We recently created a series of conversations with leading voices across the Australian property development space. Now, we're taking one of those topics and exploring it in more depth. This iteration looks at our chat with Clinton Arentz, Head of Lending and Property Assets at Trilogy Funds. Clinton offers insights developers can use to de-risk their projects and secure better finance terms while embracing innovation in the sector.

Lending has evolved over the last few years, and developers need to navigate these changes to achieve the best outcome for their projects.

Clinton Arentz knows this more than most. He's the Head of Lending and Property Assets for Trilogy Funds, which operates managed investment trusts holding assets across mortgages, direct real property and other financial assets on behalf of over 14,000 investors.

We caught up with Clinton to discover how developers can de-risk their developments while securing better finance terms. Clinton was kind enough to offer insights on everything from key credit enhancement strategies to Trilogy Funds' generalised funding parameters, and a whole toolkit of knowledge developers can use when upskilling their financials.

Using technology in the sector

Clinton has over 20 years of experience in asset management, property development, and project lending. Before joining Trilogy Funds, he provided project structuring and development directory services on commercial, industrial and residential projects in Brisbane, regional Queensland, and the Northern Territory. It's safe to say that he has a depth of industry experience and is one of the first to notice changes and innovations within the lending industry. He believes the changes in the property industry over, say, the last 30 years has been quite remarkable and is accelerating at a rapid pace.

"Markets are more dynamic now and constantly change, while liquidity levels rise and fall."

– Clinton Arentz // Trilogy Funds

"The arrival of new technology has played a role, but other factors have also contributed. Markets are more dynamic now and constantly change, while liquidity levels rise and fall. Consequently, risk appetite increases and decreases too, so all the players in the market seem to shift in the necessary direction.

"There are long-term stalwarts, as I like to call them. But also new players coming into the market and offering different products and services. As a result, we see constant innovation, which will only increase as new technology emerges."

With technology being such a pivotal factor in operational progress, companies need to embrace tech to move their business forward. Clinton supports adopting technology, saying, "is in the company DNA, as we aim to be innovative and agile.

"From our perspective, we want to be ahead of the market as much as possible to provide the right service and support. While the service is via our portfolio managers and investor relations, the product relates to construction finance. Both areas are highly competitive, so it's vital to have the right technology and levels of support to offer clients a competitive advantage."

Big bank and non-bank lending

Trilogy Funds was formed over two decades ago, so it's seen its fair share of shifts in the current market. Clinton notes that "currently, large banks don't have much appetite for construction lending, but Trilogy Funds has always occupied the space."

He goes on to say, "we've continued to lend and grow our business model through these ups and downs while large-scale banking seems to be well out of the construction space at the moment.

"Other non-bank lenders have emerged, and there are lots of them, such as private groups and smaller players that tend to raise money on a case-by-case, loan-by-loan basis. That might look attractive at first glance, but when you dig a little deeper, you'll ask whether they have a construction facility to enable the order management of progress or is there availability of funds when required?

"Is there a pool of liquidity that comes from a mortgage fund? Essentially, it's a much larger, more complex structure, especially when the approach is opportunistic as opposed to building the mechanisms over time, which is what Trilogy Funds has done."

Clinton is referring to stability. New non-bank lenders come to the fore with finance offers, be it liquidity stored up through Covid or other means, but he doesn't believe it's a stable approach to lending, and some of those funds "can be there one minute and gone the next", as he says.

He's keen to emphasise that "the stable part of the market is what Trilogy Funds and other larger non-bank lenders do – not just treat it as a one-off opportunity here and there because then you're subject to the lender's personal whims, which might look attractive at first but ultimately cause more headaches in the long run.

"The start of a project sometimes becomes a lot tougher for the borrowers at the back end of that transaction, as things are starting to play out on-site or through the sell-down program."

Read more finance tips on development and construction - here's our recent interview with Development Finance Partners on how to create a successful construction finance application.

Identifying risk as a lender

Lenders and developers need to be a good fit, which means understanding each other's needs and being fully transparent about the project. Clinton cites the importance of a lender doing due diligence and how that can benefit the borrower.

He says that "borrowers or developer clients can leverage off us to some extent, because we have a body of knowledge in terms of how the markets are performing, so we can help guide the projects to some level. Not in an interventionist way – it's more on an assistance level, as we don't go into a lending arrangement without a full body of knowledge.

"The level of research we do to set a loan even before they are approved is of the highest level. We're constantly looking to access that market knowledge and data to source from numerous places, in particular quantity surveyors and valuers whose primary consultants would be engaged in all of our projects.

"There's the depth of market research too, such as talks about sales analysis and sales rates and rates per metre in selling, as well as constructing. All of those are critical elements that we're continuously seeking out and using to calibrate our judgement about whether the project makes sense or not."

Catering to what lenders are looking for

All developers want to de-risk their development projects and secure favourable finance terms. Therefore, it's essential to understand what lenders are looking for in any potential project.

Clinton is a big advocate of sharing visions. He says, "you want to back the key people, the stakeholders in the project, so you need to understand their vision. We look at the quality of the sponsor group, which means they don't necessarily need to be experienced – instead, it's about the quality of the site, their business acumen and how heavily they've researched a project.

"We look for strong project plans and an understanding around the projects – how clear are the timelines? Do they know how the approvals process works? Those aspects are crucial for us, as is the rate of sales in the market."

Having everything together and fully understanding the ins and outs of a development project bodes well for developers looking to secure finance. A properly made submission that is well thought out increases the chances of building a relationship with the lender and getting the necessary finance.

As Clinton puts it, "key credit enhancement strategies can increase a project's chances of success". Despite all the changes and innovations in the industry, some aspects have remained the same.

If you understand the cost base, timing and exit strategy, as well as the realisable value, then you're on the way to getting the key metrics in place that can help the project become successful.

