Are you a property developer, a real estate professional or an investor looking to calculate the potential profits and costs of a property development project? If yes, then you must have heard about the residual land value model. But what exactly is this model, and how can you use it to your advantage? Let’s dive in and find out!

Residual land value model

The residual land value model is a method used to determine the value of a piece of land based on the potential profits it can generate from a property development project. In other words, it helps you calculate the amount of money you can pay for a piece of land while still making a profit from the development project.

Now, you might be thinking, “Wait, how does this model work?” Let's break it down into simple steps.

Step 1: Determine the Gross Development Value (GDV)

The first step in using the residual land value model is to determine the Gross Development Value (GDV) of the property. GDV is the total value of the completed development project, including the value of all the properties built on the land.

Step 2: Calculate the Total Development Costs

Next, you need to calculate the total cost of developing the property. This includes all the expenses related to the development project, such as land acquisition costs, construction costs, and any other fees associated with the project.

Step 3: Subtract the Total Development Costs from the GDV

After calculating the Total Development Costs, subtract it from the GDV. The remaining amount is the Residual Land Value. This represents the maximum amount that can be paid for the land while still making a profit from the development project.

We have a detailed guide on assumptions that you may want to include in the GDV and development costs of your project.

Now, you might be thinking, "Okay, this all sounds great, but how do I get started? Do I bring out a piece of paper and a pen, and start calculating?" Well, that is certainly a way. Look further, there are numerous free online tools that will give you a figure after filling in some brief assumptions. But how can you be sure that the figure is correct and error-free? What if you need a more granular approach to get an accurate residual value? What if you need to present your calculations and your appraisal to other stakeholders?

By using Aprao, you and your team can develop a structural way to inputs assumptions, and then leave the calculations to Aprao and get the residual value and other key metrics that you need in a well-presented manner.

