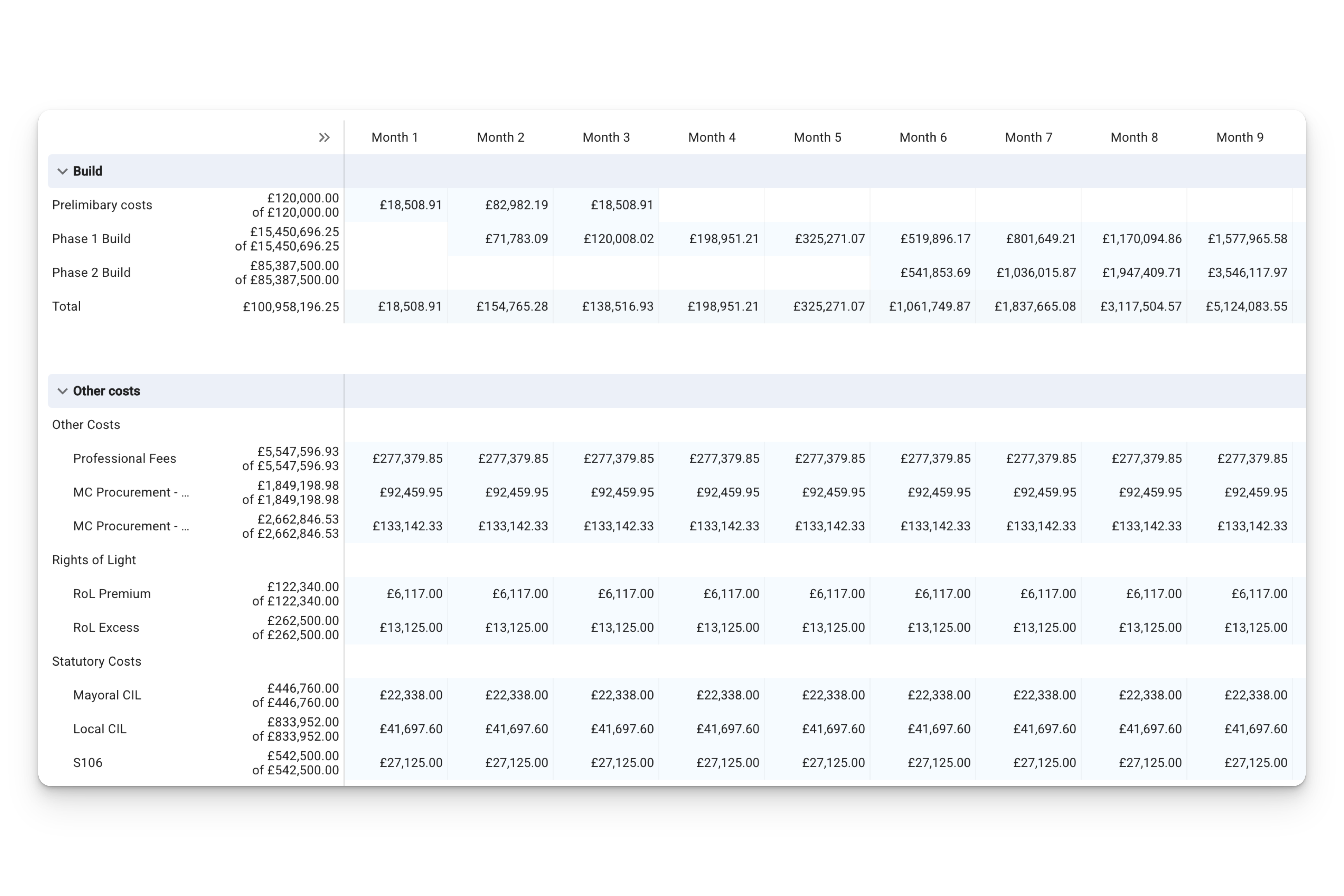

The original sensitivity analysis

Prior to Aprao, I worked in development finance banking. For every development project we looked at we created a sensitivity analysis which helped us to assess the risk profile of a property development. This table compared changes in the gross development value (GDV) and the build cost to see the impact on the financial return of the project.

