We have been exceptionally busy working on a new feature that transforms how easy it is to calculate the expected costs of property development finance.

Aprao has always provided a tool to calculate a quick estimate of interest costs, ideal for a quick appraisal to look at the profitability of a project or calculate the residual value.

However, our new functionality now also calculates an accurate interest figure based on your timings in the cashflow.

The majority of development finance is calculated on drawn balances (you only pay interest on what you are using) so it is has been notoriously difficult to really estimate what your finance is likely to cost you. Not any more.

You can now use Aprao to calculate finance in three different ways:

- Quickly estimate development finance costs (video timestamp: 00:13)

- Detailed development finance interest calculation (video timestamp: 02:37)

- Match your appraisal to your lenders' terms (video timestamp: 05:27)

Let me walk you through each of these and show you how each one works.

1 - Quickly estimate development finance costs

Let's say you are looking at a development opportunity and want to run a quick appraisal to either calculate the residual site value, or look at the profitability. You want to factor in the finance cost but do not want to spend any time doing a cashflow forecast.

Once you have entered your headline information such as sales, build costs, other costs and site acquisition you will move on to the finance screen.

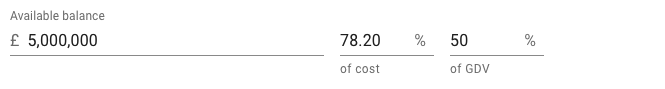

First, enter how much you expect to borrow. You can enter this as a percentage of the development costs, a percentage of the GDV (gross development value) or you can simply enter an amount in your chosen currency.

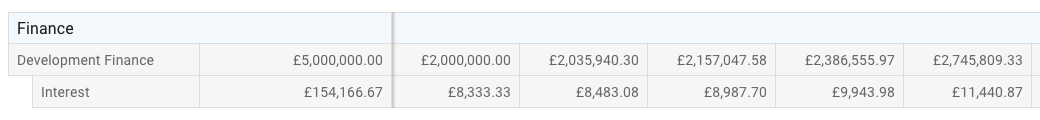

So in this example, our project has a GDV of £10m and we have assumed development finance at 50% of GDV, and it looks like this:

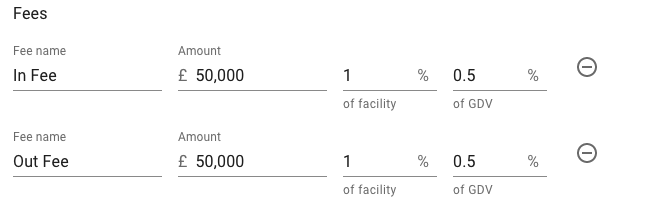

Next we can add fees. These are optional but a good rule of thumb would be a fee on the way in of 1% of the facility size, and 1% of the facility on the way out.

Next you need to set your interest assumptions, you can choose from:

- Interest on drawn balances

- Interest on the full loan amount

- Profit share

In most cases, for a quick estimate you are best placed to set this to 'Interest on drawn balances' as it's the most common type of interest calculation for development finance.

You then set your interest rate as a percentage, and select if that is monthly or annually.

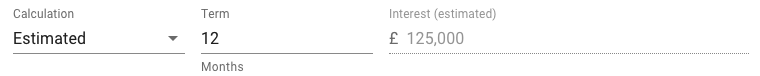

Finally, you need to enter the term (how long you need the money) and you will see an estimate of the interest costs. In under a minute you can get this quick interest estimation.

2 - Detailed development finance interest calculation

Now let's see how it works when we want to create an accurate estimation of interest costs based on the timescales of your project.

