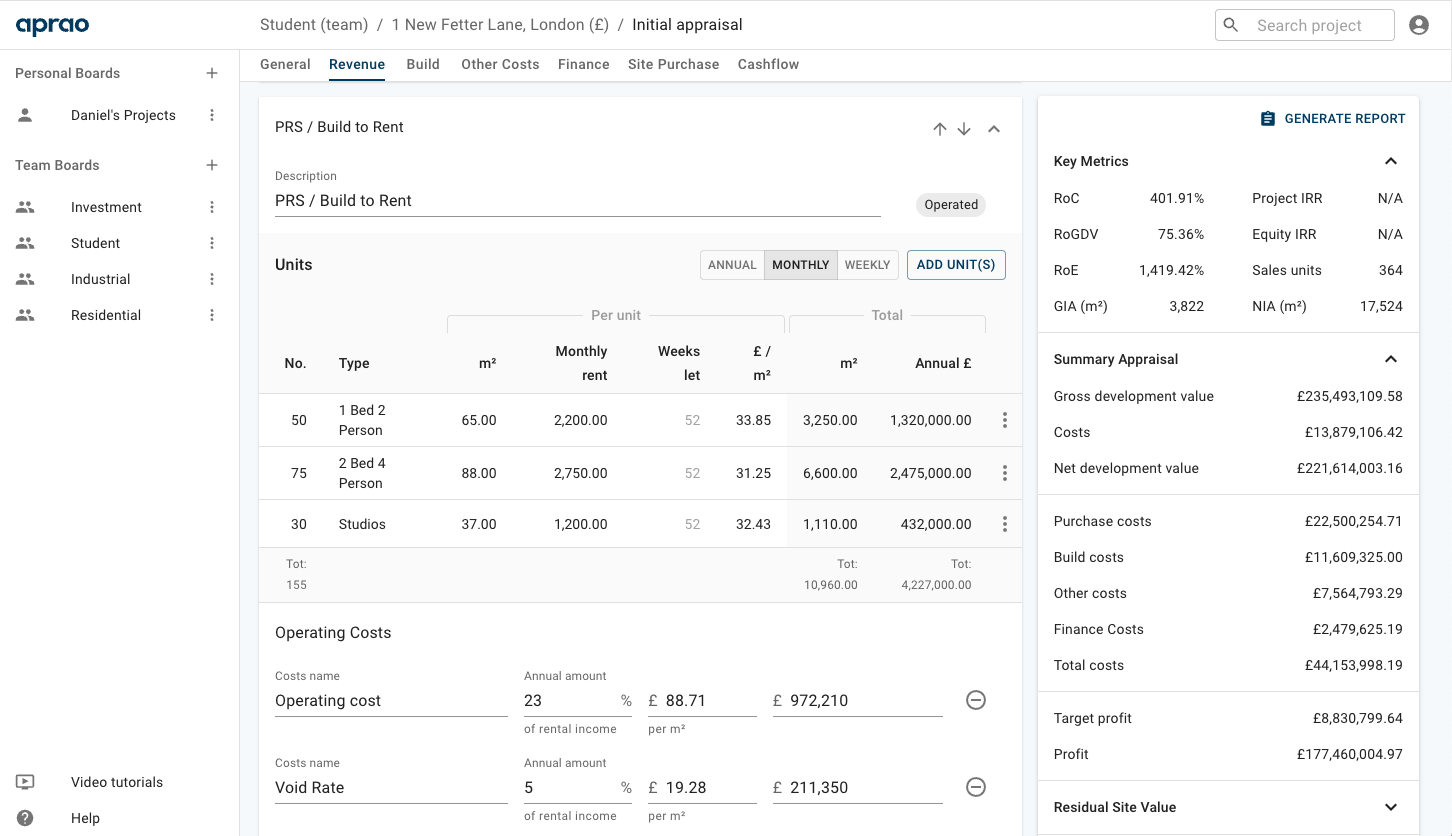

With Aprao's cashflow modeling platform, you can create multiple financial models instantly to determine how much incentive you can offer the buyer, to enable them to accept the PX package and purchase the new home. Through a dynamic cashflow model, you can experiment with different offers and packages, and see how this changes the performance metrics of your project (e.g. Profit on Cost/Equity and Project/Equity IRR). Below we show you how Aprao helps you do this, and you can follow an example scenario along with us.

