Are you interested in the future of data adoption within the property sector?

In this interview, we speak to Andrew Knight from the Tech Partner Programme & Data Standards team at the Royal Institution of Chartered Surveyors, who takes us through the global RICS data standards, and what it means for the real estate and tech industry. Andrew is a highly experienced technology specialist with a strong commercial background working for the RICS, a global professional body in land, property, construction and infrastructure. He currently leads the programme and adoption of the RICS’s data standards, and the support of data exchange between service providers, technology companies and end-users of data.

Topics in this conversation include the evolution of innovation in the property sector and how the tech industry can be progressed in the property market. We also speak about barriers to data adoption, the need for further digitisation in the industry and how collaboration between different actors could make this happen.

"PropTech firms and other actors need to understand that they're part of that story. They need to help by assembling this data for customers."

– Andrew Knight, RICS

Where do you think the property industry is on the technology adoption curve and why do you think that is?

"It's a hugely mixed picture. I think for me, it reflects perhaps the fundamentals of the industry, which is that it's a fairly fragmented sector in terms of the number of participants and their activities and practice area. What I see, both in my home market and as I talk to people around the world, is how different this adoption curve is in different jurisdictions and in different asset types.

"You have extremes; there are some people on one side that have very powerful digital equivalents of their assets, which are doing incredible things, and they have a very deep knowledge of the assets they deal with. At the other extreme, we are effectively in a kind of Edwardian or Victorian era, where we have bits of paper that may have been digitised or turned into PDFs. In some respects, that kind of proliferation, which in many ways is great in terms of driving innovation in PropTech and ConTech, means that we now have many more silos of data in different formats.

You can watch this interview, part of our Aussie Experts series, by clicking here.

You can watch this interview, part of our Aussie Experts series, by clicking here.

"I remain hugely optimistic about the power and the opportunity here to digitise the built environment, but we are in this incredibly mixed picture where certain participants have made tremendous progress, such as digitising leases and geospatial information. Yet at the other end, it can be incredibly hard to have even basic information available on an asset for due diligence purposes, or for fire safety purposes, for example."

How can we progress the tech industry in the property sector in terms of that adoption?

"Factors like COVID, for example, are a very sad thing to have as a catalyst, but I think there are a number of things that are driving the kind of digitisation of the built environment. ESG for example will be a huge issue. This is because investors are now very concerned about their assets looking forward.

"They are now thinking, 'do I have the data that gives me a sense of [a developer's] ESG credentials? And if I don't, am I looking at real risk here?' There may even now be restrictions on whether you're actually able to lease or rent a building, for example, depending on its quality, and therefore there is a cost that might go with that. So I think there's a real driver now to get data, particularly surrounding ESG criteria."

"I remain hugely optimistic about the power and the opportunity here to digitise the built environment."

– Andrew Knight, RICS

Focusing more specifically on the RICS Data Standards, can you give us an overview of what they entail?

"We started from the premise that our profession is out there measuring, reporting and assuring information. And information increasingly has to become digital. We need to think about this from a standards perspective, whether it’s valuation standards, whether it’s overall due diligence, whether it’s a standard around cost reporting - right through the lifecycle.

"We realised the industry needed to build a common standard, a common way of naming and exchanging information on the built environment that really fundamentally would support our members and our profession in exchanging that information. We're not in any way implying that everybody should copy our [RICS] data standard with their internal models, but we are saying that when you begin to exchange information, we need this common language, this understanding of what we describe and how we describe it."

"We need this common language, this understanding."

– Andrew Knight, RICS

What can tech firms provide the industry with to be able to link this data and standardise processes?

"In the European market, the banks and the valuers have come together with software houses to actually make sure there is a fairly seamless, machine to machine way of passing valuations around to make sure that the banks can send out the instructions and the valuations can come back in a set format. In that system, they are getting rid of PDFs and have effectively got rid of Word documents.

"They've managed to structure a process from end-to-end in both directions, where instructions go out and valuations come back and the whole process is much more efficient. I think what's really important is that the various PropTech operators out there should understand that they will need to work within this ecosystem. The fragmented nature of real estate in the built environment means that when you're assembling your digital twin (your equivalent of an asset), you are quite often pulling in data from lots of different sources. No one operator is going to have a monopoly on all the data.

.jpg?width=500&name=carlos-muza-hpjSkU2UYSU-unsplash%20(1).jpg)

