We recently created a series of conversations with leading voices across the Australian property development space. Now, we’re taking one of those topics and exploring them in more depth. This iteration looks at our chat with Matthew Royal, Co-founder and Director of Development Finance Partners & Airlisting. If the thought of a loan finance application stresses you out, Matthew has everything you need to know about being successful with construction finance.

Financing your construction project is one of the most vital steps in the development process. There is no project without the right finance in place, and you're essentially back to square one.

That's why it's so important for everything to go off without a hitch. Or, if there are issues, you already have contingency plans in place.

If you're new to the world of construction financing, you're probably looking for some advice. Matthew Royal has an extensive understanding of the financial criteria and methodology used for assessing property development and investment proposals, and he is regularly quoted by major Australian media outlets.

We sat down with him to see what advice he had to share for anyone looking to secure construction finance.

The dynamics of finance

Mathew understands that obtaining finance isn’t easy, especially if you “don’t know what you don’t know”, as he puts it. He believes it’s an important acknowledgement to make and says, “dealing with the truth and what’s real in any endeavour is necessary, especially when it comes to choosing between bank or non-bank finance. For example, people’s experience of dealing with a bank two years ago isn’t necessarily true of dealing with a bank now.

“Ultimately, what’s important is understanding the details around your specific circumstances, based on your objective, whether it’s rapid growth, scaling up the business or if you’re more interested in maximising profit by minimising the financing costs ”.

What you believe to be the case or what an advisor might suggest is the right way to go might not always be the best approach. Having an open mind, willingness to learn, and ensuring that your objectives are consistent and aligned will serve you well as you move forward.

Communicating your objectives to the financer

Having a clear goal is well and good, but you need to communicate it to lenders. This is one of the most important stages in lending. Mathew believes it's vital that developers build relationships with various bankers to understand where they're at regarding lending guidelines, pricing, and concerns.

"Essentially, it's a process of first understanding before being understood", says Matthew. He continues, "building a relationship with bankers before submitting anything helps when it comes to the application stage. You'll be well-armed and better understand what they're looking for in credit applications.

"Understand the risks they see in the market so you can spend more time mitigating those concerns inside your credit application." Even in an era where technology leads to most actions happening digitally, the need for personal relationships and the ability to build trust with financers still holds plenty of weight.

Navigating the guidelines

GFC guidelines left many bankers with their hands tied when it comes to the nuances involved with lending. But where does that leave developers looking for a bit more wiggle room with their loan applications?

Matthew is generally positive about the current landscape, saying that "the credit market is strong at the moment, but even with banks and non-banks, the best approach to negotiation is competitive tension in a way that builds goodwill and doesn't destroy it."

"The best approach to negotiation is competitive tension in a way that builds goodwill and doesn't destroy it."

– Matthew Royal // Development Finance Partners

Transparency is key to negotiations, and Matthew doesn't believe there's anything wrong with a borrower being upfront in a credit application after having built up that relationship with lenders. "Tell them you're going through a process of a finance tender, and you're going to make an application to two or three lenders, on the basis that the application is based on their earlier feedback. As a result, there should be competitive tension. If managed transparently and professionally, the results can be positive. At the end of the day, the bankers are still suppliers, and everything is negotiable."

It's a case of healthy competition between lenders resulting in the best outcome in terms of the negotiation. In Matthews' eyes, the worst thing you can do is rely on one banker or existing financier who will ultimately be in control of the negotiation.

Reducing the risk

Developers want to reduce risk and increase their return on equity; something Matthew acknowledges as an important part of the process. He says, "the most effective way to decrease risk and increase your return on equity is to invest effectively in advertising and marketing.

"It's the single best way to increase the rate of a sale across not only an individual project but also the entirety of the group. When you look at the established and successful developers, they all have an effective sales and marketing strategy, which they've used to grow into a substantial business.

"The real leverage on a cost-to-complete or feasibility is in the advertising and marketing budget. Yet, it's still one of the most neglected aspects, even though a robust strategy for advertising and marketing helps mitigate risks and decreases the total cost of a sale by reducing the commission paid."

From his experience, Matthew believes that a strong advertising and marketing pitch helps qualify for larger amounts of cheaper debt. And where there are multiple KPIs involved, it's also the most effective way to increase return and decrease debt.

Understanding credit strengths and weaknesses

A strong credit application increases your chances of success, but how do you determine its strengths and weaknesses before submitting it? Matthew notes that a project's location should be a strong point, such as a beachfront spot on the Goldcoast, or if there's a shortage of supply where you're planning to build.

Whereas a weakness might relate to a borrower who hasn't completed a project of the same size before, Matthew notes that you can "mitigate the weaknesses with actions like hiring a project manager or external developer if you don't have the experience of building something similar to what you've put forward for finance approval".

