In How development appraisals can help with construction and land loans, we discussed the concept behind creating a development appraisal. It's possible you already used spreadsheets before reading this blog, or you're a pro at Excel. But Excel can take time and a lot of energy. With Aprao, you can model construction and land loans in just a few minutes.

Today, we dive right into the steps to creating an appraisal using Aprao when considering construction and land loans. Get started for free with Aprao and follow along.

In our example, Peter plans to purchase a piece of 'shovel-ready' land and build a custom residence on it. A suitable custom home builder has already been contacted with design and construction plans in place. The only thing Peter needs now is a construction and land loan because he lacks all the cash needed at the moment and does not wish to use all his savings on this project.

Unlike applying for a mortgage when buying an existing house, Peter needs to provide detailed specifications of the house that he intends to build. He also needs to provide a financial budget to show the loan drawdown that he will need each month. The housebuilder and Peter decide to create the budget in Aprao since it already has a self-generated cash flow model.

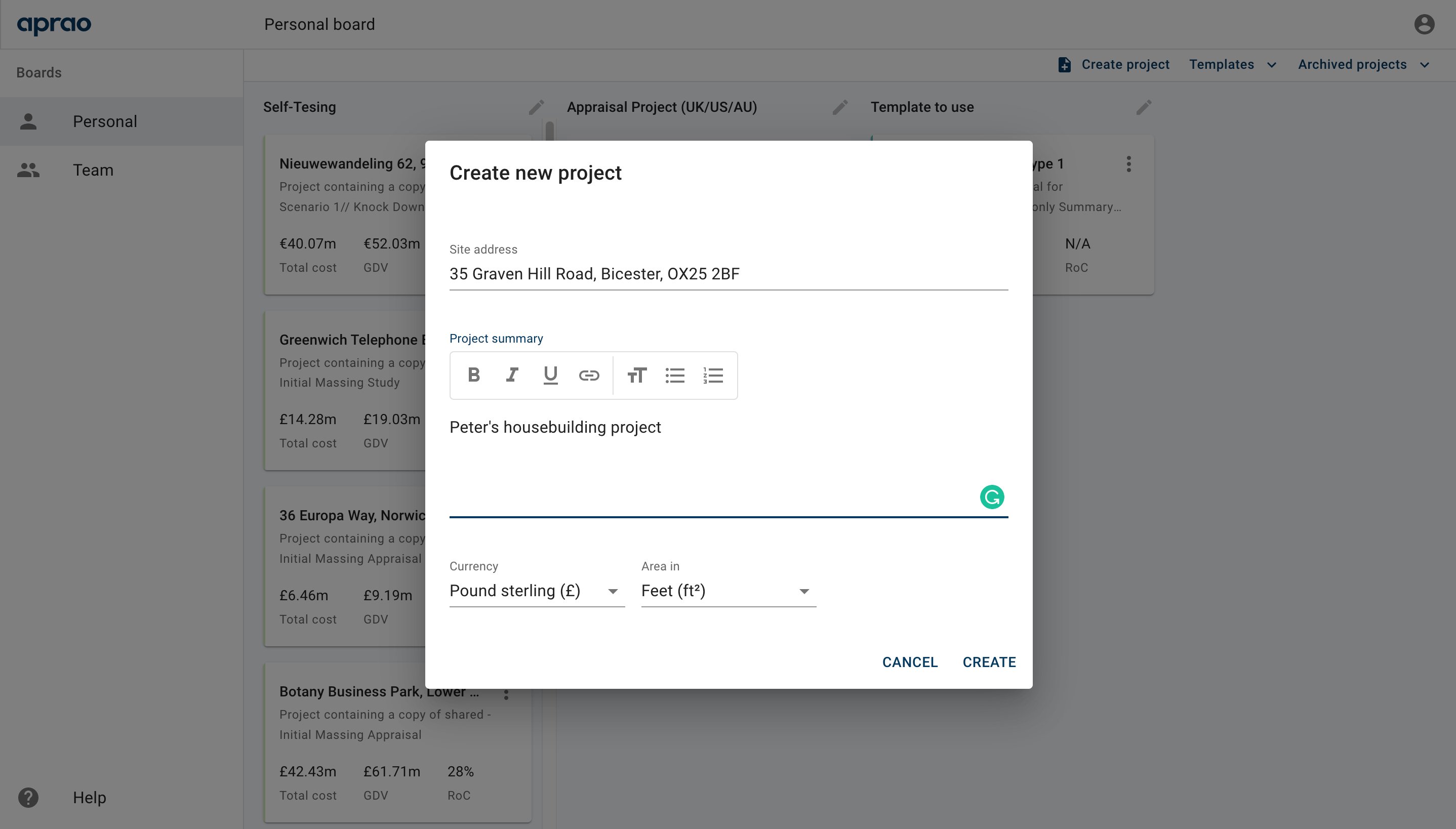

A new project

The first thing Peter does in Aprao is to create a new project. Peter enters the site address and names the project 'Peter's housebuilding project.'

