In this 4-part series, Aprao's resident RICS Chartered Surveyor Nick Fisher shares best practice around creating a variety of different property development appraisals. In Part 3, he provides a detailed analysis of how to appraise a house build development.

The Development Scenario

In this appraisal we are analysing a subject to planning house build scheme in a semi rural location. The site is surrounded by low density residential housing and has received positive feedback from a pre- application to the local authority.

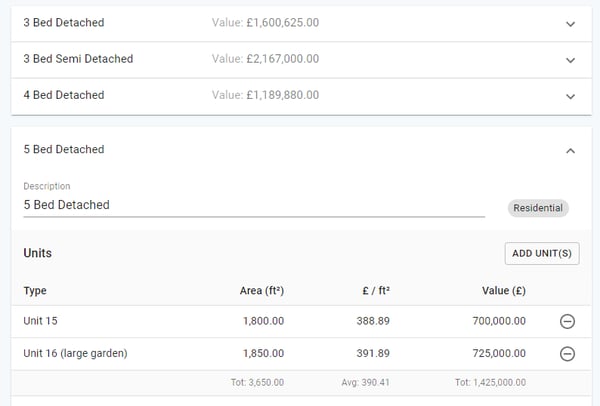

The Gross Development Value

We have assumed we can build 24 units on the site which consists of a mix of house types. This will include 16 private units (mix of 3 beds, 4 beds and 5 beds) as well as 8 affordable housing units which have been forward funded by a local housing association.