Get started using Aprao

Helps You Determine the Right Price

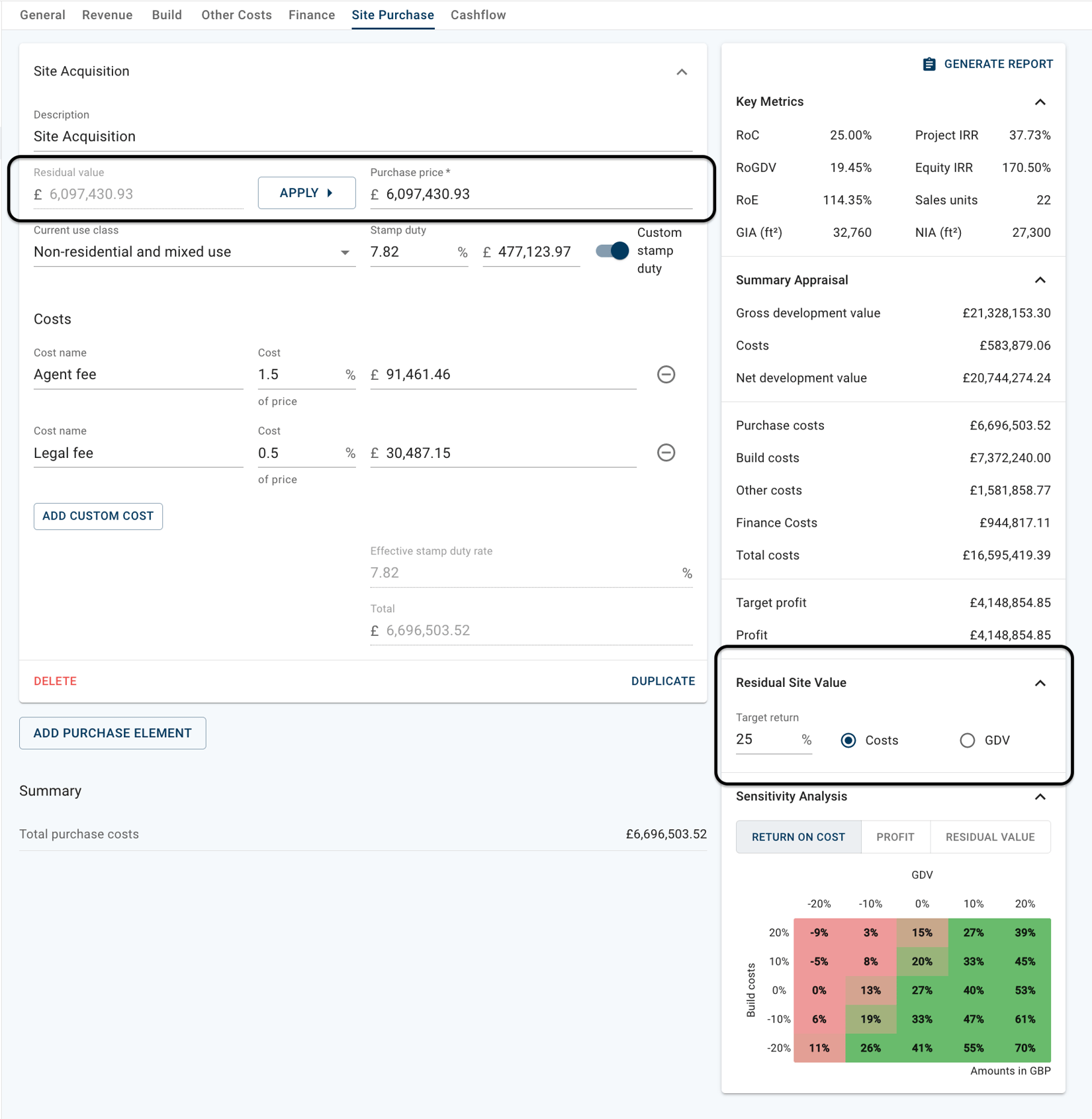

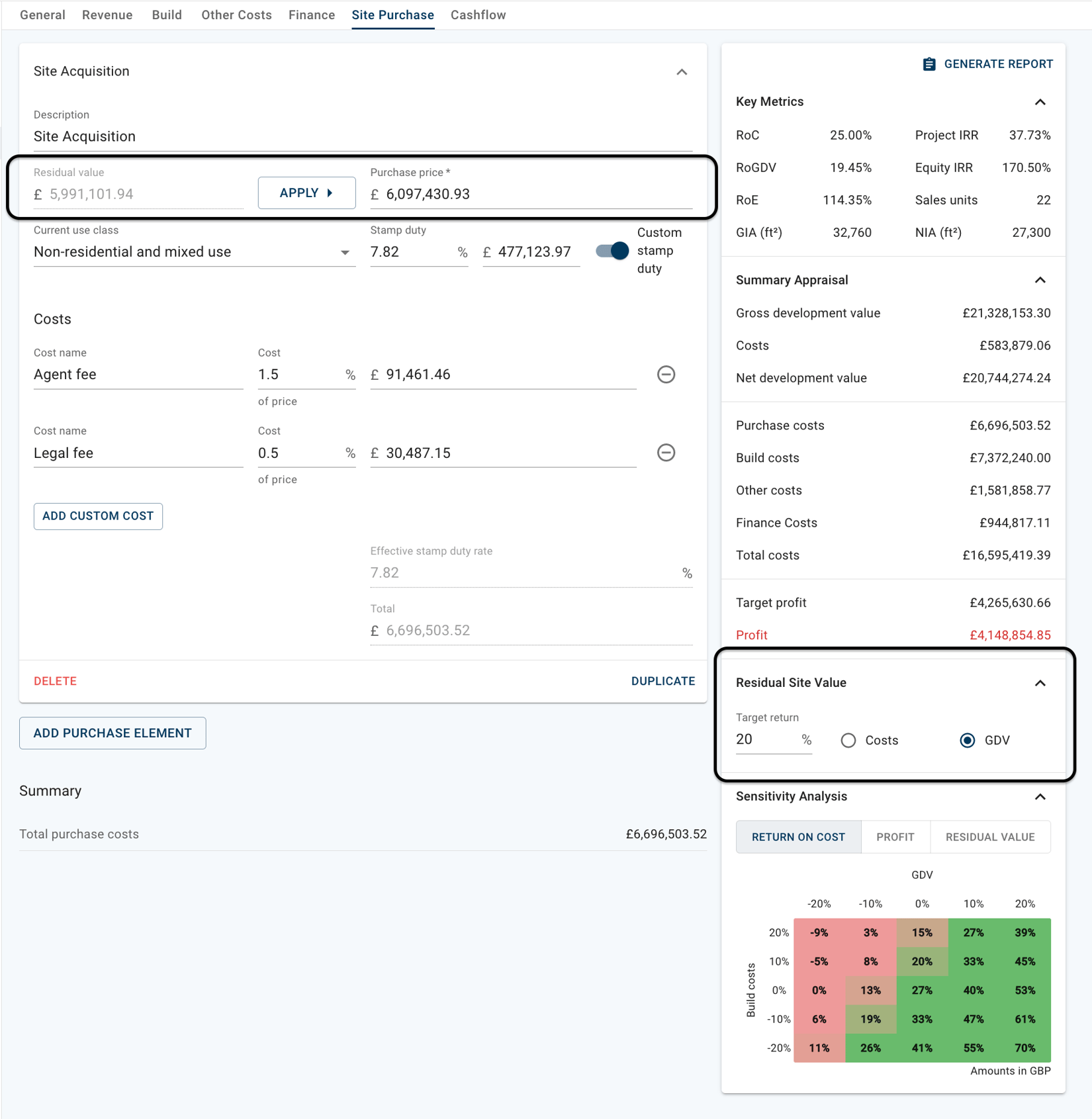

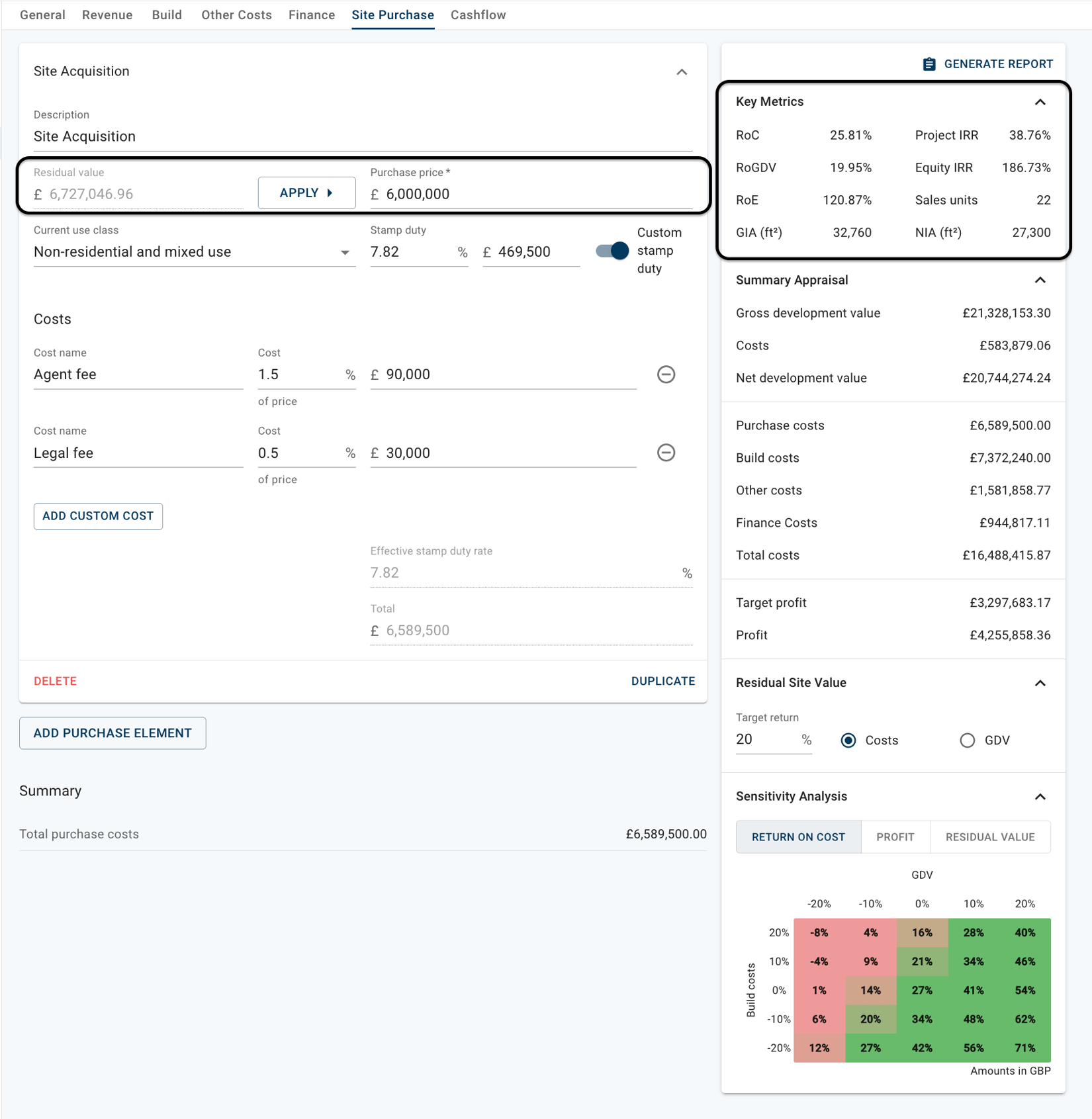

One of the most significant advantages of using Aprao is that it helps you determine the right price to pay for a piece of land. You can calculate the maximum amount you can pay for the land while still making a profit from the development project. This ensures that you do not overpay for the land and end up losing money in the long run. By entering a target return either on Costs or GDV, Aprao will calculate the maximum residual value that meets your target return goal.

When you change your target return, the calculated residual value changes dynamically, without the need for you to manually recalculate and reload the application.

Allows You to Identify Profitable Opportunities

Using Aprao to calculate residual land value can also help you identify profitable opportunities for property development. You can quickly determine whether a particular piece of land is worth investing in or not. If the calculated residual land value is higher than the purchase price that you are being offered, it means that the land has the potential to generate significant profits, making it an excellent investment opportunity. You can see all the key metrics on the summary table right away, also dynamically, so you know exactly what’s your actual return.