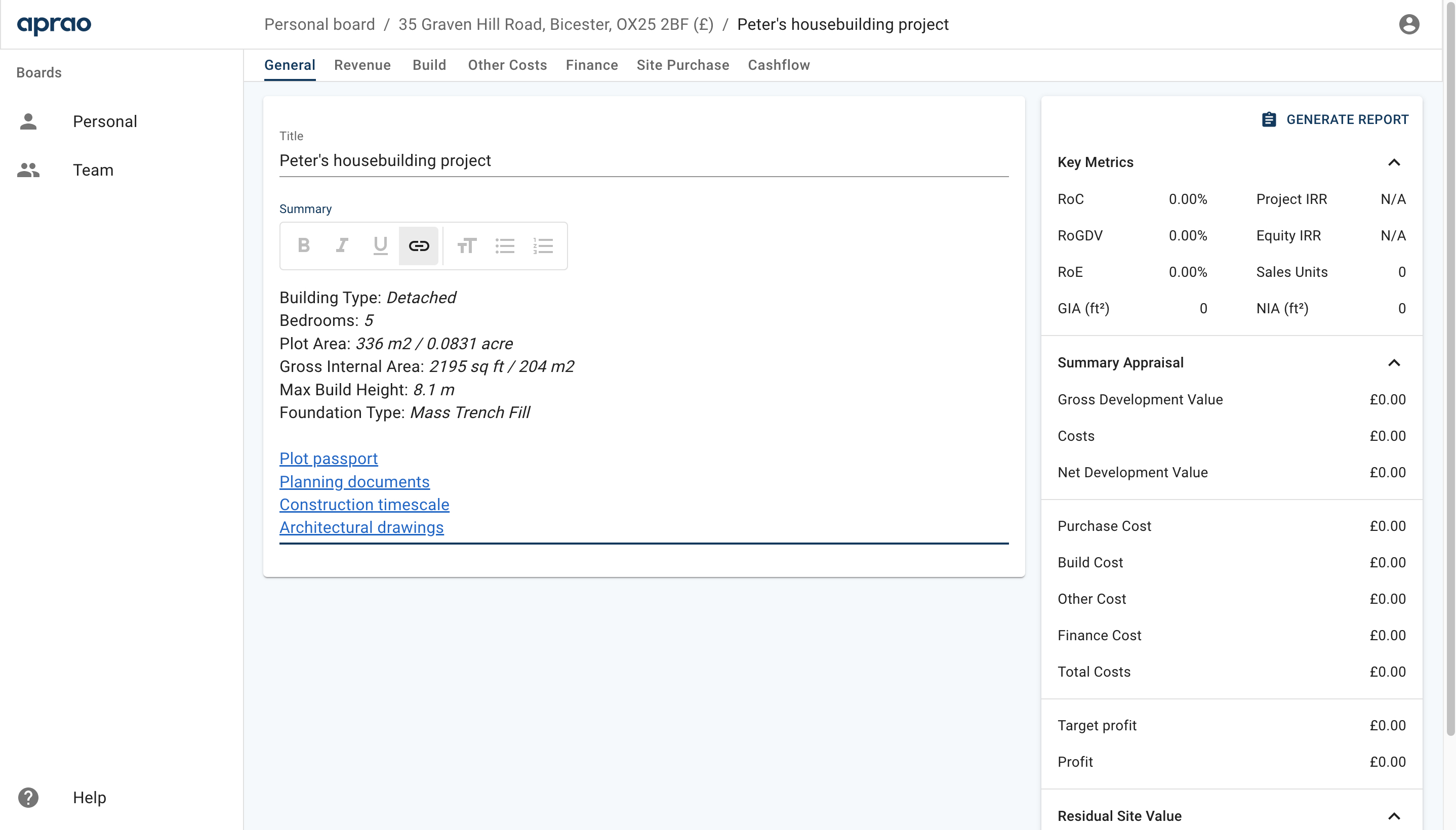

Then he adds a new appraisal and inputs different details onto the summary page. He includes a short description of his project and links several documents required by the lender (planning documents, construction timescale, architectural drawings etc.) into one place.

Revenue and Build Costs

Next, Peter goes through the Revenue, Build and Other Costs tabs. He entered the estimated market value of the house that is to be built, the build cost quoted by the housebuilder and some bits and pieces of costs that will incur throughout the project.

Finance

Now, Peter moves on to the Finance tab. He enters the loan amount (70% of cost) and a 5% interest rate that he expects from the lender. He can always go back to this and change the number whenever his offer from the lender changes.

Under Payout, he selects Serviced and Drawn Balance, which is how construction and land loans operate. Under Calculation, he chooses Cashflow and leaves it there for now, since the cash flow will be created in the next step. He enters other fees related to the loan and this section is completed.

He then slightly modifies the numbers he entered earlier during the appraisal. Because Aprao is a dynamic tool, the changes are immediately reflected in the summary table on the right. This allows Peter to easily move on to other tabs without having to make any manual changes.

