How does rolled-up interest work?

Retained interest is a type of interest arrangement that is commonly used in property development loans. The borrower does not have to worry about making monthly interest payments with this arrangement. Instead, the interest is added to the total loan amount right from the start. As a result, the borrower initially receives a slightly smaller loan amount, but they will repay the entire loan facility, including the interest, at the end of the loan term.

By deducting the interest cost upfront, the borrower effectively receives a reduced loan amount, which then becomes their available balance. The purpose of retaining the interest amount upfront is to cover interest payments throughout the duration of the project or loan term. As the interest has already been accounted for in the retained amount, the borrower does not need to make separate interest payments during the project.

Problem with retained interest in practice

However, in practice, there is often a challenge in accurately calculating the precise amount of retained interest that will be incurred in the borrower's specific project. Typically, the lender will provide an outline of the terms, including how interests are paid, such as whether it is rolled-up, retained, or serviced. However, since the lender does not have early-stage details about the borrower's project cashflow, their calculations on the projected interest may be somewhat speculative.

Suppose a borrower obtains a property development loan with a total facility of £5,000,000, an annual interest rate of 12%, and a 12-month term.

The retained interest will be calculated by multiplying the total facility (£5,000,000) by 12%, resulting in £600,000.

Subsequently, the lender holds onto the interest for the entire 12-month term, reducing the upfront amount received by the borrower to £4,400,000, which serves as the available balance throughout the term.

When the 12-month term concludes, the borrower repays the available balance (£4,400,000) in addition to the retained interest (£600,000), resulting in the total facility amount being repaid (£5,000,000).

