In this series of 'The Aprao Story', CEO Daniel Norman tells the story of how Aprao was born. Enjoy the first instalment!

Let's start by setting the scene to nearly 15 years ago. It’s 2007 and the global financial crisis is about to cause chaos in the property sector, just as I was about to embark on my first job in that very industry.

Early steps

Ultimately, I had the vision of becoming a property developer. This was the era of 100% finance and 110% mortgages so the barriers to entry for starting on a first development project were low. Despite this, I still recognised the need to gain experience.

I set out on a quest to gain some work with a range of property developers in a variety of positions from Land and Construction, to Design and Finance teams.

With this in mind, I lined up my first role working in a Land team. I clearly remember sitting in the office as they introduced me to everyone and explained that their role was to identify the next sites to enter their development pipeline.

They went through the steps of evaluating an opportunity and then they gave me my first chance to run some numbers on a new opportunity to see if it stacked up. I was given some high-level bullet points, a printout of the site with some (roughly to scale) paper cut-out house shapes. Then I was invited to look at how many houses we could fit on the site. By this point, it was time to have a go at running the numbers in a spreadsheet.

This was the first time that I was introduced to a development appraisal.

The first of many appraisals

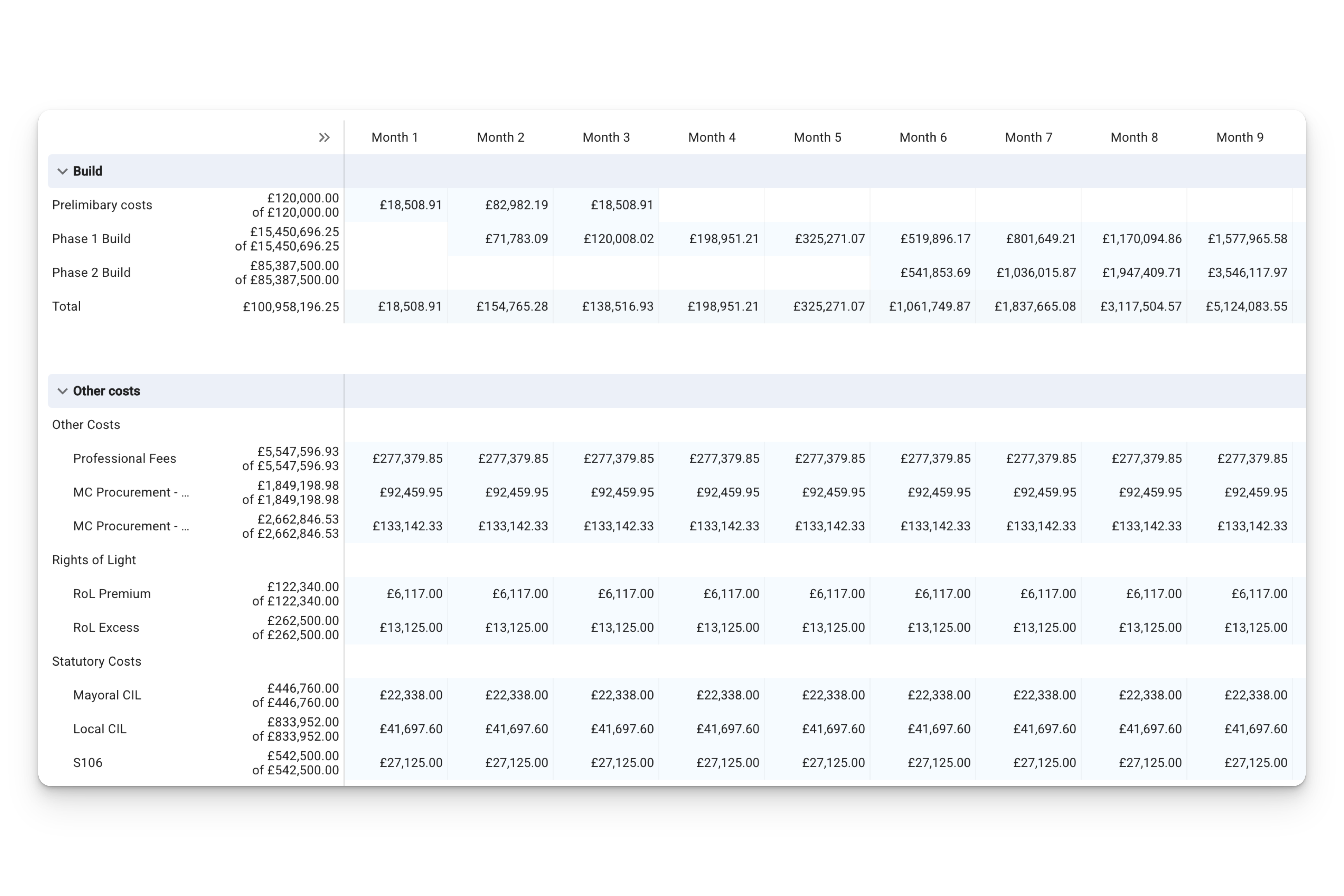

The spreadsheet was extensive. It had what seemed like a never-ending number of tabs and being new to this, it made little sense at the time. Of course, I understood the basic principles of what we were looking to achieve – calculating the development potential and true value of a site to assess if it made business sense to explore further. But it seemed to me that this spreadsheet, created by the Finance Director of the business, was total overkill for what the Land team were trying to achieve.