A step-by-step guide to creating multiple cashflows

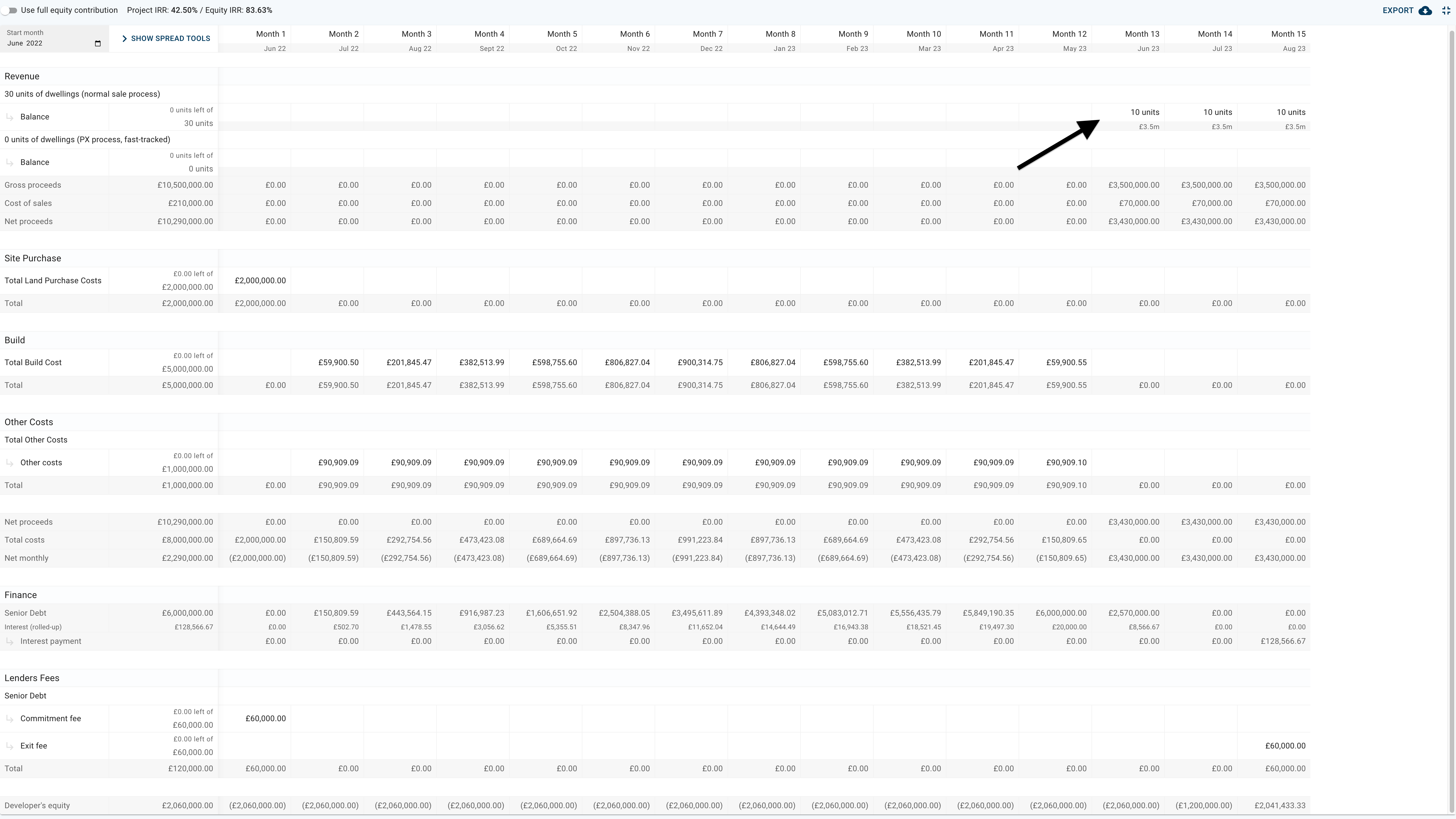

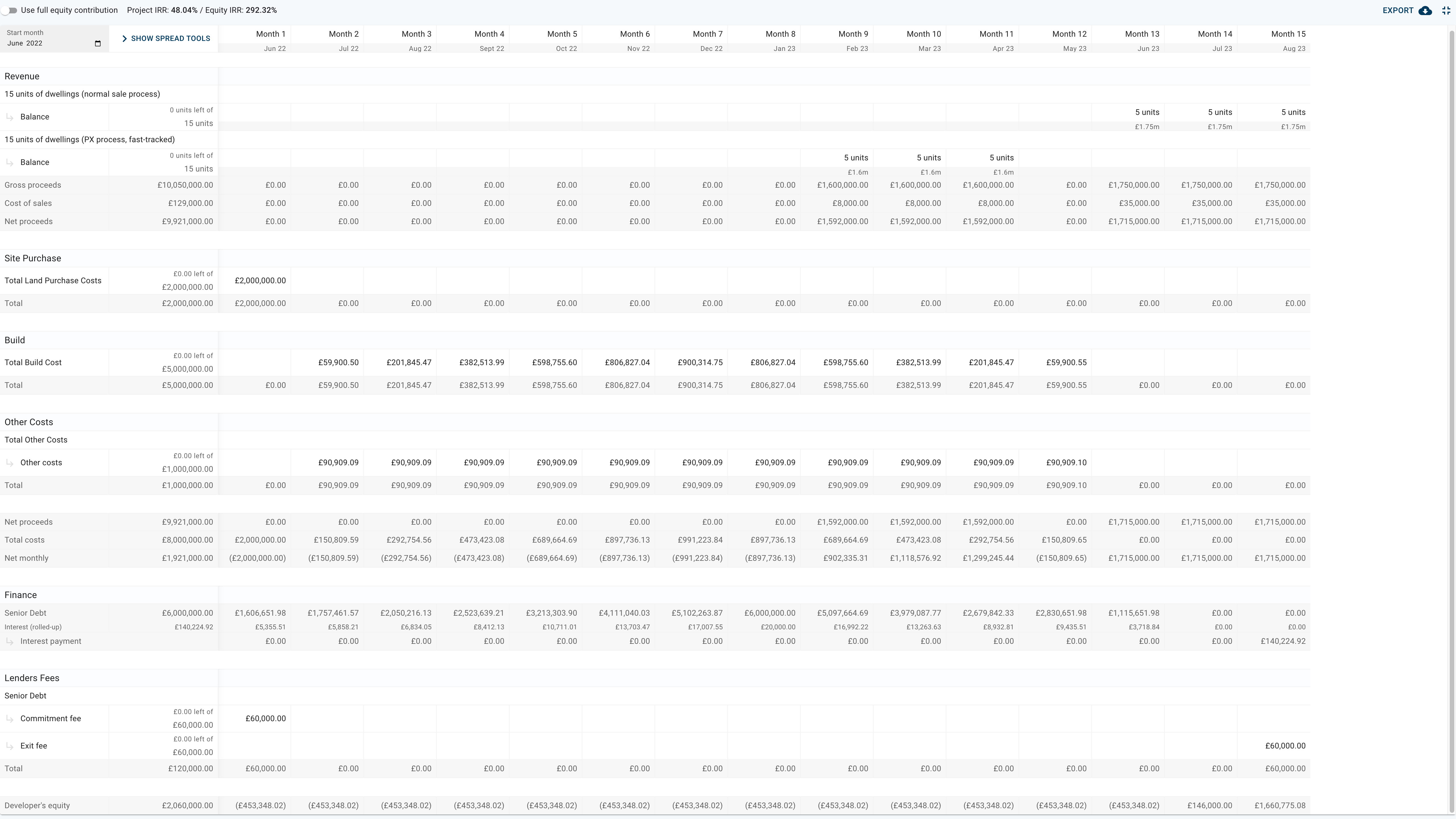

Let’s say an SME housebuilder is currently developing 30 units of dwellings. In order to speed up the sale process and improve its cashflow, the housebuilder decides to use the part exchange service provided by the PX Partnership for approximately 15 units. Before any buyer shows interest in the part exchange service, the revenue cashflow looks like this:

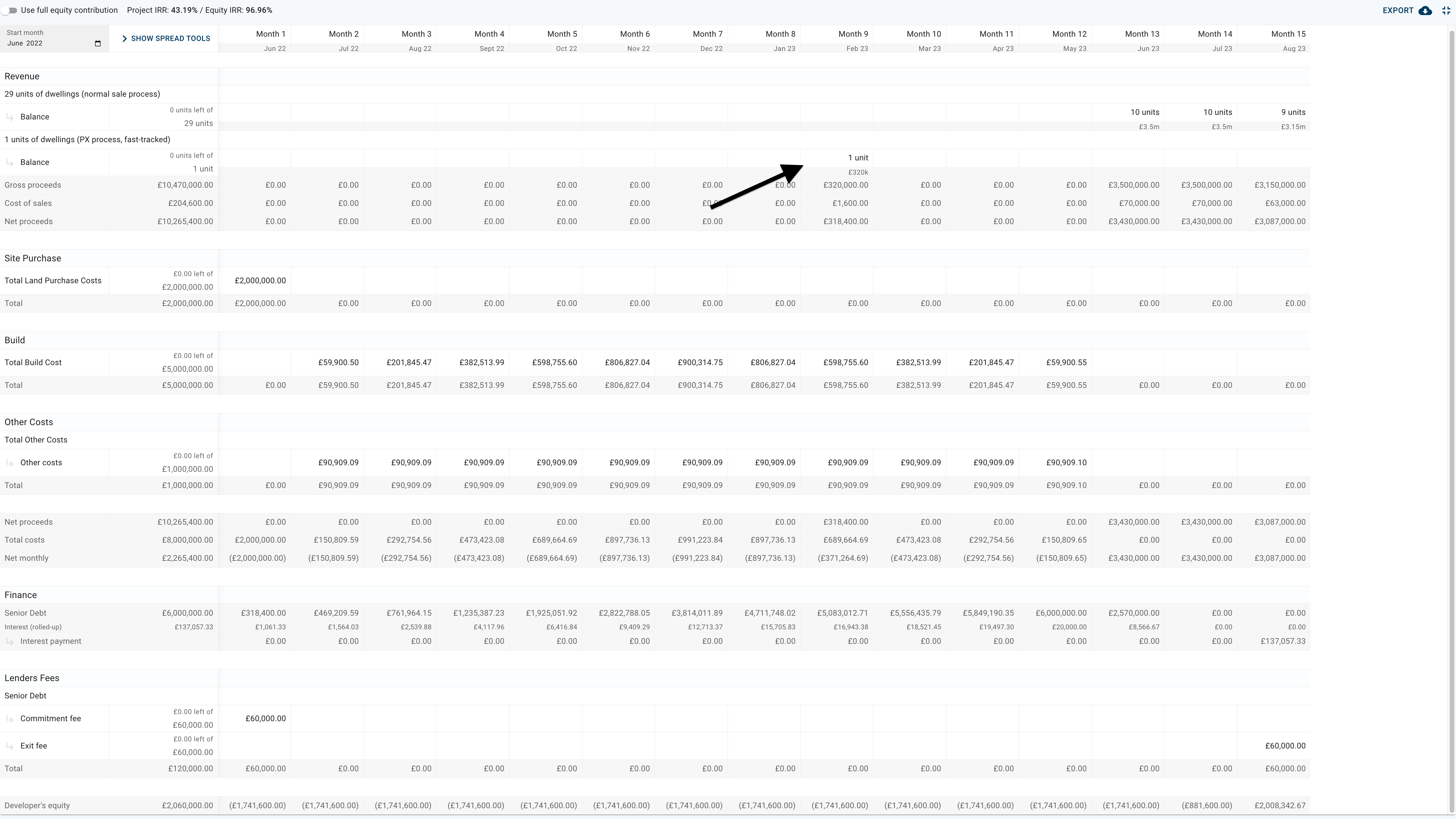

A buyer and housebuilder who decide to use a part exchange service go through Step 1 to Step 4 of the PX Partnership 7-step process. A part exchange offer is now made directly by the PX Partnership to the builder. The housebuilder must now assess the offer and put together a package that enables the buyer to accept it.