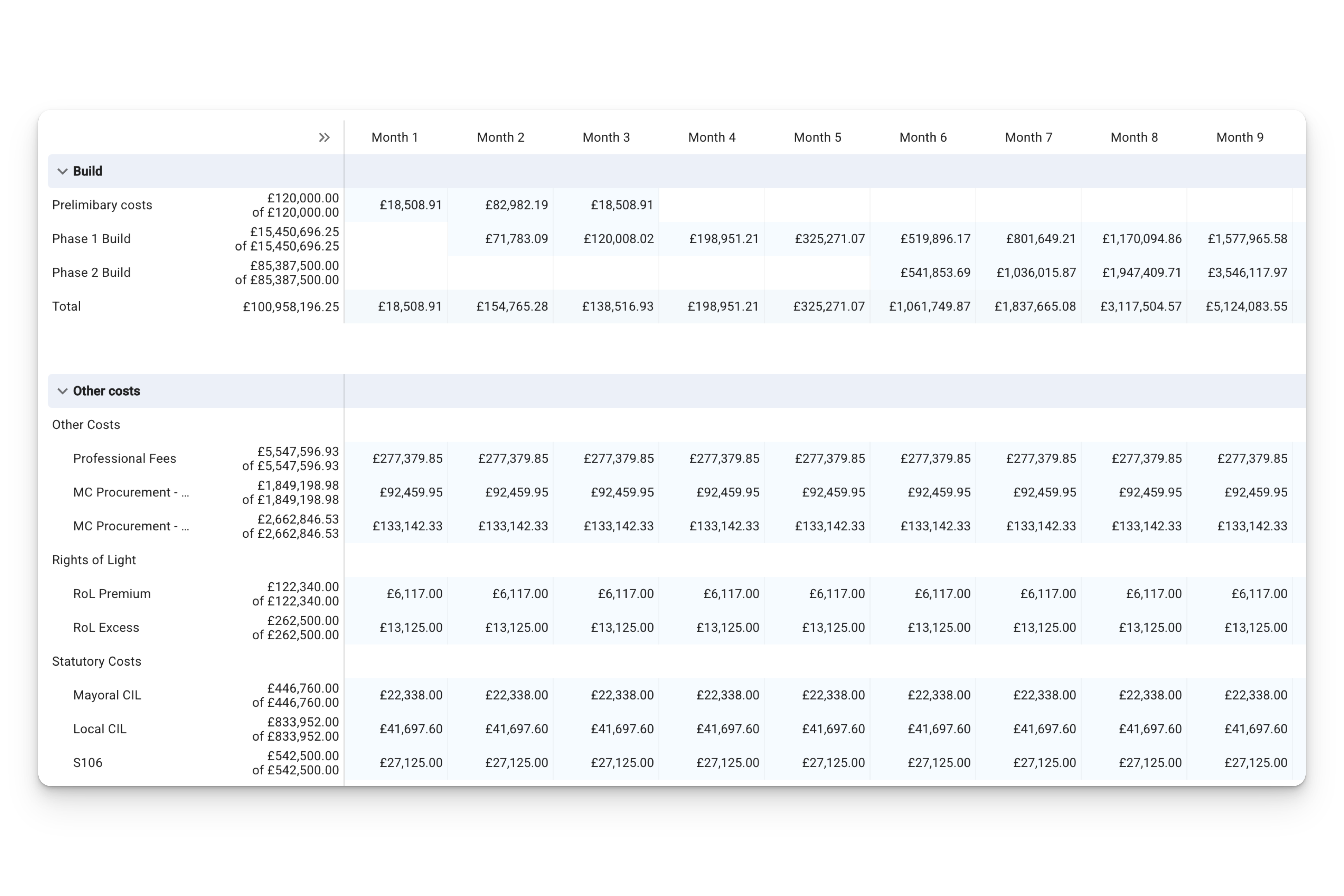

Upon analyzing the project cashflow, it becomes evident that the available balance is not fully utilized on day one due to the spread-out development costs over the course of the 12-month project. The loan drawdown gradually increases from month 1 to month 7, and revenue starts coming in on month 8, allowing for the complete repayment of the loan by month 10. With this newfound information from the cashflow analysis, the borrower realizes that the lender's calculation of the retained interest (£600,000) is indeed an overestimate.

A key question arises: How can the borrower accurately determine the retained interest based on the cashflow and effectively communicate this information back to the lender?