Helps You Manage Risks

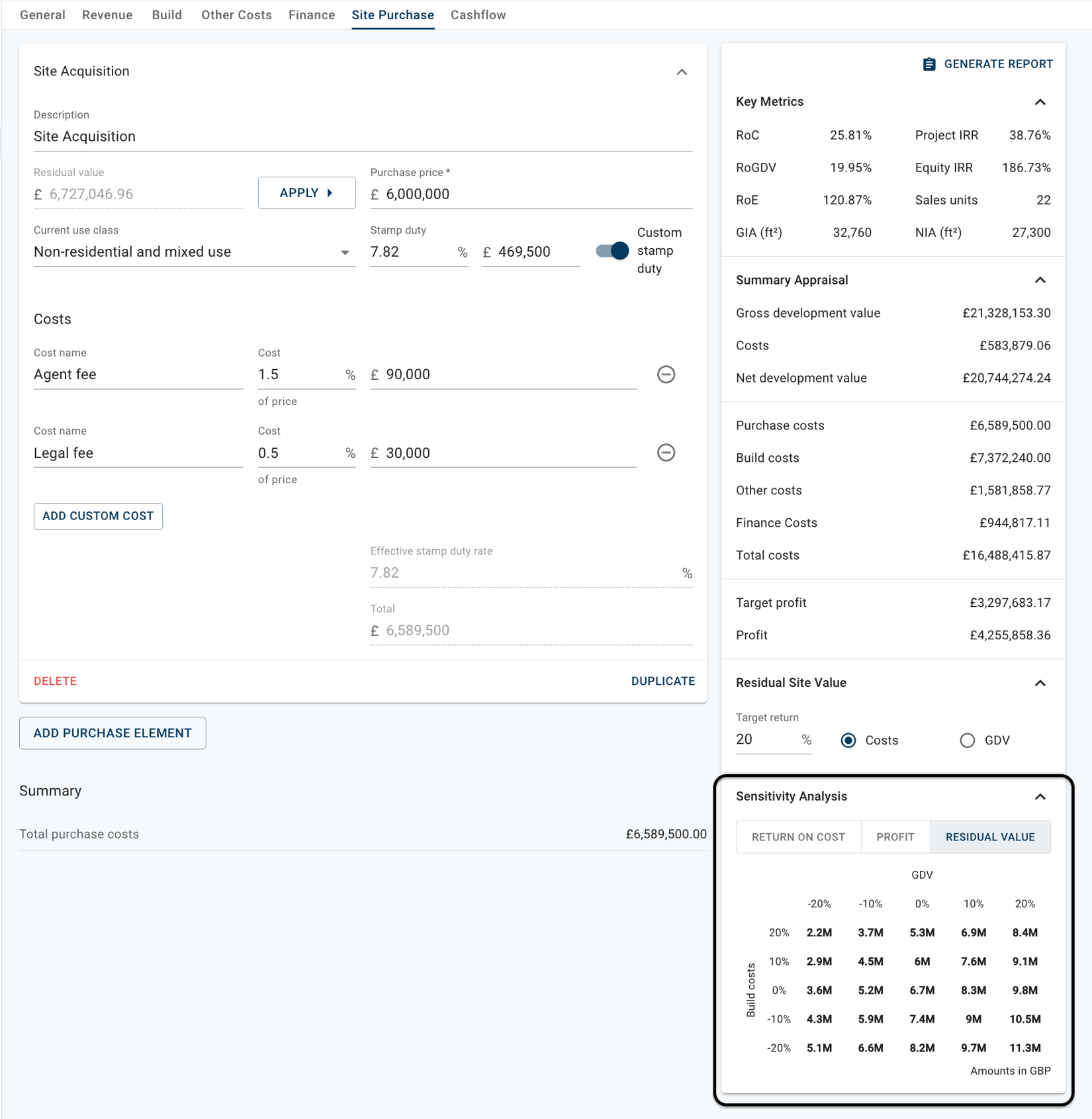

Investing in property development comes with its fair share of risks. However, by using Aprao’s real-time sensitivity analysis, you can manage these risks effectively. It allows you to understand how changes in GDV and build costs affect the maximum purchase price or valuation of the piece of land, making it easier for you to make informed decisions no matter what the circumstance is.

