Panic buying and price hikes! These are just some of the trends Paul Heming is seeing in real-time within the construction sector. Paul is the founder of C-Link, an end-to-end solution where developers and contractors can manage their subcontract procurement all in one place (from discovering subcontractors to automating contracts and controlling their construction programmes). In this interview, Paul chats to Aprao about current procurement trends and his predictions for the future of the industry.

What trends do developers and contractors need to be aware of?

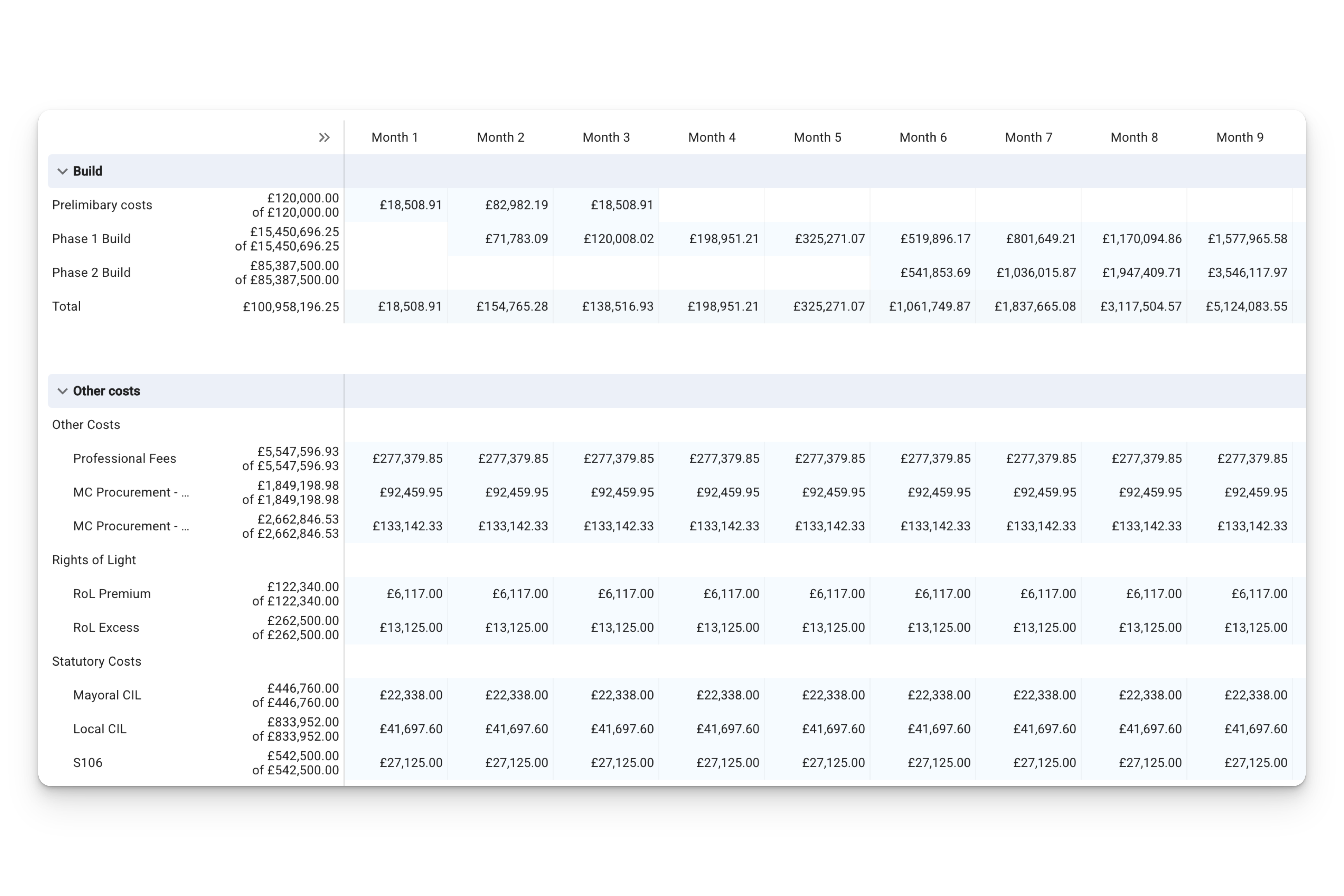

“Well to start,” Paul tells us, “the world is getting turned upside down and we, as a sector, can’t cope with it.” The prime root of this is fluctuating build costs and material prices. “If you look at steel in June 2021, it was up 53% on the 12 months which is huge; this year they’re talking about steel going up another 50%. You’ve got cement costs now up 30% and sealants at 20%.”

For context, material prices increase every January, typically at a range of 2-9%, with 9% representing a particularly high upper bound, so these kinds of numbers mean soaring build costs. “We’re seeing absolutely insane numbers, rates are soaring and going through the roof.”

Everyone’s talking about timber

According to Paul, prices are at an all-time high. Although the UK government has committed to tripling the rate of tree plantation in the wake of wood shortages, it hasn’t prevented the fluctuation of prices. To illustrate this, in October 2020, developers were willing to pay under £500 for timber. By May of this year, the price had ballooned to £1400, meaning a nearly three-fold increase. Paul attributes this to the dwindling amount of structural wood in the global market supply.

The export of timber from America is low due to Covid. And it’s not just the US. Sweden, which supplies 50% of wood used for infrastructure in the UK is at a 2-decade rock bottom for stock levels. Consequently, costs are “at unprecedented levels, and although it’s lowering, it’s still very volatile at the moment”.

However, Paul is optimistic: in his view, there’s a delay in the timeline which means “what is currently going out to the contractors is yesterday’s news – I do think timber is going to settle down”.

Unfortunately, this price hike is making trade flow unstable. Much like in the retail sector, when the pandemic led to panic-buying groceries and household items (remember all the empty shelves in your local supermarket!), Paul has witnessed similar behaviour in procurement.

“There is a de-risk strategy that some are taking. An example of this is one of our developers are currently procuring their groundwork. But rather than procuring the materials in a sequential way, they’ve taken the decision to buy absolutely everything now.

"They’re not even out of the ground and they are about to place orders for dry lining, tiling, painting and decorating. That means they are paying more, but they’re locking in the risk now.” But are stress responses like this cooling down?

“What is starting to trickle through to me, from my conversations with sub-contractors, contractors and developers is that next year, things are going to change and ease up.”

How is the climate crisis affecting build costs?

According to Paul, the industry has not sat up and taken notice in the way that it should. “Unfortunately, I don’t think it’s changing build costs right now because I just don’t think there is enough push from the architectural level. "Sustainability is not enough of a trend in the sector to be affecting build costs.” This is in spite of “cement and steel being the biggest contributors [to the climate crisis]”.

Found this interview interesting? It was originally published in our recent Res Dev Real Talk: Autumn 2021 report. You can read the full report for free below:

.jpg)

Leave a comment