Calculate retained interest with Aprao

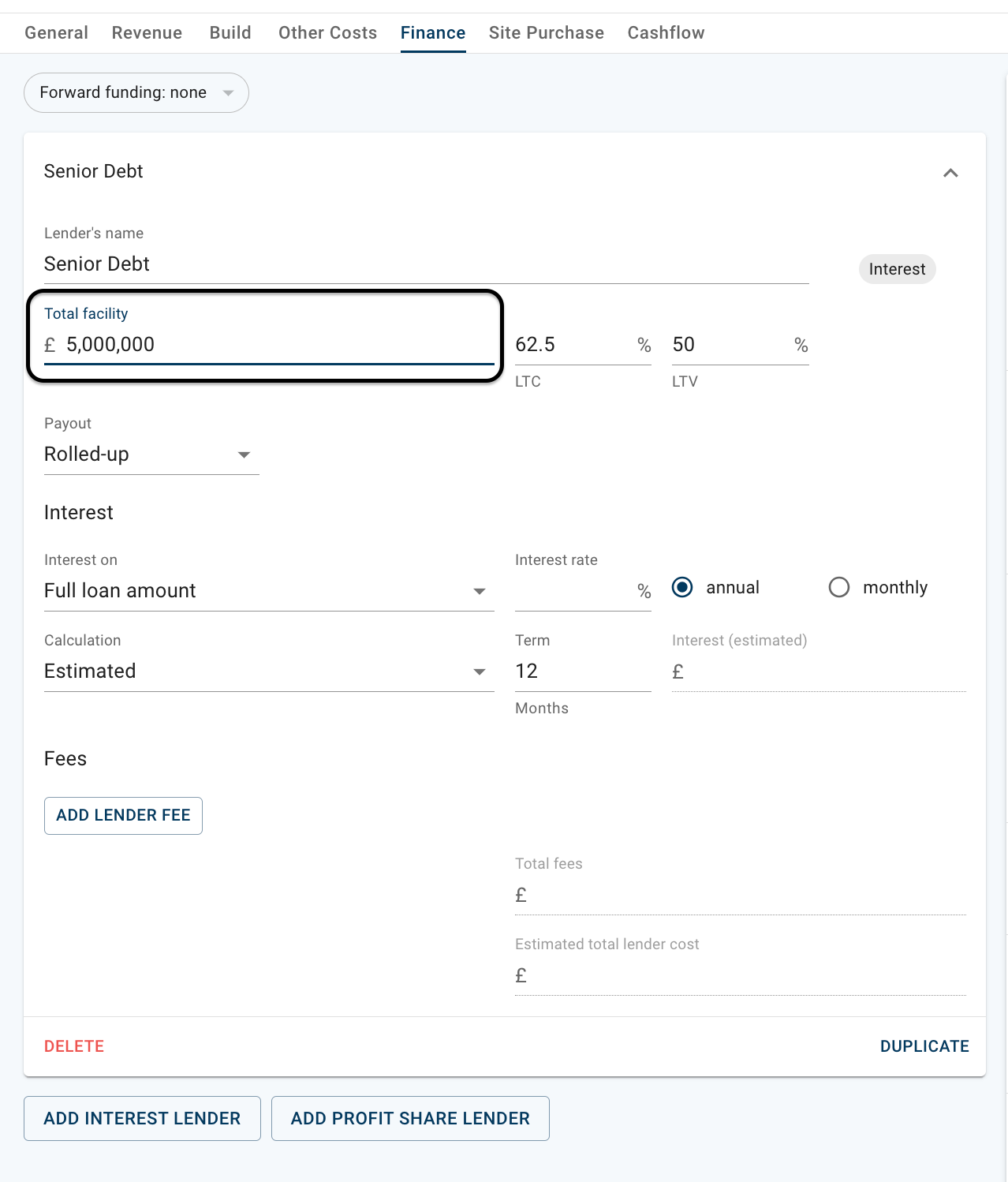

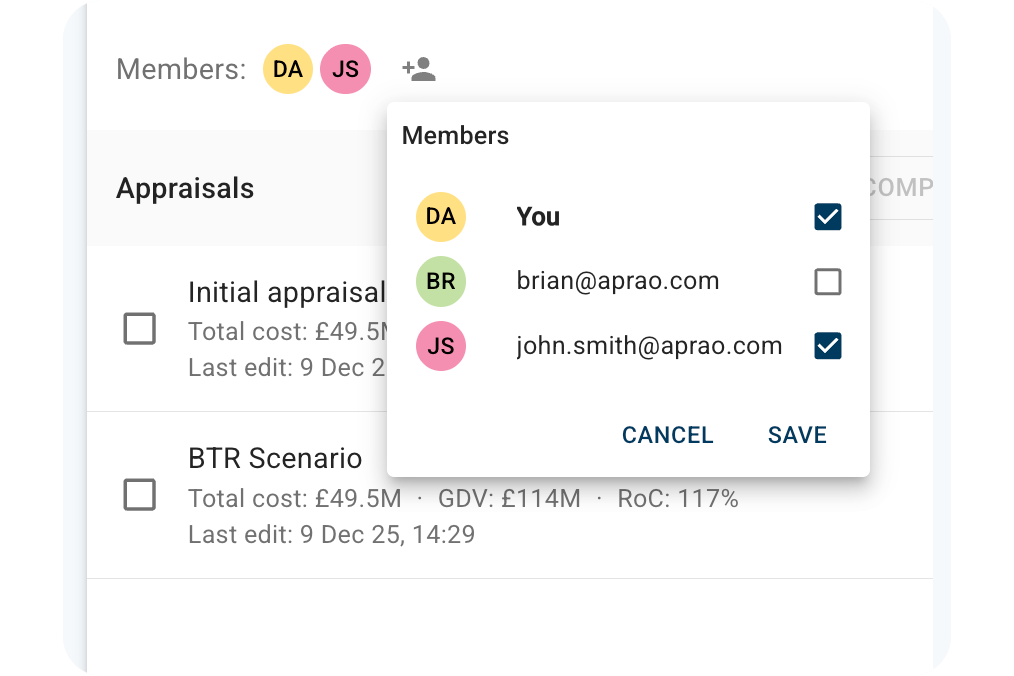

Let’s say the lender provides you with a loan with a total facility of £5,000,000. Keep in mind that you should have already added all the revenue and costs and also completed the smart cashflow in your Aprao appraisal. To create your first appraisal in Aprao, click here and follow along with these instructional videos. First, input the total facility of the loan that you are getting. Here, we assume a total amount of £5,000,000.