Allows You to Create a Ready-to-Go Report

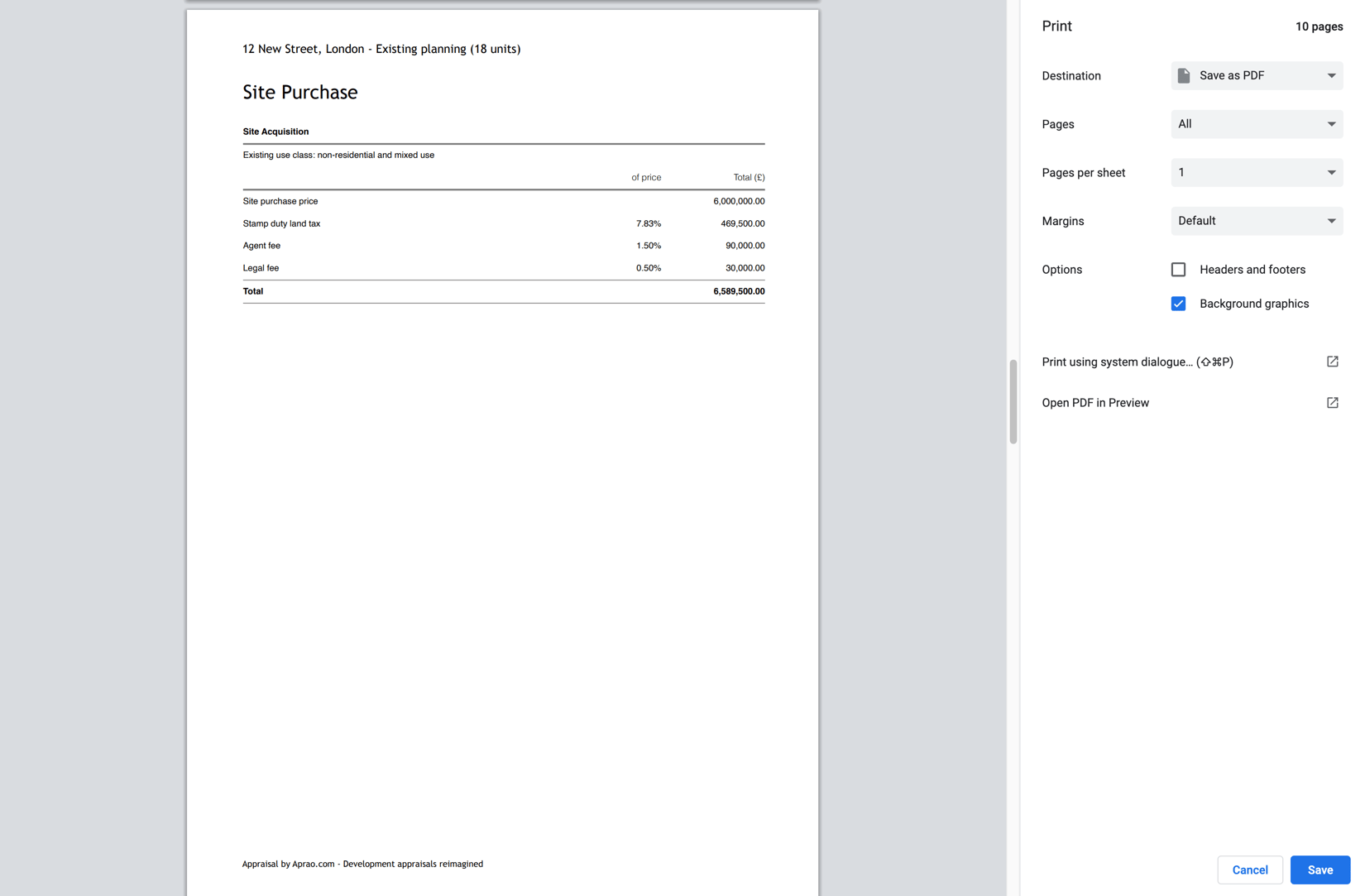

Once you are finished with all inputs and get your residual land value calculated, click ‘GENERATE REPORT’ for a downloadable PDF that you can share with your colleagues, investors and lenders. There is no need for any formatting and typesetting (which takes up a huge amount of time, we know!) as Aprao generates the report for you using a consistent template every time. We work with a wide range of industry professionals and lenders that loves seeing a detailed but aslo easy-to-read Aprao report sent to them.