This seemed like such a smart tool to me, I was shocked to find out that very few property developers have been making use of a sensitivity analysis. One reason is that it's extremely complex to build an accurate sensitivity analysis which assesses 50+ development scenarios instantly.

When we launched Aprao we knew we had to build this into our software as it is such a valuable tool for property developers, valuers, banks, investors and pretty much any other stakeholder assessing a development opportunity.

We took this one stage further and also added colour coding to the table to give a clear visual representation of the risk profile of a project.

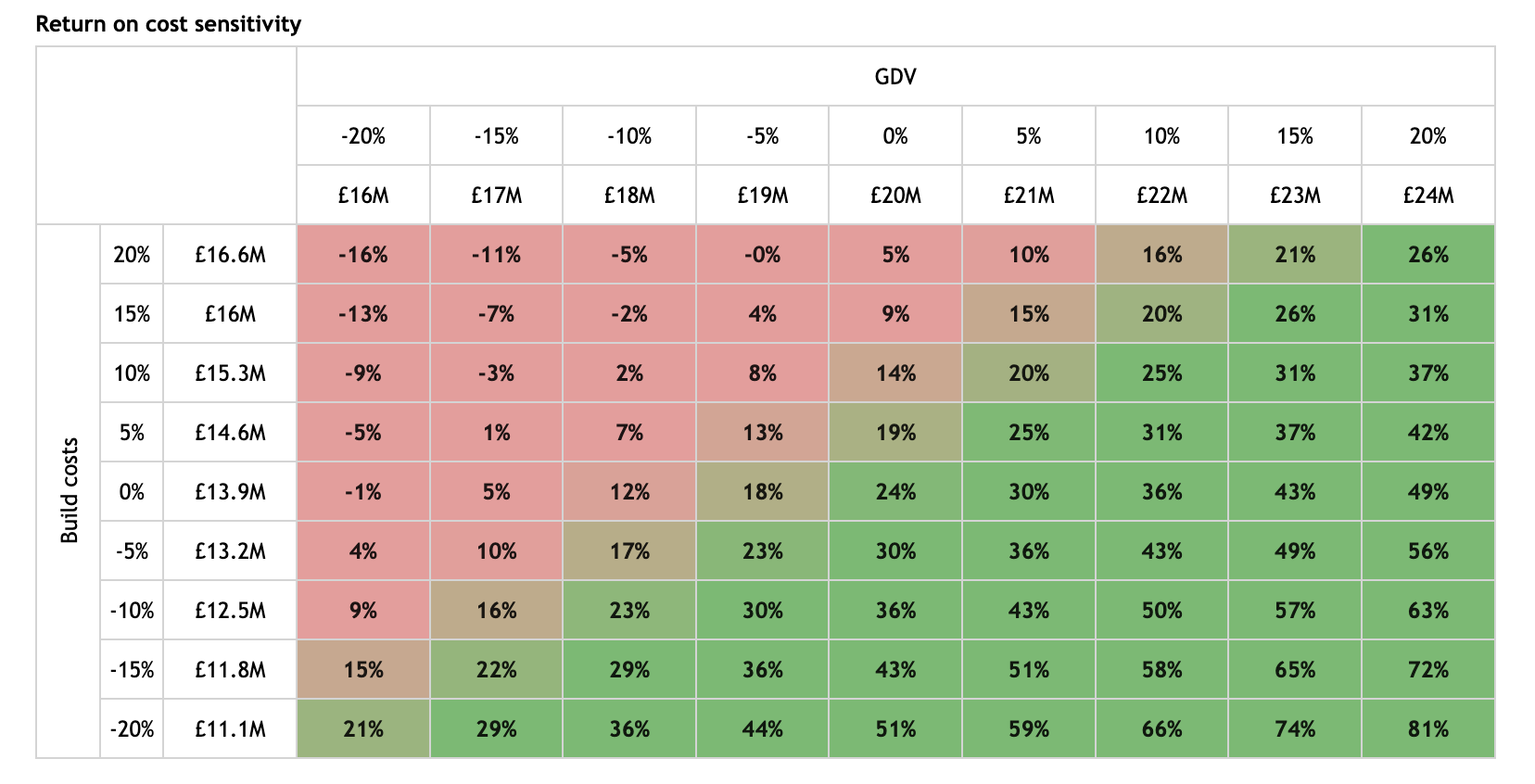

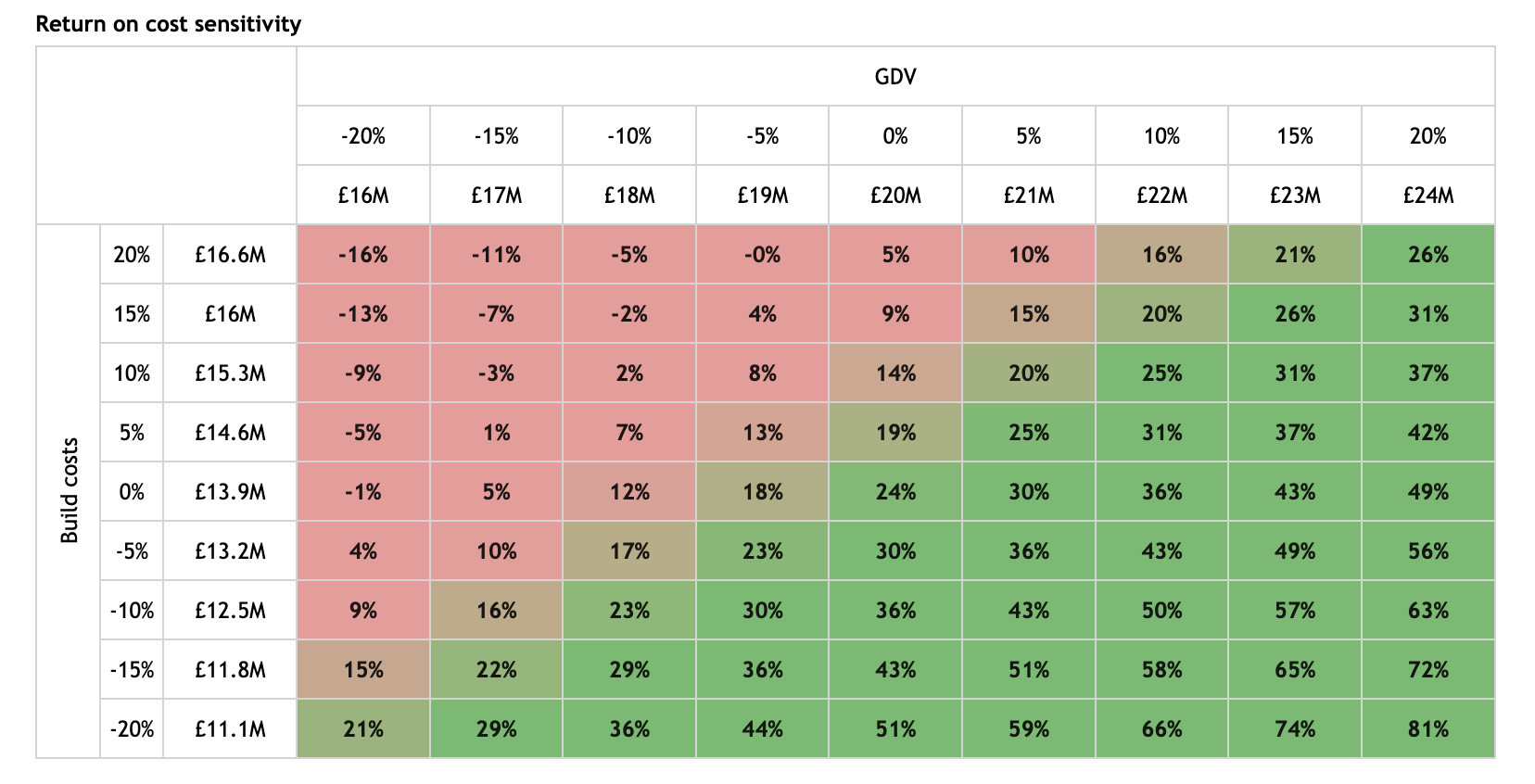

Here's an example of our original sensitivity analysis.