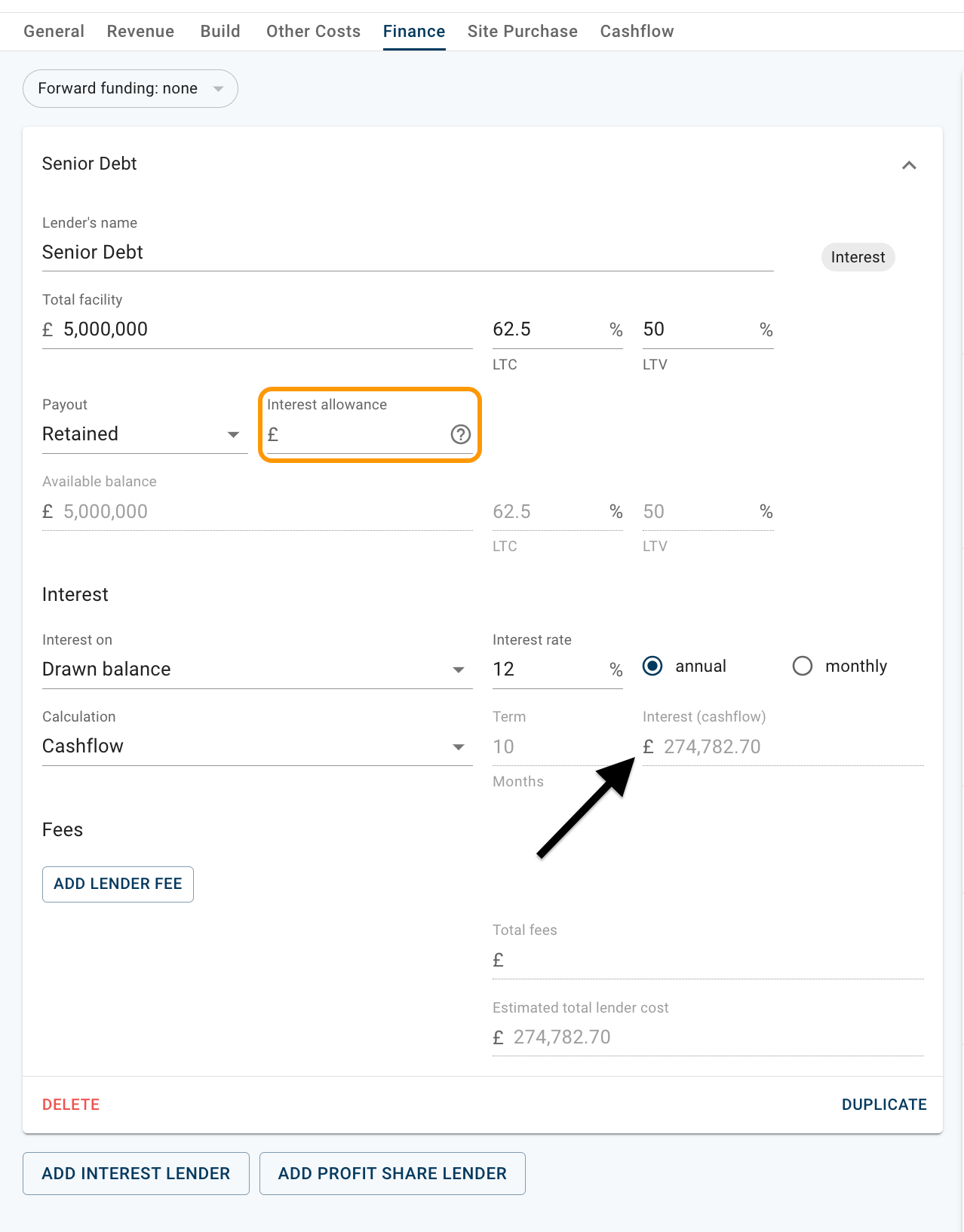

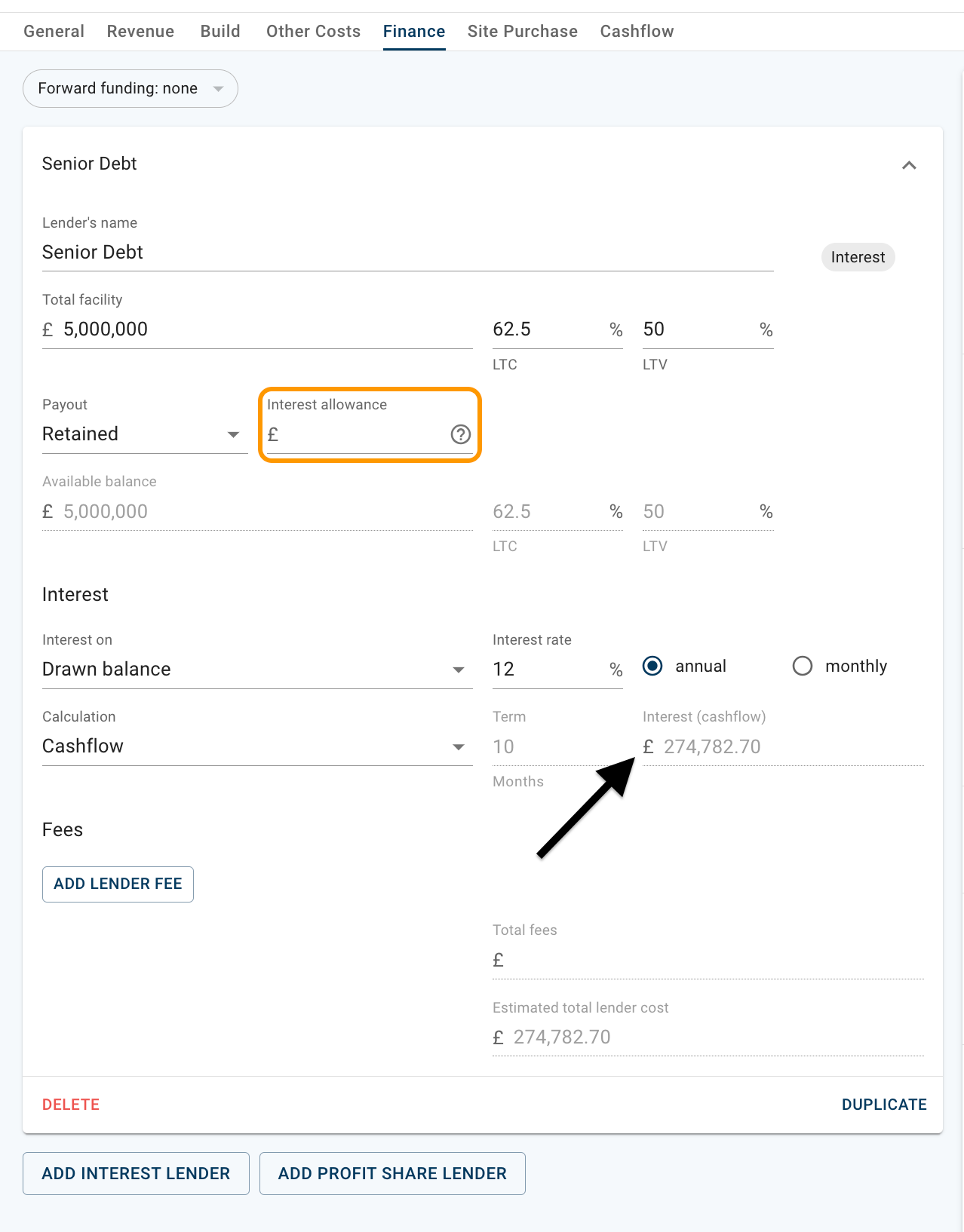

In Aprao, you have the option to choose between 'Retained', 'Rolled-up' and 'Serviced' as your loan’s interest type for interest calculation purposes. By choosing ‘Retained’, a box named ‘Interest allowance’ appears. This is where you can input the retained interest amount after the system calculates it for you later on, in order to establish the correct figure for the available balance. We skip this step for now and we will revisit it later in the process.