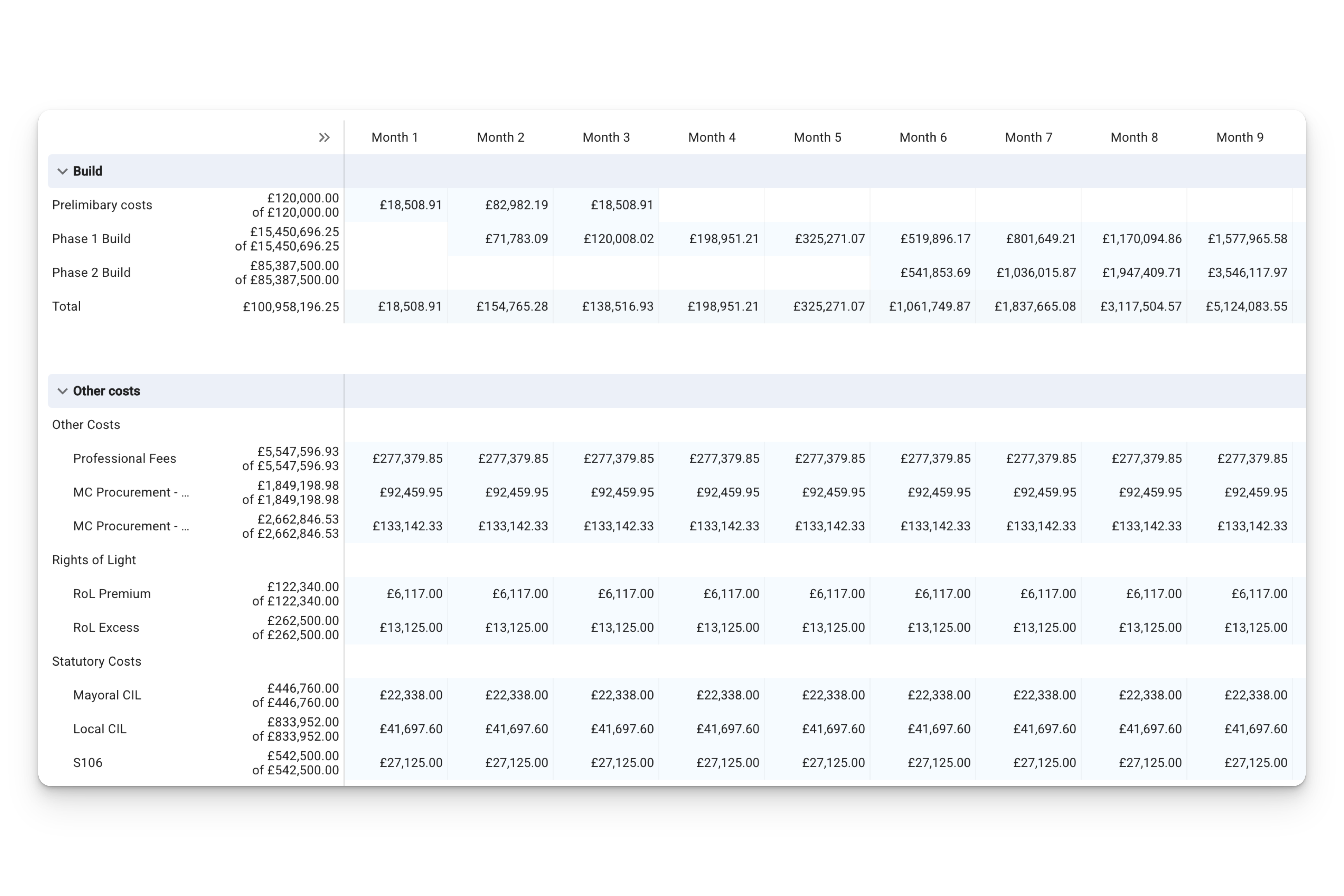

Curating data and analysing it can help work out where to alleviate a project's stress points; such as finance.

"So instead you're going to need to get data from your local registry, cadastral and taxation systems - you're going to have data coming from lots of different sources- so it's unlikely that one particular vendor, or one particular actor, has got all the data. A data standard like the RICS’s seeks to join these islands of data together. It's in that working together to assemble these full digital equivalents of assets that I think PropTech firms need to understand that they're part of that story. They need to help by assembling this data for customers."

There is anxiety around sharing data freely in the industry. Do you think we’ll ever get to a point where everyone freely shares their data to add value to the market?

"In a previous life, I worked in an ad-serving company and we did analytics for the FMCG market looking at buyer behaviour. We had a database with lifestyle and transaction information on every household in the US and the UK, and with that, we did well. Before people used words like 'big data' or 'AI', we had regression models and chain models and we looked at all this data in a room full of Linux machines. The interesting thing there was that everybody putting in their data, in recognising the levels of competitors, realised it was better to pull the data and then have us as an independent analytics house do all that analysis."

I think the digitisation of real estate presents many more opportunities than downsides in terms of requiring professionals to assure and curate that data."

– Andrew Knight, RICS

"So in certain markets and in certain sectors, that journey has already happened. They realise that it's better to have 90% of the market view by sharing data, with the power being in the analytics. I think in that sense, for better or for worse, real estate almost depended on that kind of siloed, protected data rather than recognising that it's the analytics where the real value is derived.

"But it'll take some time to get there because I think there are some market incentives where people enjoy this information asymmetry and they enjoy the fact that they have a set of data that nobody else has access to. But I think it will change as once again, things like ESG and the drive to get residential properties more sustainable will force more openness with data. Then it's down to the analytics, and what you do with it afterwards."

Focusing back on the RICS, would it be fair to say that you're looking to continuously move your members up the value chain by supporting them with tech and data? If so, where will they be in five years?

"In some respects, the profession has always taken technology on board. I think we're seeing a particular wave at the moment in terms of the amount of change that's going to take place. It's even more important that, as we digitise the real estate and the property industry, there's a profession there to curate and manage that data and make sure that people can rely on it.

"There's always a danger that just because you see a number on a computer screen that it must be right. I think we still need that professional scepticism. We still need people to be curating and gathering that data, because ultimately although we now have IoT sensors and we have a degree of automated data collection, there are still a lot of occasions where you need boots on the ground with people looking at physical assets to assess what's going on.

"So going up the value chain, they'll certainly be issues, I think particularly where data collection and valuation may be much more automated, where we can take tasks away from the profession to free them up to do more value-added work. However, I think the digitisation of real estate presents many more opportunities than downsides in terms of requiring professionals to assure and curate that data."

💡If you enjoyed this interview, you can read the original market report by clicking on this link.

Leave a comment