In the above image you can see that across the top is the Gross Development Value (GDV) which changes in 5% increments. Along the side you can see the build cost, again with changes at 5% increments. In the sensitivity analysis table you can see a percentage. This represents the return on cost (also sometimes known as profit on cost or yield on cost).

In the middle you will see the 'base case' which is the return based on the financial model assuming nothing changes. As you can see this is a return on cost of 24%.

Now look at what happens if the GDV drops by 10% and the build cost increases by 10%. The return on cost is now only 2% and probably not a project work embarking on if you feel that those variables are likely to occur in the market over the duration of the project.

What's new?

Our customers have enjoyed using the original sensitivity analysis and have requested that we take it even further. As a result we have now refined the original sensitivity analysis and released two additional sensitivity analyses. Let's take a look in more detail.

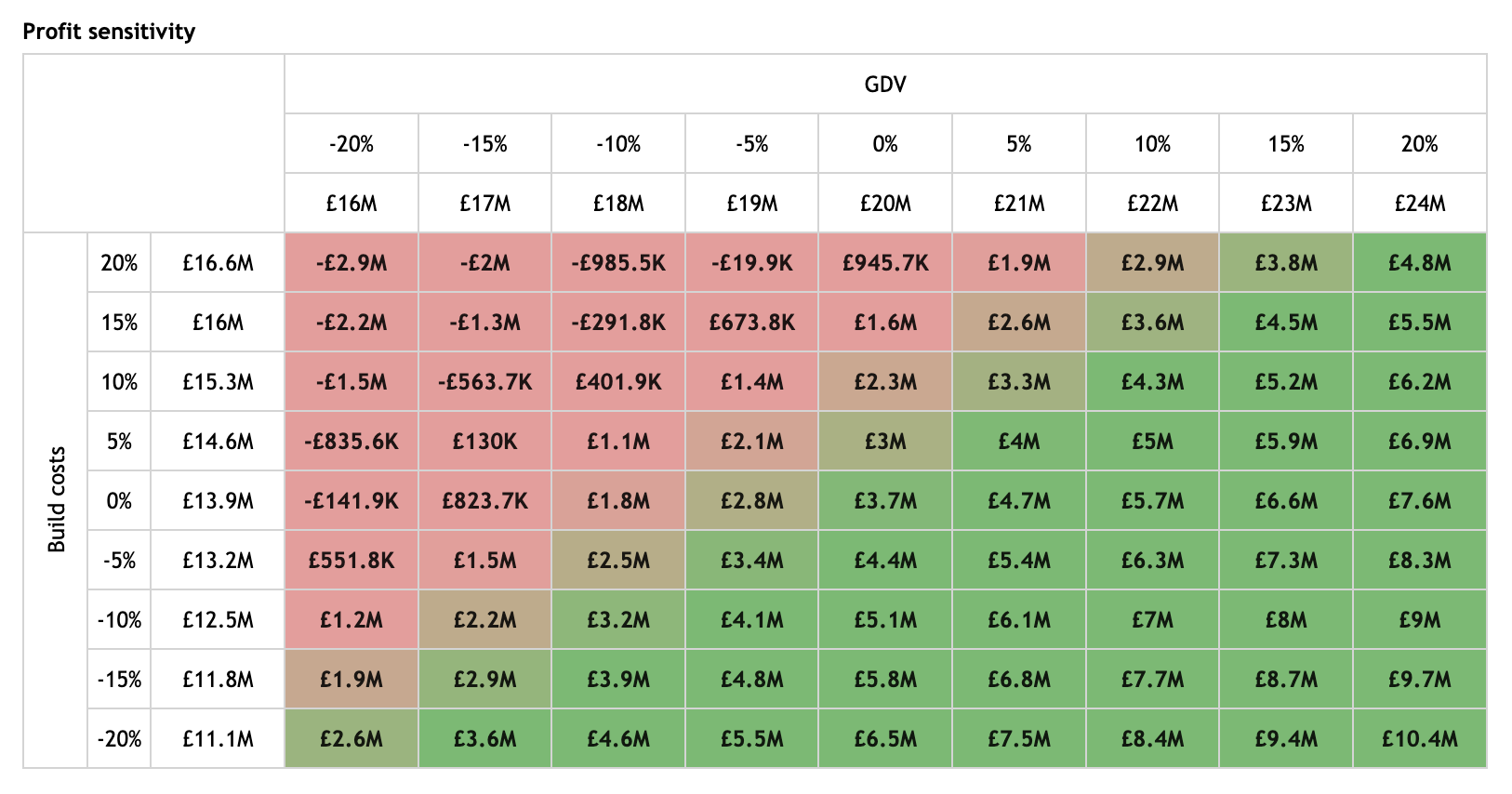

The profit sensitivity

As we have covered, we previously had the profit metric return on cost (also known as profit on cost or yield on cost). The profit sensitivity looks at a financial figure that sits behind that percentage return.

As you can see from the image above, the variables remain the same but in the cells you are able to see what that profit figure actually looks like.

Taking the example from above, our base case would generate £3.7m profit and the variable with a 10% drop in sales values and a 10% increase in construction costs would equate to that profit being reduced to £401k, a drop of £3.299m.