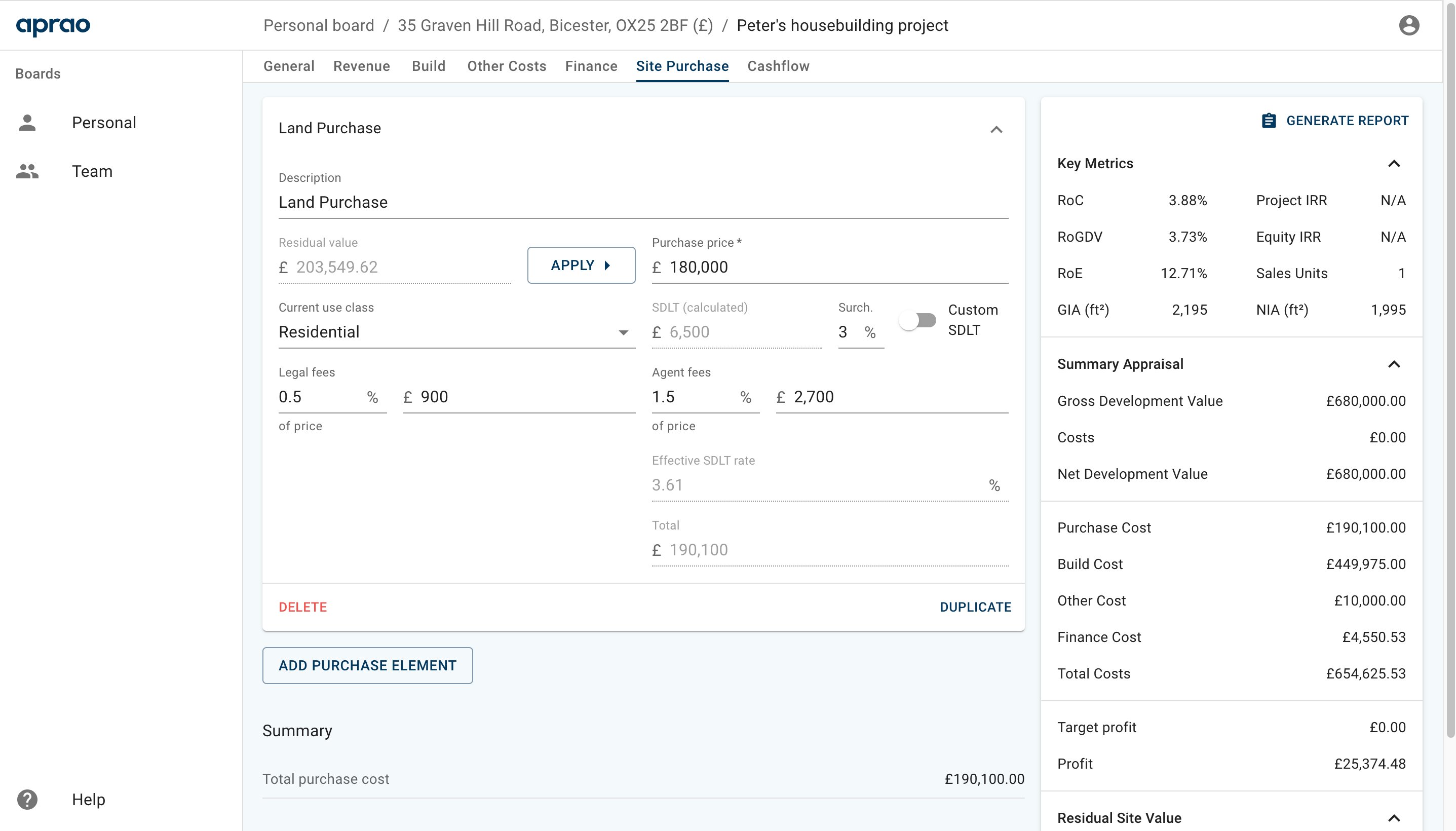

The next step is Site Purchase. Peter enters the price of the land that he is going to buy along with the fees involved. The residual value is not needed in his situation, so this section is completed as well. At this stage, Peter can already have a quick glance at the various costs on the Summary Appraisal table on the right-hand side.

