What is bridging finance?

Bridging finance is a type of short-term loan, typically lasting 12 to 18 months, that can be used for different purposes until long-term funding, sale of a property, or when the next stage of financing becomes available. The typical maximum Loan-to-Value ratio of a bridging loan ranges from 60% to 80%. It is considered as a tool to cover the timing difference of funding within a property development process. Hence, it should not be seen as a total replacement for development finance, but a component of development finance within a short period of time in the development cycle.

How does bridging finance compare to other development finance methods?The main difference between a regular loan and a bridging loan is the time it takes to organise the funding. It can take months for a regular lender to complete a deal, but bridging loans can be ready within weeks or even days. Mainstream lenders often require more information from the applicant and the company. Bridging finance lenders generally take a much more simplistic view of the process. They put their focus on the property that is used to secure the loan, and the proposed exit strategy to repay the loan.

The goal of bridging finance is not to support the funding needed throughout the whole development process. Instead, it allows developers to take advantage of opportunities that arise, secure property deals and also resolve emergency situations when traditional development finance lacks the speed and flexibility that such situations require.

However, as bridging finance is often short-term, the interest on it is higher than the rates of other loans. Bridging loans are generally considered to be riskier, and given that the money is lent for a shorter period of time, the actual income of the lender is usually relatively less, even when the headline interest rate looks high.

For the above reason, a key point to keep in mind for the borrower is that you need to be aware of the arrangement fees, legal fees, valuation fees and other fees that come with the loan. Compared with other types of development finance loans, these fees will contribute to a more significant portion of the total financing costs alongside the interest repayment. When modelling bridging finance into your development appraisal, you need to be extra careful about the fees required by different bridging finance lenders, as they can impact the profitability and viability of your project.

Why do you need bridging finance?

Bridging finance can be useful in different timeframes of a development project and it can be used to overcome several funding scenarios in property development:

At the beginning of a project, say, before longer-term development finance can be set up:

- Developers can benefit from the speed and flexibility of bridging finance as it can be used to take advantage of market conditions and help to secure discounted investment opportunities in a tight timeframe.

- Another common scenario is when a developer needs short-term cash flow while obtaining planning permission to convert a property from commercial to residential use. Traditional development finance usually prefers development projects with planning permission already in place. In this case, a bridging loan can be arranged to provide some pre-construction finance until a development loan is agreed, once planning has been granted.

At the end of a project, to extend finance when a development loan is coming to the end of term:

- Delay in construction and sales of completed units can cause problems to developers whose development loans are approaching the repayment date soon. Extending your initial development loan can be an option but the lender may charge you a significantly higher interest rate during the extended period. On the other hand, funding to repay development finance before the units are sold tends to be looked upon favourably by bridging loan lenders. As a result, you may benefit from low rates and a simple application process.

- Another common scenario is when a property developer’s project is close to practical completion. During the development, the developer has accrued several lines of finance, which have become cumbersome to manage and are proving more costly than they need to be. A short-term bridging loan can be used to consolidate the borrowing into one place until a sale of the completed units is achieved. This also allows you to get on with your next project without having to wait for your cash to be released from your current one.

Refurbishment and renovation of dilapidated properties:

- Most high-street lenders will not provide traditional development finance for property investors and developers to renovate uninhabitable properties as these types of projects are seen as high risk. Bridging loans can then be used by people fixing up these properties, where traditional mortgages and development finance will not be approved.

How does bridging finance work?

Like any other loan, the lender loans the money at a fixed interest rate, on a period agreed by the borrower and the lender. Lenders will typically expect a bridging loan to be paid back within a maximum term of 12-18 months. However, the borrower can normally choose to pay off the loan at any time within the 12-18 month time period, if they are able to gain access to the next stage of financing that they require. The timing of repayment normally depends on the type of bridging loan.

There are two types of bridging loans:

- Closed bridge: The borrower has a set date when the loan will be repaid. For example, the borrower has already exchanged to sell a property and the completion date has been fixed. The sale of that property will serve as the exit plan to repay the bridging loan.

- Open bridge: The borrower sets out a proposed exit plan to repay their loan but there is no definitive date at the outset. The end of the fixed loan period will be a clear cut-off point that the loan has to be repaid, but the borrower can pay off the loan earlier when the proposed exit plan is executed.

Concerning interest payment, since the majority of property development projects generate no revenue until the final sale, monthly repayments are often not practical. Hence, rolled-up interest is the most common way that bridging loan operates. Rolled up interest is calculated throughout the loan period but only paid from the sale or refinance proceeds. This enables you to pay for the interest in a lump sum at the end of the loan period instead of paying in monthly installments. Retained interest can be an option but it is less common as the repayment date of an open bridge loan is uncertain and it is harder to decide on the overall interest amount.

How is bridging finance incorporated in a development appraisal?