Now let’s skip forward. I had been working in a few positions across different development companies. At this point, it was 2008 and the global financial crisis was starting to cause havoc in all sectors but particularly real estate. I’d gained the basic knowledge that I set out to learn and felt ready to embark on my first development project, but that 100% finance I mentioned earlier no longer existed.

Even a modest development at this point would have required several hundred thousand pounds, and as someone who had just left my teenage years behind, this wasn't something that I had! Ultimately, I’d found an affinity with property development but I didn’t have the resources to become a property developer at that moment in time, so I made the decision to move into the financing of property development.

It was at this point I realised that I could still keep my exposure to property, gain valuable experience and minimise my risk. It turns out that I thoroughly enjoyed working in the development finance sector and spent nearly 10 years doing that across two businesses.

As a development finance lender, my role was to review development opportunities to decide which ones we should fund. It was in this process that I realised that the massively complex spreadsheet that I’d used in one of my very first roles was one of the better financial models!

A gap in the market

The majority of property developers are great at identifying sites and building projects but they are not always great with financial modelling - it's a totally different skill set. To make matters worse, there was no real industry standard and the quality of information varied massively from 3 lines in a spreadsheet to 30 tabs of granular information.

I realised that everyone was trying to achieve the same thing but they were all going about it in different ways. There was a need for consistency, standardisation and most importantly, an easy format!

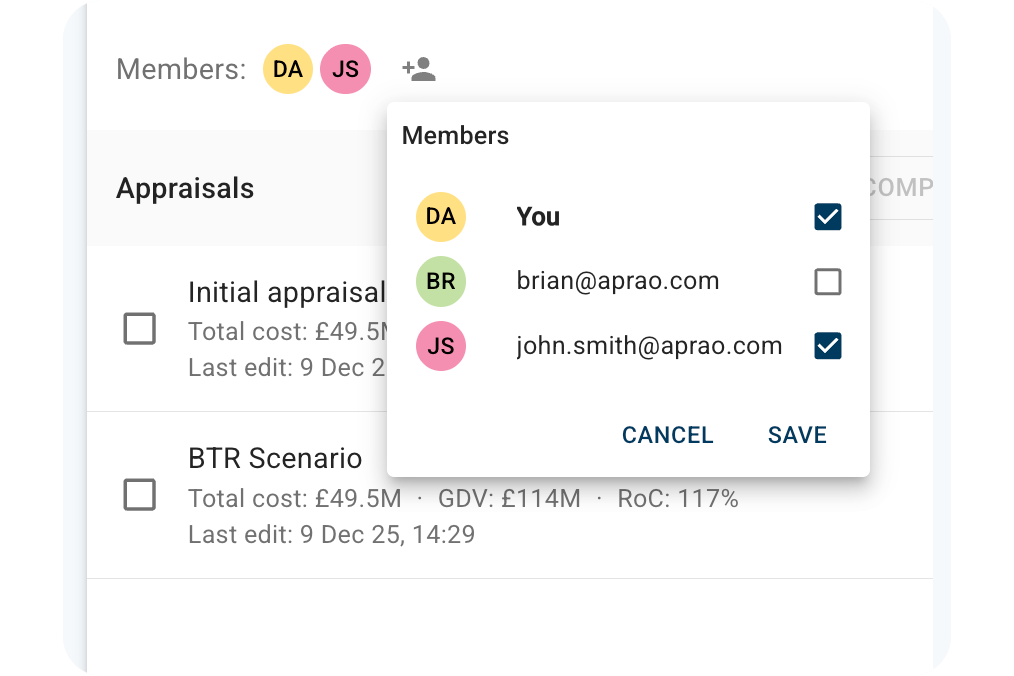

This was at the time that cloud-based apps were beginning to gain momentum and I could see first-hand that there was an opportunity for me to pursue here: a cloud-based financial modelling tool for real estate development. I had the vision to create a new cloud-based tool to set the new industry standard and make the lives of developers and lenders easier. And so the idea for Aprao (then Appraised) was born.

In 2017, I set off on a quest to find a co-founder who knew something about building software and that’s when Jonathan Raoult (Co-founder and CTO) of Aprao came into the picture.

More on that next time.

Leave a comment