Accelerating approval times

The faster developers can access funding, the quicker they can begin working on projects. That in itself helps to de-risk the development, but lenders can only go with the information they have from the borrower.

Clinton says, "the accuracy of the original application drives approval times. We can only work off the information provided. Approval times are very much linked to the quality of the original submission.

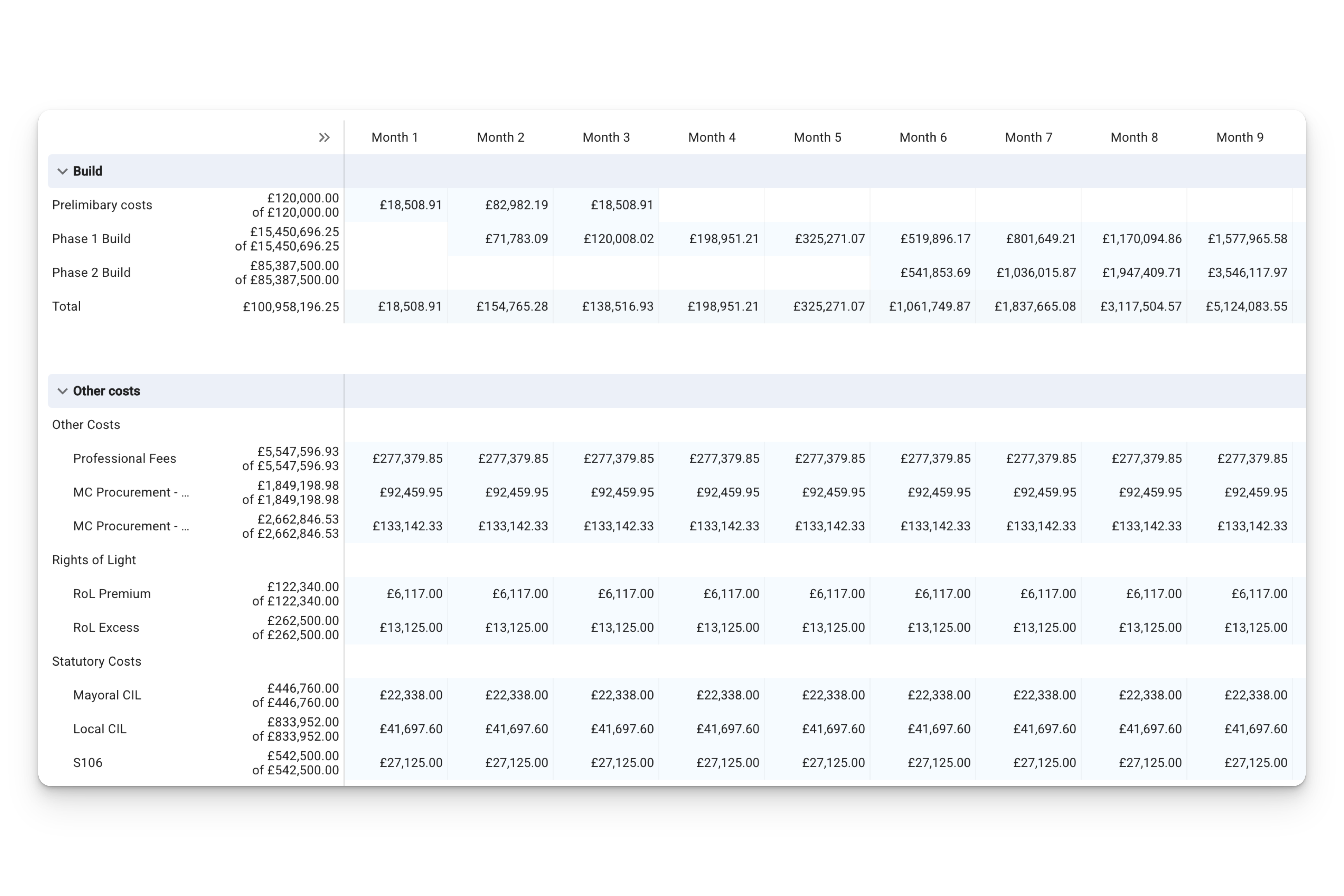

"However, technology, such as Aprao, has allowed us to speed up approvals, as it gives us a working model where we can absorb data into our internal modelling and assessment process. That's beneficial for customers and us, as everything takes place on one platform.

"Aprao gives us all the data and provides a full picture, helping the developer communicate their plan succinctly. I like the interactive nature and the ability to input data from a raft of different points that other parties can tap into in real-time. When you can do that, you have a powerful tool."

The importance of an agile and tactile business

Technology will further enhance processes, leading to easier decision-making and swifter results. Innovation and technology play a key role for borrowers who want to secure finance.

Clinton says, "Agility and innovation need to lead to a tactile, modern business. It's the same in this industry – our capabilities as a society seem to rise when there is more technology to us. It has this aggregator effect.

"It's why Trilogy Funds is so heavily invested, and we've got two whole departments of people who are focusing on our operations and our strategic direction in terms of I.T. and resourcing. So I think you've got to be there in the space, or you'll be out of the market. The only way forward is to be agile and innovative and ultimately competitive."

Summary: blending old with new

There are many ways for developers to de-risk their projects and secure the right financing. But after talking with Trilogy Funds, it's clear that key insight must be there around the project, even if the experience is lacking. If developers can display in-depth knowledge about the specifics of their projects, then new technology can help them access funding faster. And the result will hopefully be more developers getting the green light for their projects.

If you enjoyed this interview, you can watch the full episode via this link.

💡 Did you know: with Aprao, you can ensure accurate cashflow calculations in real time, and share you feasibilities directly with lenders through a quick link? Click here to learn more.

Leave a comment