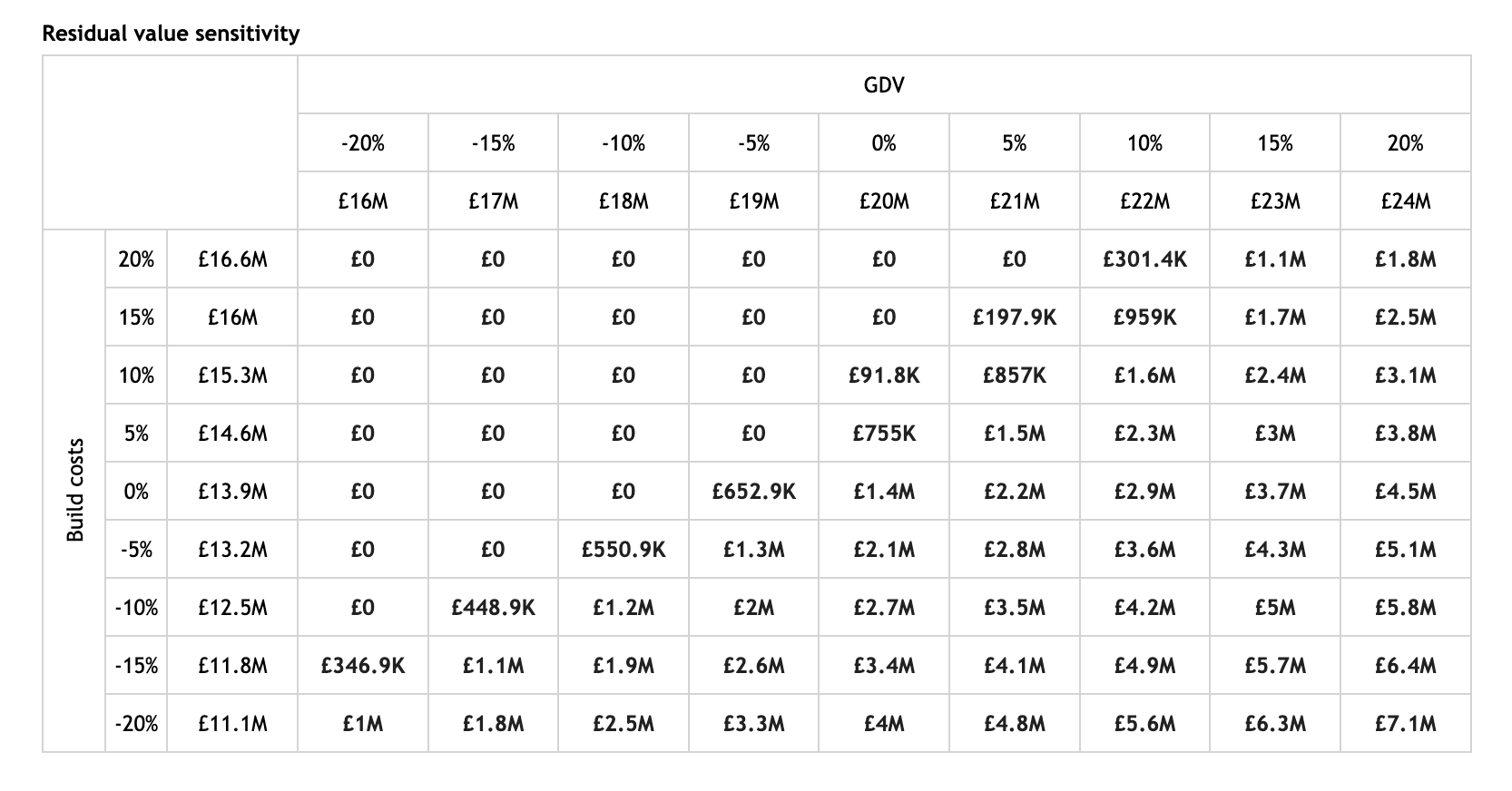

The residual value sensitivity

Now we know what happens to our profit as a % and as a financial amount but what does this mean for our residual value? Let's say that you are targeting a return on cost of 20%, the table below will show you the maximum valuation on the land in order to achieve the target return.

Using the table above, look at what happens to the residual value if I am expecting construction costs to rise by 5% during the life of the project. You will see that my residual value changes from £1.4m to £755k.