Hopefully, the lender will take the strengths into account and see how you're trying to minimise weakness. In any scenario, the bankers will at least be willing to offer feedback to help ensure you secure credit sooner rather than later.

The technology factor

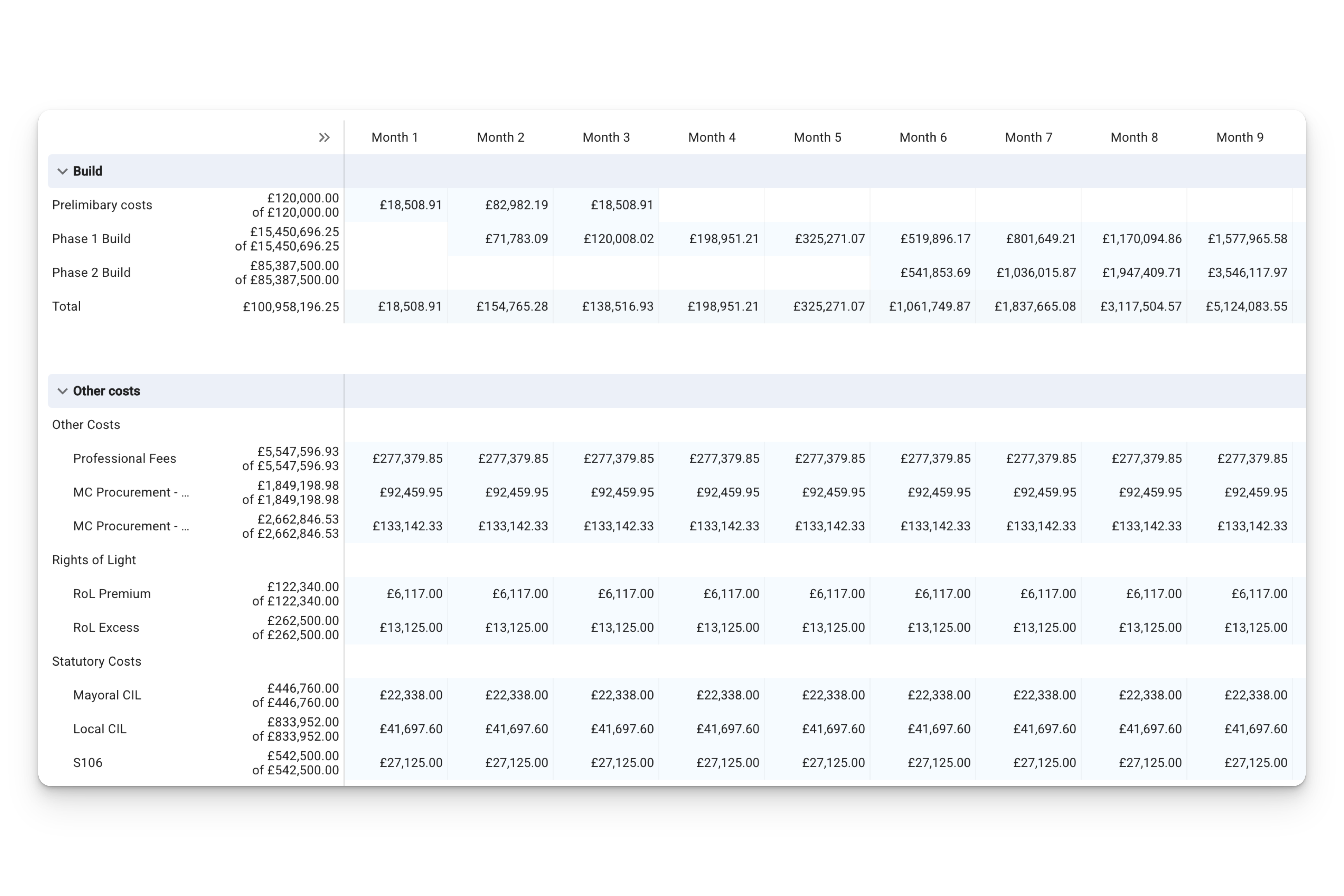

Even though personal relationships are vital, there's no doubt that technology plays a crucial role in smoothing over most processes. Matthew says, "the right technology can improve processes and even sales rates, whether it's airlisting software or Aprao, which can effectively use technology to identify and financially sensitise project feasibility and cash flows.

"It can have an impact on the real effect of potential credit risks, and they can be better understood, which can help with how and to what extent you might utilise credit enhancement strategies to really appropriately manage the risk."

While many still think of property technology as robots laying bricks, the reality is that there’s sophisticated tech available that’s providing more visibility to the market, both on the lending and developing side.

Summary: making construction finance work for you

Many variables go into nailing your construction finance application. Using these tips can act as a boost to ensure you make more right moves than wrong ones. If you want more insights from Matthew, check out the full video of the interview below.

Leave a comment