Using Aprao, the housebuilder goes back to the project page and duplicates the initial financial model, and names it ‘02/06/2022 (PX#Buyer1-Package1)’.

Due to the proposed PX offer, the housebuilder changes the revenue timing of 1 unit to an earlier date in this newly created appraisal. The revenue is adjusted to reflect the incentives provided in the package for the buyer. For a simpler illustration, this example just pushes the revenue timing 4 months earlier and reduces the revenue of 1 unit from £350,000 to £320,000. You can see this example below.

Here is the new cashflow:

Now, when comparing the Key Metrics of the initial ‘01/06/2022 (PX#N/A-N/A)’ model with the new ‘02/06/2022(PX#Buyer1-Package1)’. You can see that the Return on Cost (RoC) is slightly lower than before, but the Project IRR and Equity IRR are higher than before.

Due to the improved IRR metrics, along with the benefits of a Fixed Offer Price from the PX Partnership, quicker completion of the new-build units, and no risk or funding requirement compared with operating an in-house part exchange service, the housebuilder is satisfied with this offer and package combination. Therefore, he accepts and moves on to the final stages of the process.

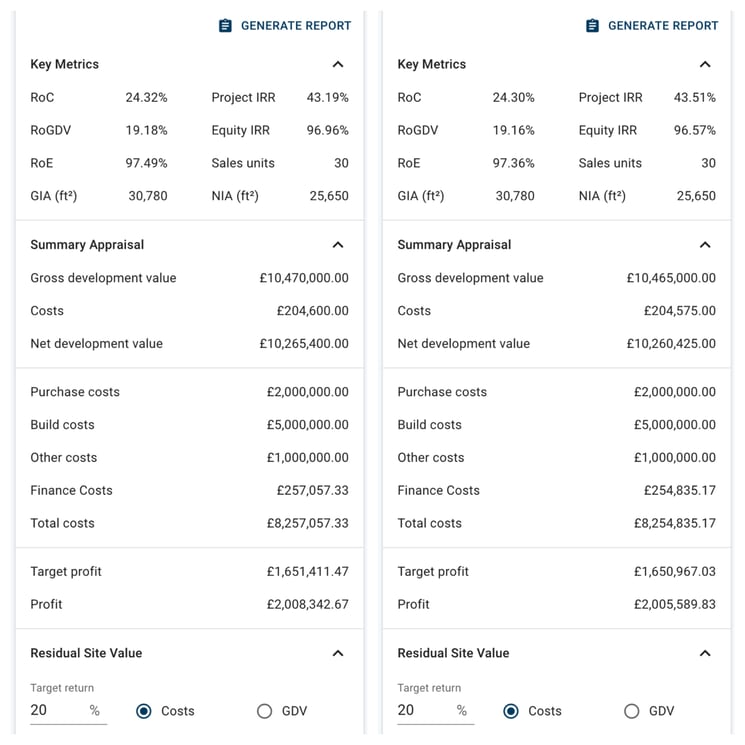

If the housebuilder wants to explore more possibilities on the bespoke package that suits a buyer’s individual needs, they can again, go back to the project page and duplicates the financial model, and name it, for example, ‘02/06/2022(PX#Buyer1-Package2)’. Let’s say the revenue in Package 2 is adjusted to £315,000 instead of £320,000 in Package 1, but the revenue timing can be further pushed to 2 months earlier than Package 1. Aprao allows the housebuilder to modify the model and cashflow with just a few clicks to compare the metrics of both scenarios.

This example updates the cashflow so that 15 of the 30 units have undergone part exchange, and you can see the units have earlier completion dates and adjusted revenue values that can be easily modeled into the cashflow. This will all positively impact the developer financially.

💡 Interested in trying Aprao to see its value for yourself? You can get started for free, no payment needed, by clicking the link here. Test around the platform and when you are ready to take the first part exchange deal, contact The PX Partnership to arrange a meeting or to begin offering part exchange now.

Leave a comment