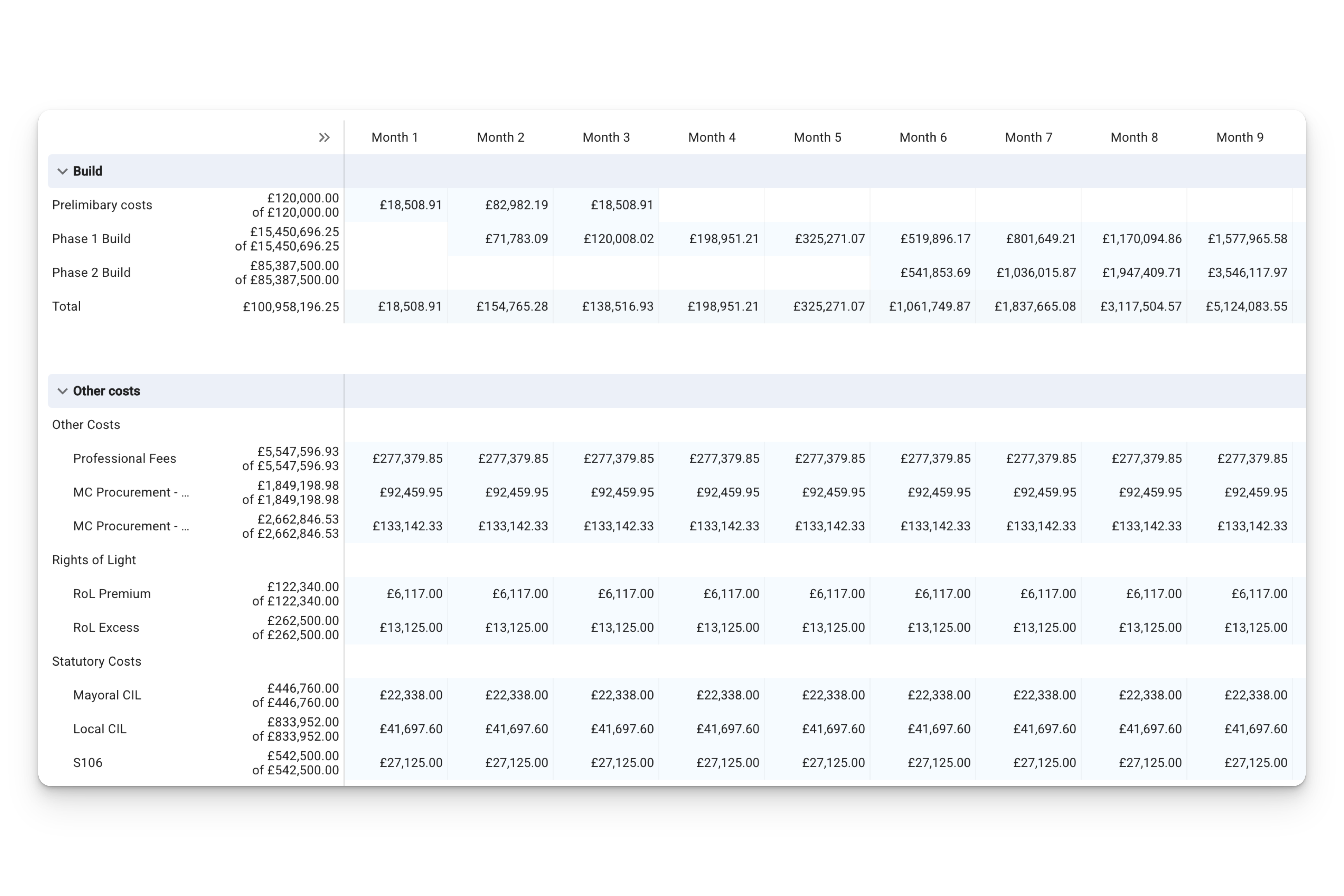

Aprao offers way more than solely a residual land value calculator. Also check out our feature to create a cashflow that’s 5 times faster than using Excel. Click here to sign up for a free 14 day trial of Aprao and try it yourself!

Leave a comment