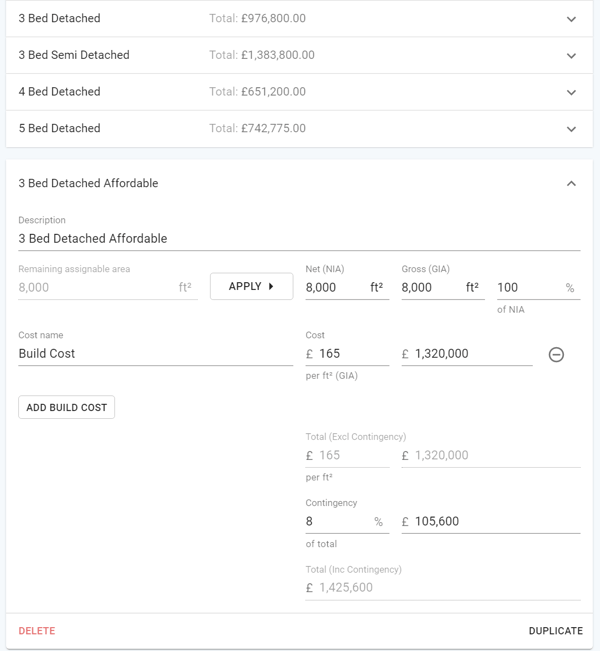

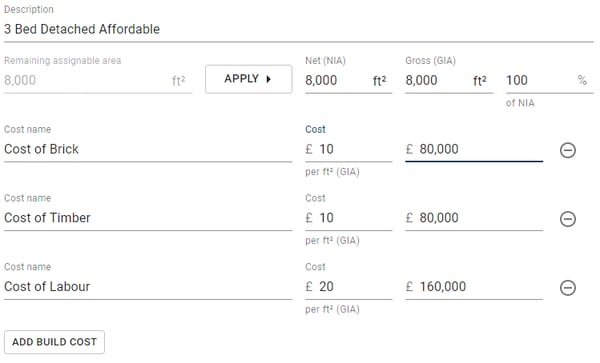

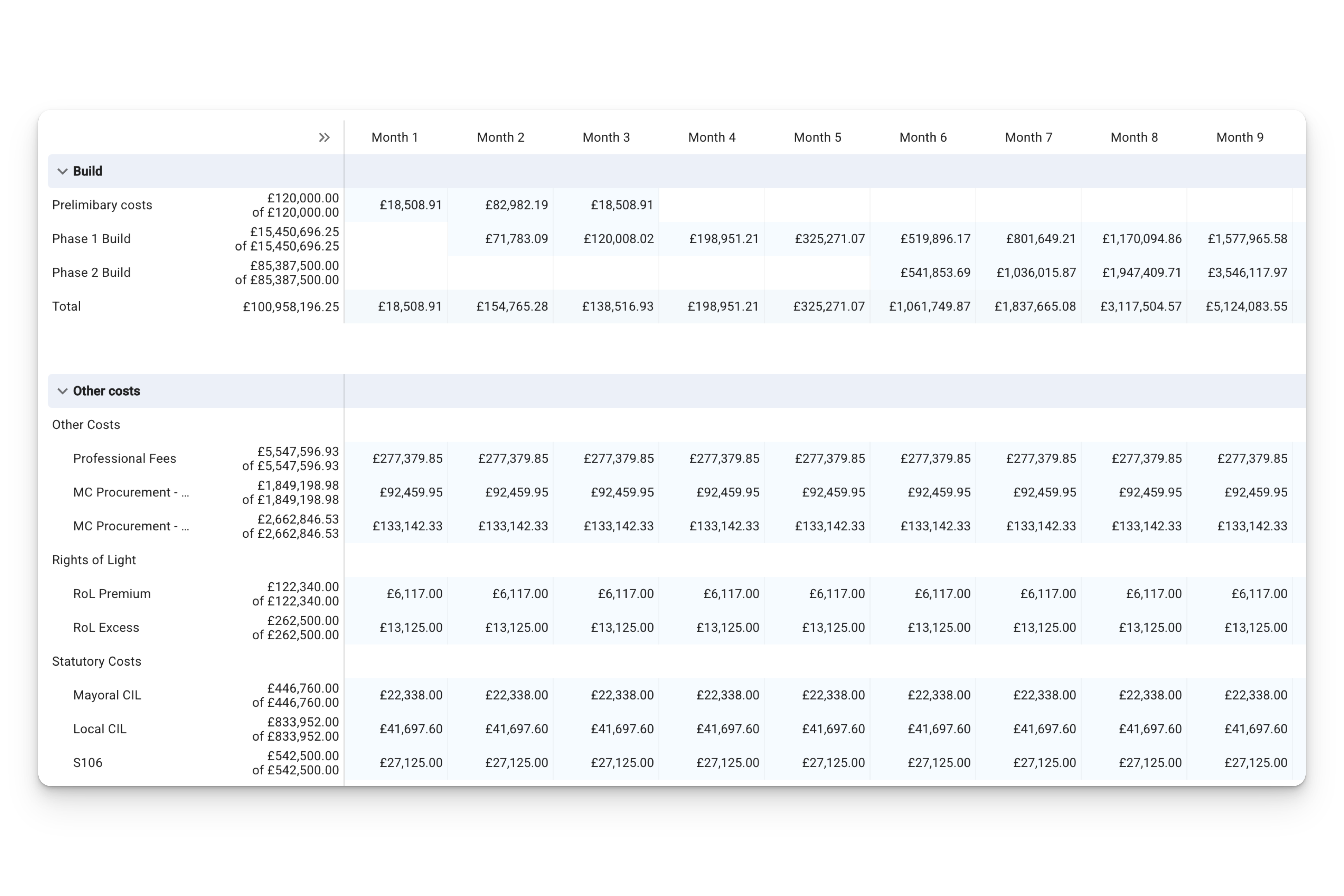

The Build Costs

To calculate the construction costs, we will split out each unit type to allocate a specific rate of build. As we are building houses, we can assume the net area and gross area are the same.

In this example we have assumed a headline rate. If working with a Quantity Surveyor or Commercial Manager, we could also add the costs on a cost-by-cost basis as outlined below.

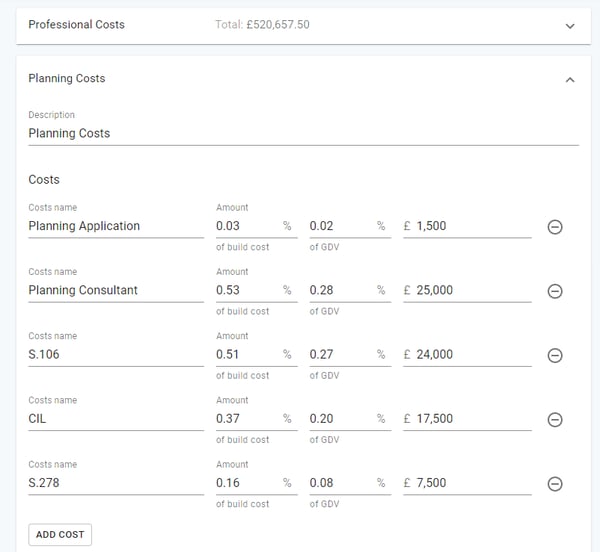

Other Costs

The site does not have planning consent - we therefore need to assume the associate costs to gain the appropriate planning approval.

We have included the development professional costs in one group, and added another group for the planning costs.

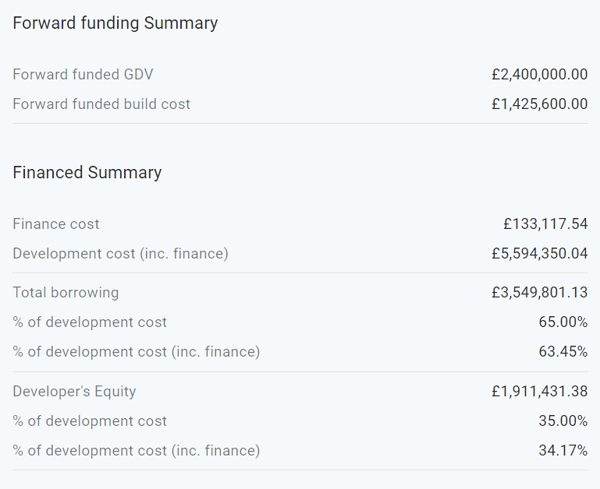

Senior Debt and Forward Funding for the Affordable Housing

The affordable housing has been forward purchased by a Housing Association, as have the build costs. We have assumed we will take a senior facility on remaining private construction.

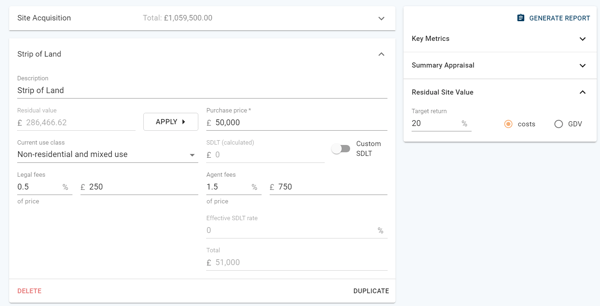

Multiple Site Acquisitions

We've agreed to buy the site for 1 mil. With the associated SDLT and fees, the total site acquisition is 1.05 mil. There is a strip of land that needs to be acquired to commence the scheme.

As a developer we are targeting a 20% return on cost. The residual value indicates we can pay 286K for the site. We have, however, agreed the acquisition at 50K.

Would you like to view the final feasibility? You can see it here.

If you're an Aprao user, you can add this feasibility to your dashboard and use it as a template for your own feasibilities! Just open the link and click the "Copy to your dashboard" button.

Not an Aprao user yet? Get started for free, no credit card required, and we will activate your account immediately - then you can log in, and add this appraisal to your new dashboard!

Leave a comment