Cashflow

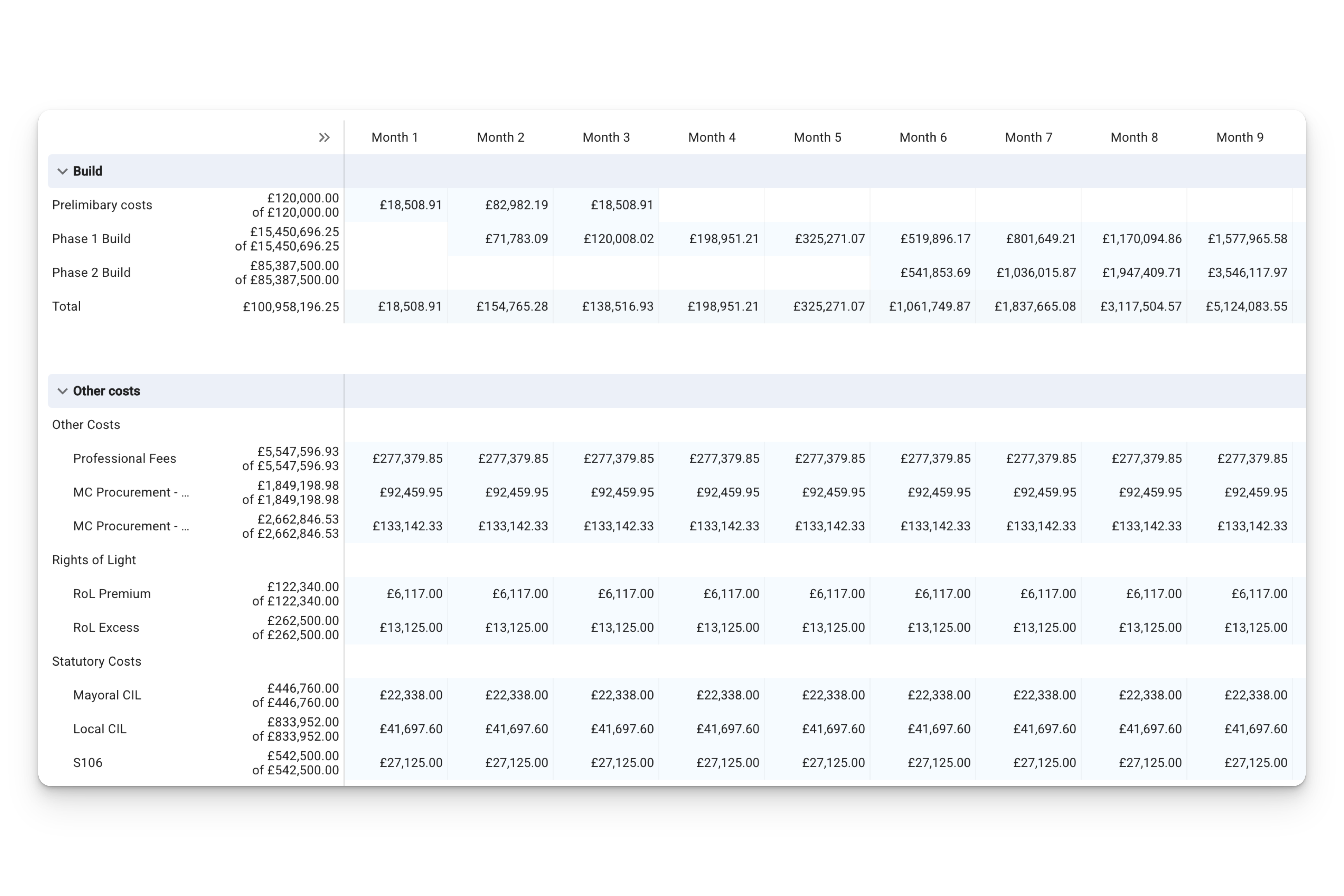

The final and the most important piece of the puzzle is the cash flow that is used to determine the loan drawdown each month. Peter goes to the Cashflow tab and sees that there is a left column with numbers that are already pre-populated. These are the numbers he inputted in the previous steps. Some cells are filled out in orange - Peter can decide the timing of these items throughout the project.

Peter and the housebuilder estimate that the project will take 12 months to complete. Therefore, the Revenue Balance will be shown in the 12th-month column of the cash flow. For that, he enters 12 under start, and 1 under length. This is the start of the month, which is the 12th month, and 1 is the total number of months the revenue will be incurred.

With a click of the tick symbol, Aprao creates an entire row of cash flow cells with the correct figure entered in the 12th-month cell. At the same time, the orange colour disappears in the cell saying 0 units left of 1 unit. This means Peter has completed the cash flow of this row and there is no missing number that he's forgotten to put in.

The process is basically the same for other rows. In the Site Purchase section, all the payments related to site purchase will happen in the first month. Hence, in the Land Purchase row, he enters 1 under month, and enter 100 under %, then he clicks the + symbol to apply it to the cash flow. This means the land cost will be incurred in the first month and it will be paid 100% within the first month. In other cases, Peter could enter a fixed amount of cost under amount and split the total figure.

As long as the total amount has correctly been inputted throughout the row, the orange colour in the cell should have disappeared, indicating that the cash flow of this row has been completed. Peter does the same for SDLT, Legal Fees and Agent Fees.

Build costs

Moving on to Build costs, Peter and the housebuilder estimate that build costs will start to be incurred in the second month, and will last for 11 months. Therefore, in the Custom House Builder Cost row, he enters 2 under start, and 11 under length.