As bridging finance can be used in various scenarios within a property development project, the following section will demonstrate one of the most common scenarios - using bridging finance to purchase a site and then apply for planning permission before ultimately getting a senior debt facility. Many senior debt lenders prefer to lend money on projects already with planning in place, hence bridging finance can fill in the gap between site purchase and obtaining planning.

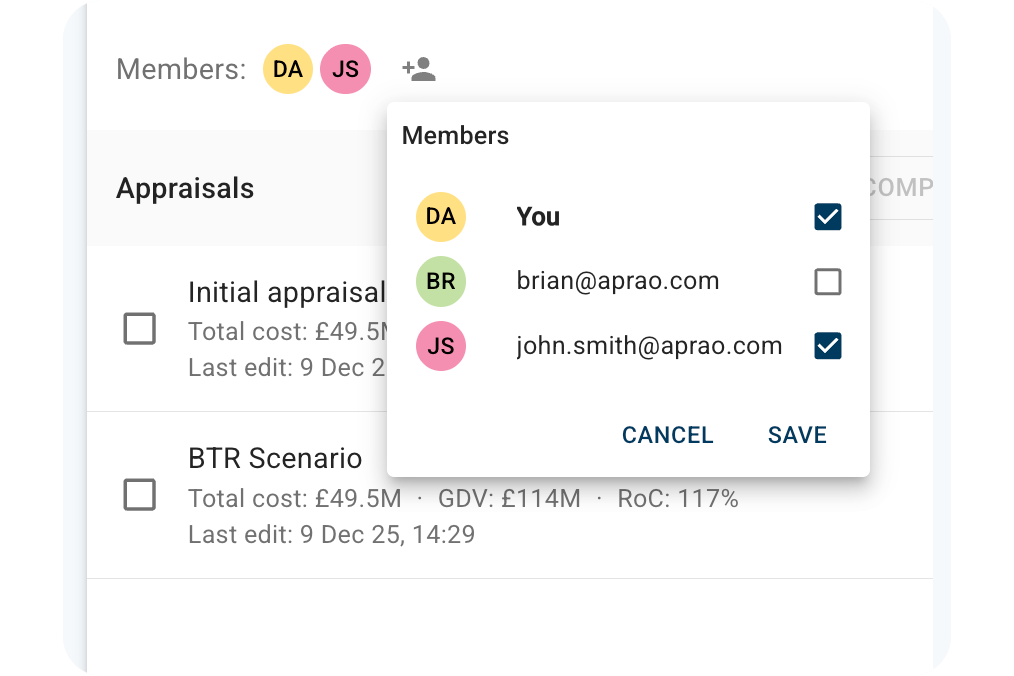

In Aprao, you can create multiple appraisals within a project. One of its advantages is to enable comparisons of different financing structures. Such features are also illustrated in the Senior Debt and Mezzanine Finance blog, click the links to check them out if you want to learn more about them. Another advantage is that you can create appraisals for different stages of the project. If you are a developer who is deciding to purchase a site that is without planning permission for your proposed development. You can split your project into two stages: Site purchase and obtaining planning permission as the first stage; Construction and completion as the second stage. If your goal is to determine the residual value of the site you intend to purchase, you can start with the second stage appraisal and work backwards.

Step One - Calculate the residual value of the site as if the development is completed:

The first step is actually looking at what we hope to get planning for as this will help give us our residual site value.

In order to do this start by creating a development appraisal of your project by entering the estimated revenue, costs and financing. In this appraisal, we assume that the planning permission is already obtained and we leave out all the planning and holding costs. If we assume a target return of 15% on GDV, then we can go to the ‘Site Purchase’ tab and see the automatically calculated residual value of the site. This figure is important because we will use it in the first stage of appraisal.

Step Two: Calculate the bridging cost

Now, create another development appraisal within the project which accounts for the period that is required to obtain planning permission.

In the ’Revenue’ tab, you can click ‘Add Income Group’ and name it ‘Increased site value’. Then, input the residual value figure you got in the second stage appraisal. This figure is indicative of the increased site value when planning is achieved and will allow us to see the projected profit from the increase in site value if planning is achieved. You may choose to sell a site once planning is achieved so it is good to see the potential profit at this point.