This feature is excellent for negotiation when looking at development sites as it can be used to demonstrate the reasoning behind an offer.

Summary

Ultimately we want to help you assess risk effectively and these three sensitivity analyses are designed to do exactly that.

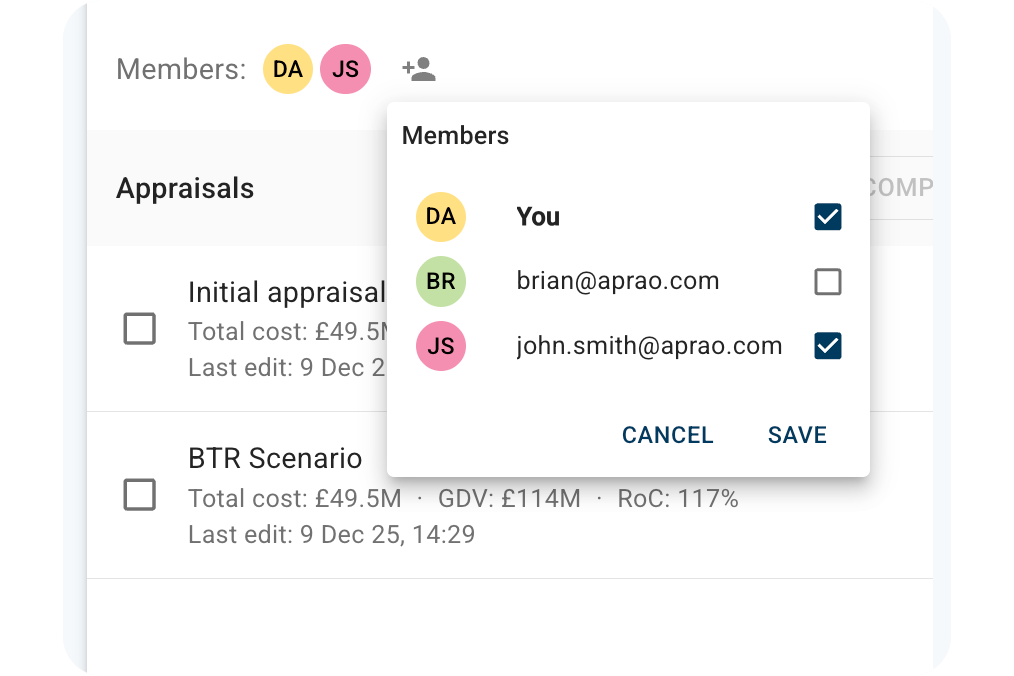

All three sensitivity tables are now released and available to all Aprao customers. When you share or export the Aprao report you will see all three of the sensitivity analysis visible on the final pages.

Existing customers can log in here to take a look and new customers can click here to sign up for a free 14 day trial of Aprao.

Leave a comment