You know that the loan is not fully drawn on day one according to your cashflow. In this case, you should select the option for interest on 'Drawn balance’ instead of 'Full loan amount'. Next, input an interest rate, here we assume 12% per annum. Then, select ‘Cahsflow’ as the basis for the interest calculation. The estimated interest amount will then be calculated and shown.

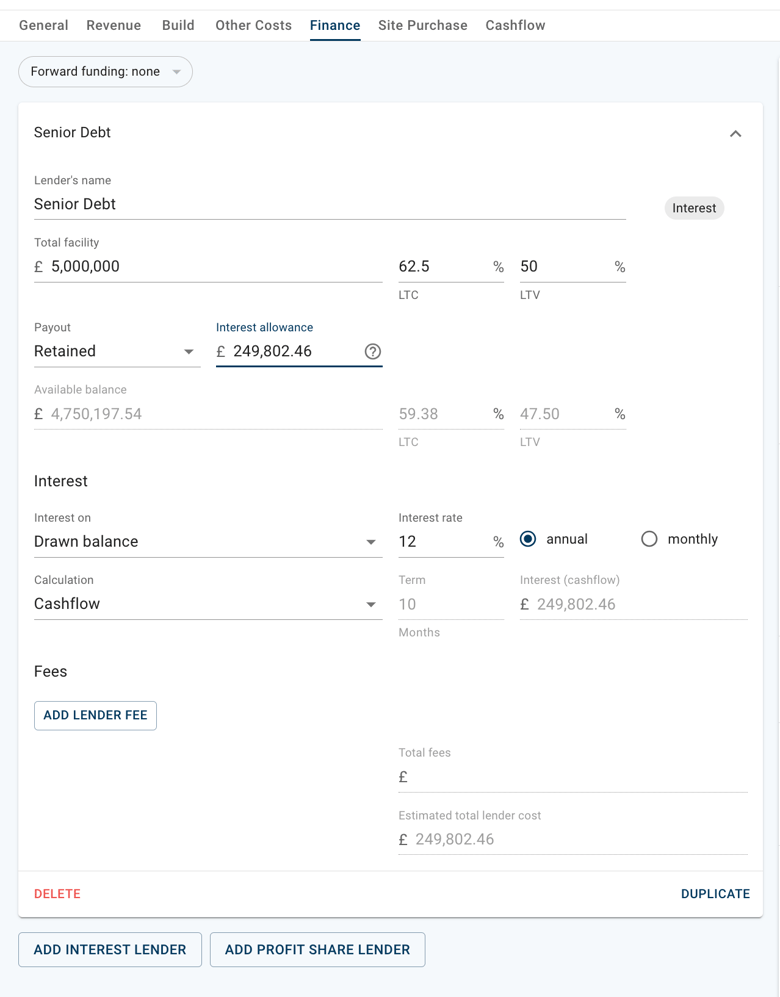

You can already see that the term of the loan is not 12 months but 10 months, because the cashflow shows that the revenue can repay the loan completely on month 10 already. The final step is to enter the 'Interest allowance' in the designated box outlined in orange. This orange outline reminds you to provide an allowance that adequately covers the calculated interest. As you enter the allowance, the calculated interest adjusts dynamically based on the interaction between the retained amount, available balance, equity required for your project, and the cashflow. The great news is that you do not have to manually adjust all these figures yourself. Once you input the interest allowance, all the necessary adjustments are made simultaneously, ensuring an accurate real-time appraisal.

In this particular case, the interest allowance has been aligned with the calculated retained interest. This means that the total loan facility amounts to £5,000,000, with the actual retained interest being £249,802.46, resulting in an available balance of £4,750,197.54.

Read this blog series on interest types - rolled-up, retained and serviced. Read this complete guide on how to incorporate development finance into your project.

Want to follow along and create your own appraisal? Existing customers can log in here and new customers can click here to sign up for a free 14 day trial of Aprao.

Leave a comment