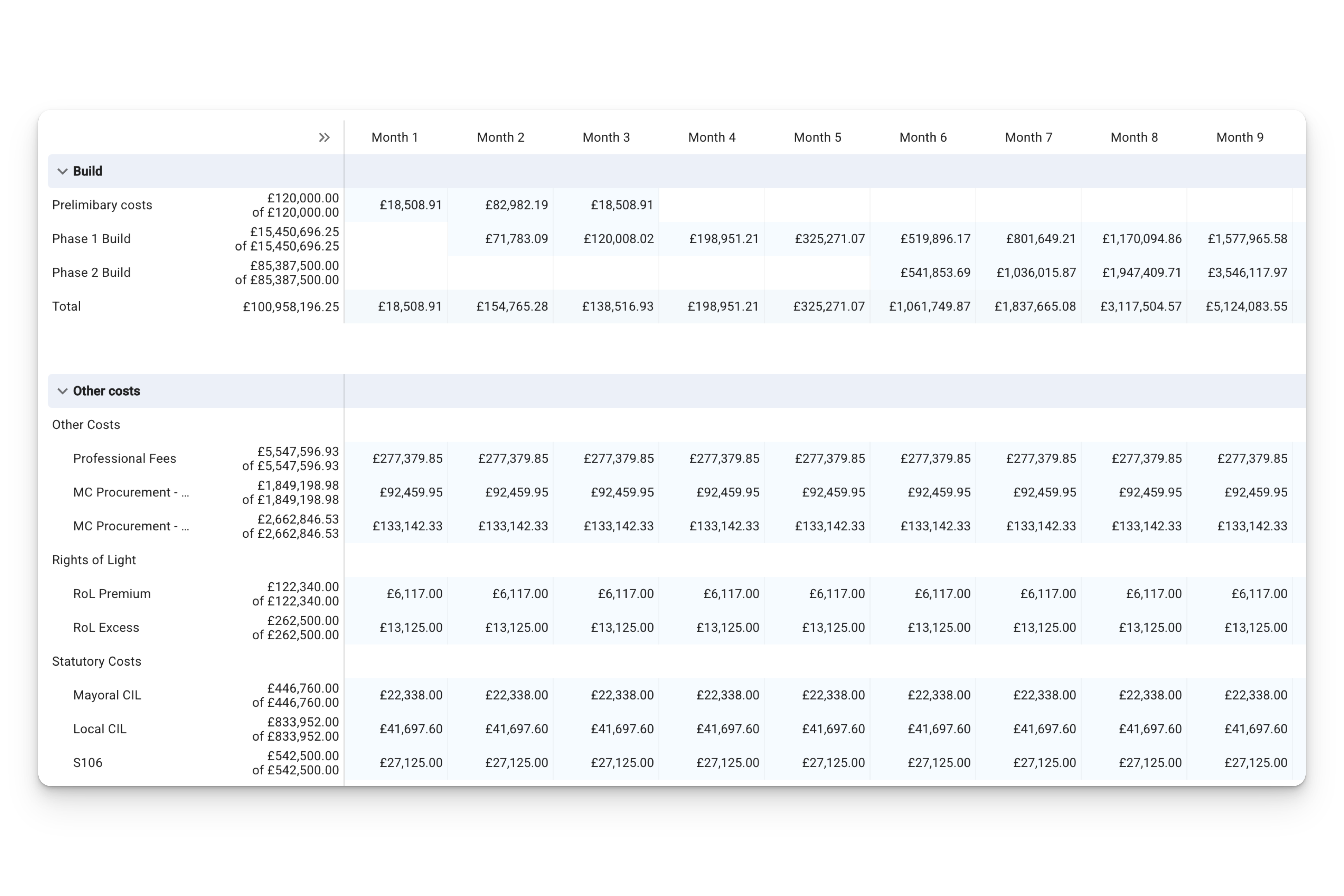

Next, skip the ‘Build’ tab (unless there are any light refurbishment works taking place) and go to the ‘Other Costs’ tab. Add the planning and holding costs that you excluded previously in the second stage appraisal. You can now move on to the ‘Finance’ tab to incorporate your bridging finance.

You can then enter an estimated loan amount. It can be a predetermined amount, or it can be a percentage of cost or GDV. Let’s assume 70% of cost in this example.

Go to payout and choose ‘rolled-up’ as your bridging loan will most likely operate with a structure of rolled-up interest. Then, choose either ‘interest on drawn balance’ or ‘interest on full loan amount’ depending on your bridging loan arrangement. Here, we select ‘interest on full loan amount’ because all of the finance is being used from day 1, and assume a 1% interest rate per month and an 11-month loan period. Finally, include other fees as specified by the lenders into the appraisal. In this example, we assume a 1.5% arrangement fee.

The last piece of the puzzle is the ‘Site Purchase’ tab in this first stage appraisal. At this point, you either enter the purchase price of the site to see the impact on the profit or you can use residual site value to see the impact on your profitability.

Where can you find a mezzanine finance provider, and how can you get the best deal?

‘A robust development appraisal is the foundation of getting development finance.’

Daniel Norman, founder of Aprao with 10 years of development finance experience.

A robust and concise development appraisal allows the lenders to better assess your project, which increases the speed of the application and the chance of a successful application. Financial appraisals created using Aprao are well-recognised by lenders across the UK as their preferred appraisal format. Check out our ‘Learning from Lenders’ video series to listen to what lenders are really looking for when assessing deals and what they think about Aprao.

Click below to get started free with Aprao, no credit card required.

Can't see any images or videos? If you're on LinkedIn click 'View Full Post' below or try opening it on your desktop.

.png)

Leave a comment