New in Aprao: Operated Assets

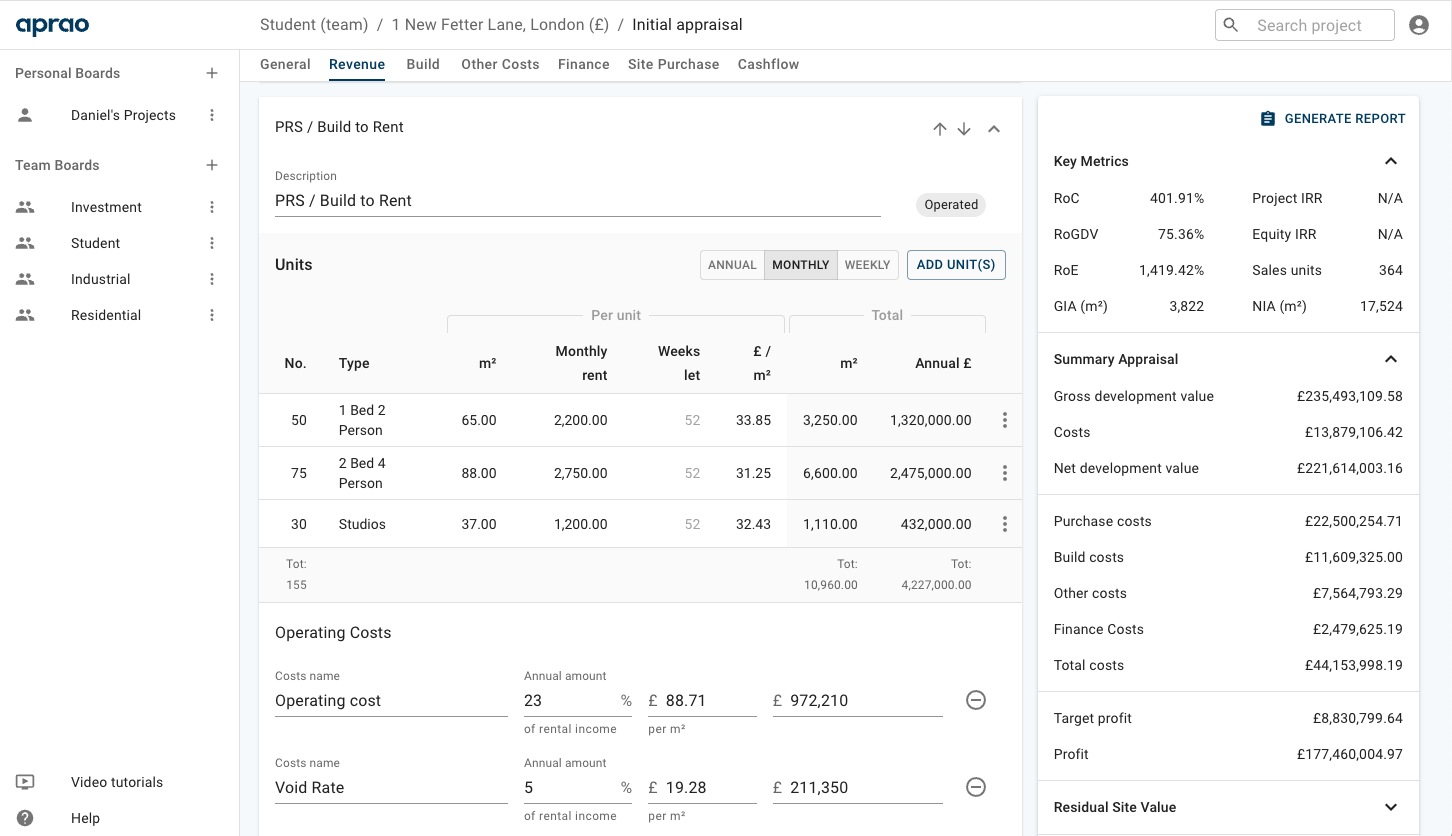

I am pleased to announce one of our most powerful updates to Aprao yet. We have completely redesigned how we handle revenue to open up the number of use cases that Aprao can handle.

As the property market evolves, we hear from our customers that they are continually looking beyond the standard build to sell residential model to look to extract additional value from new development sites.

There are so much alternative asset classes in property and now I am happy to say that Aprao makes the financial modelling for them effortless.

Introducing a new way to handle revenue in Aprao

Increased demand for 'residential to rent'

With higher interest rates, many residential markets have seen growing rents and flat sales. As a result, there is more interest from developers building 'residential for rent' projects. These are residential led projects build specifically for the purpose of renting out and coming in many forms including:

- Build to rent (BTR)

- Private rented sector (PRS)

- Co-living

- Houses of multiple occupation (HMO's)

- Student accommodation

Unlocking more operated assets

We didn't stop at the residential for rent use classes mentioned about. We continued to speak to our customers and understand the full spectrum of the nature of the operated assets that people were assessing. As a result you can now also model the following revenue types in Aprao:

- Industrial

- Retail

- Office

- Logistics

- Healthcare

- Aged care / care homes

An powerful new feature set

As a result of months of hard work from our team, I am proud of the new features we have built. I would like to thank all of the companies that have helped provide us feedback along the way and I am excited to see what our customers will build using Aprao.

How to get access?

Existing Aprao users can log in to start using these new features right away

If you are new to Aprao you can sign up to a free 14 day trial and jump straight in.

Leave a comment