When Peter clicks the tick symbol, he is able to choose either a straight line or S-curve distribution when splitting the amount across the 11-month period.

For build costs, the common assumption is that the cost will be split into an S-curve along the period, with more cash needed in the middle than at the start and the end of the period. If he wanted to average the cost across the time period, he would choose straight.

After completing all the rows and identifying no orange cells, Peter finishes the cash flow model. He doesn't need to format cells, enter formulas or check each cell for errors as Aprao has done this automatically for him.

Exporting the spreadsheets & generating reports

In the Finance section of the cash flow, Aprao is able to directly show the loan drawdown needed each month automatically. If you want to view this cash flow model using excel, you can simply click EXPORT on the right upper corner and download the excel spreadsheet.

Now, Peter goes back to the Finance tab and under Interest (cashflow), he can immediately see the cost of the interest calculated according to the cash flow model. And the figures on the right side of the summary table are slightly adjusted according to the cash flow.

Now, Peter is ready-to-submit his development appraisal. He clicks 'Generate Report' and downloads the pdf file.

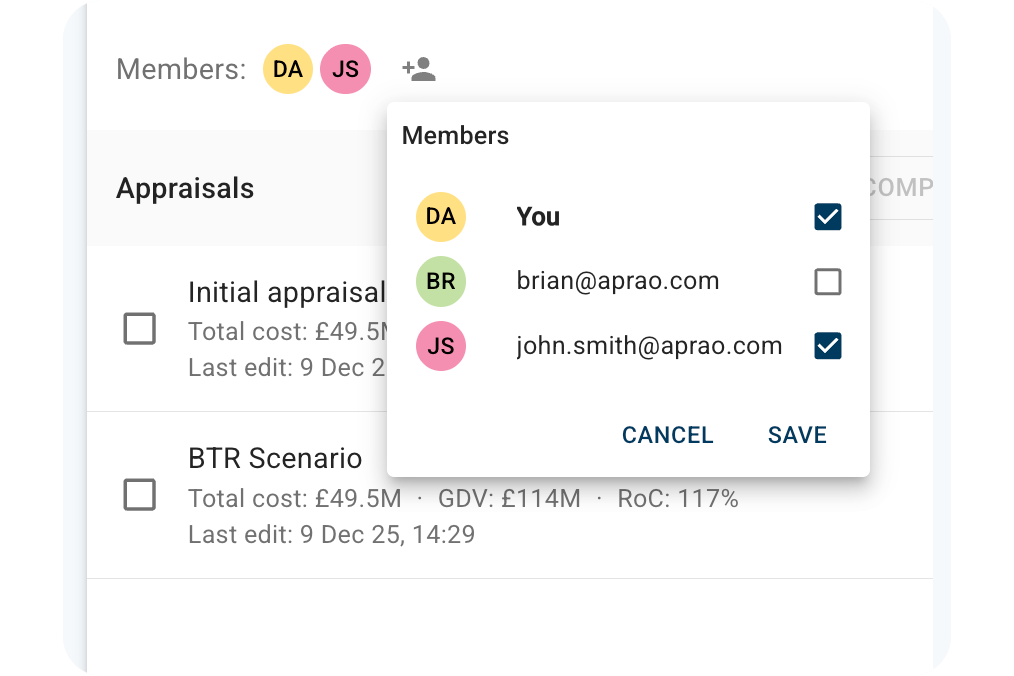

For an online view of the appraisal, he can go back to the Aprao board and choose an appraisal to share. The link shared will look like this:

The financial appraisals created using Aprao like the one created by Peter, are well-recognised by lenders across the UK as their preferred appraisal format. Check out our Learning from Lenders video series to listen to what lenders are really looking for when assessing deals and what they think about Aprao.

Interested in modelling construction and land loans in Aprao for yourself? Get started for free, no payment required here.

.jpg)

Leave a comment