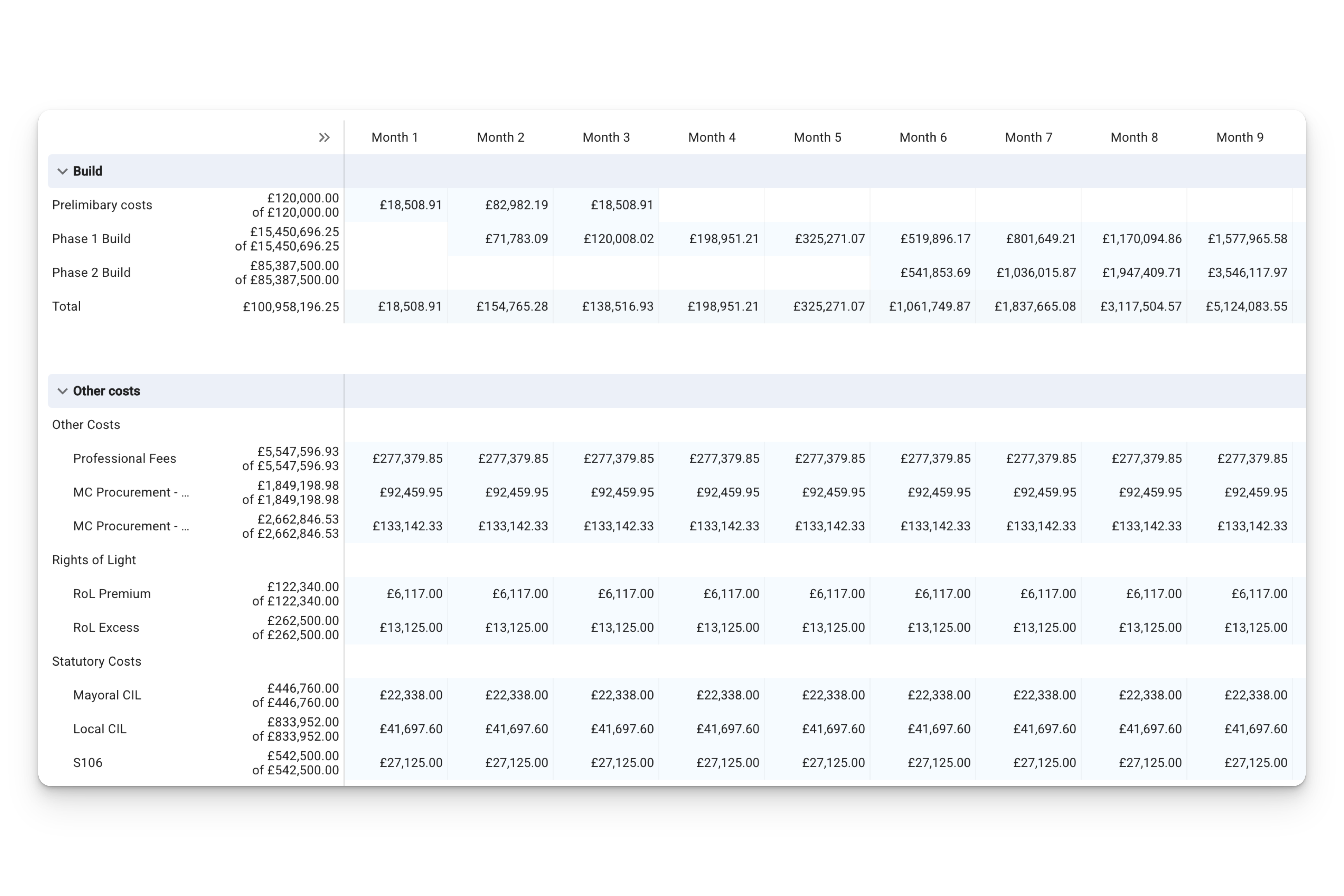

Once your appraisal is set up you need to head to the cashflow tab and create a cashflow for your project - you can see a video on how to do that here.

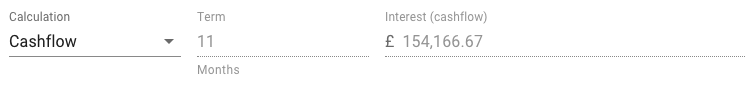

On the finance screen, you set the lender up in the same way with the loan size, fees and interest type - but this time in the calculation option select 'Cashflow' and this will instantly allow you to see the accurate interest cost estimate based on your timings.

You will see that the term is adjusted based on how long your project requires the finance and the interest figure is clearly displayed.

You can also see in the cashflow the running interest costs on a monthly basis. When the finance amount increases, the interest increases.

3 - Match your lenders' terms

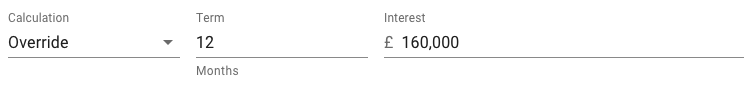

When you are given terms on a project, you may want to match your feasibility to your lenders' assumed debt costs. You can follow exactly the same process but set the interest calculation to 'Override' which will manually allow you to set an interest figure.

So given the example above, the estimated interest from the cashflow was £154k but a lender is likely to assume a bit of a buffer and may allocate £170,000 of their facility to interest.

Wrap up

Don't worry if this is all a bit confusing, it's actually very simple in practice and we are always on hand to help. Just send your questions to support@aprao.com.

If you have not yet tried Aprao, get started free, no credit card required.

Leave a comment