Forward funding is a type of property development finance where an investor agrees to purchase a property from a developer before it is completed. For example, the investor agrees to buy a development that hasn’t yet been built with the benefit being that the investor can acquire the investment with a better yield than if the development had been built already and being sold in the open market.

Forward funding can be a beneficial arrangement for both developers and investors. As the investor would fund the land purchase and construction (common arrangements include staged payments or interim valuations), it helps developers to reduce their financial risk and free up their equity throughout the project. For investors, it can offer the potential for high returns, as they are essentially buying the property at a discounted price.

Another scenario in which forward funding is utilised is when a residential developer receives forward funding from a social housing provider for its affordable units within a mixed-tenure development. In such cases, the social housing provider agrees to forward fund and acquire the affordable units, while the developer handles the financing and sale of the market-rate units.

Let's look at an example

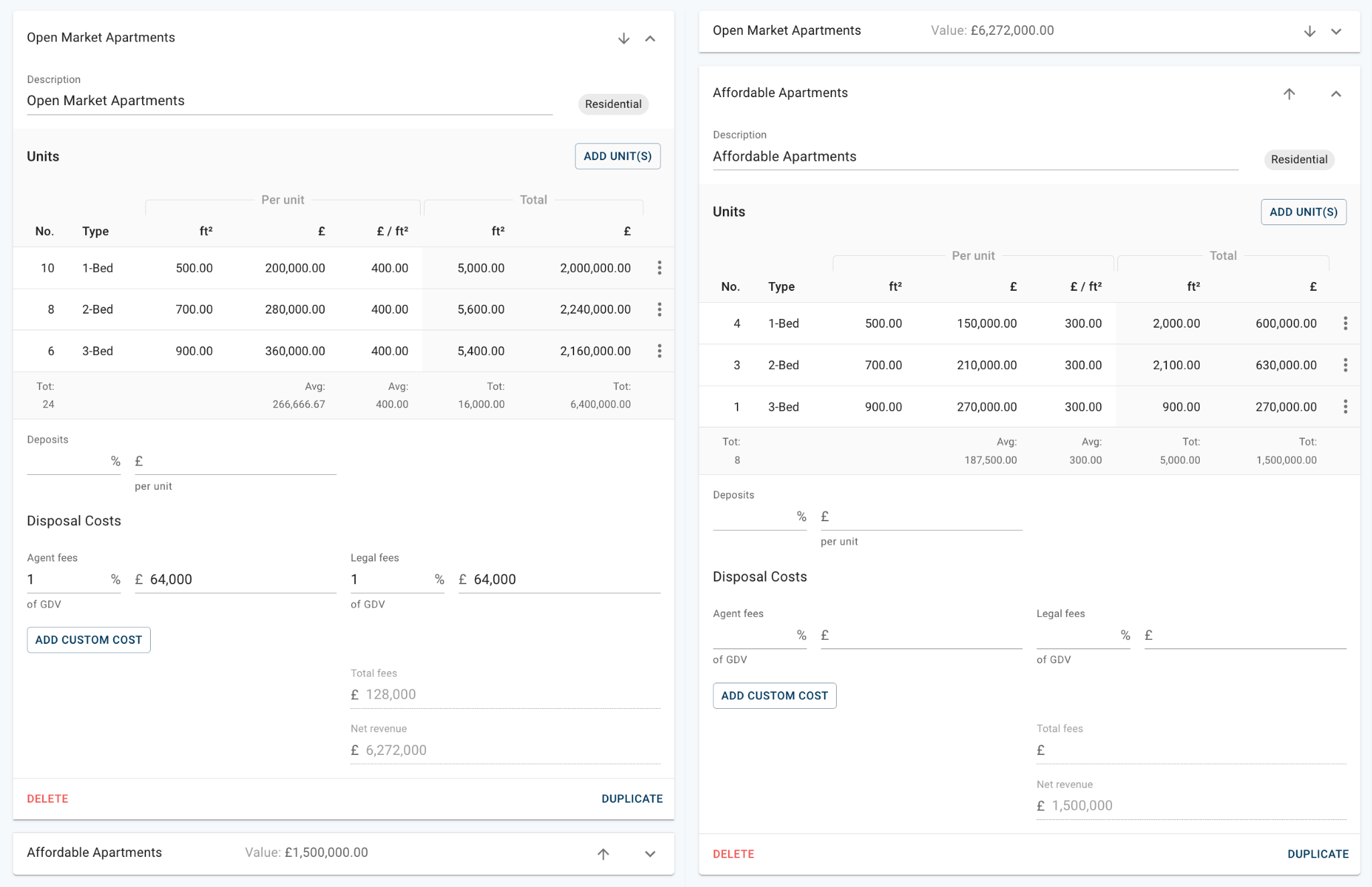

Let's say you are looking at a development of 24 open-market apartments and 8 affordable apartments. Your unit breakdown may look something like this:

The affordable apartments are going to be purchased by a social housing provider and they have agreed to forward fund the construction of the units.

As a result of this arrangement, there is no longer a need for your development finance to cover the cost of the affordable units, and the sales proceeds from these units will not contribute to repaying your development finance. Therefore, you need to exclude these units from the development finance calculation for the market-rate units.

Incorporate forward-funded units into your appraisal

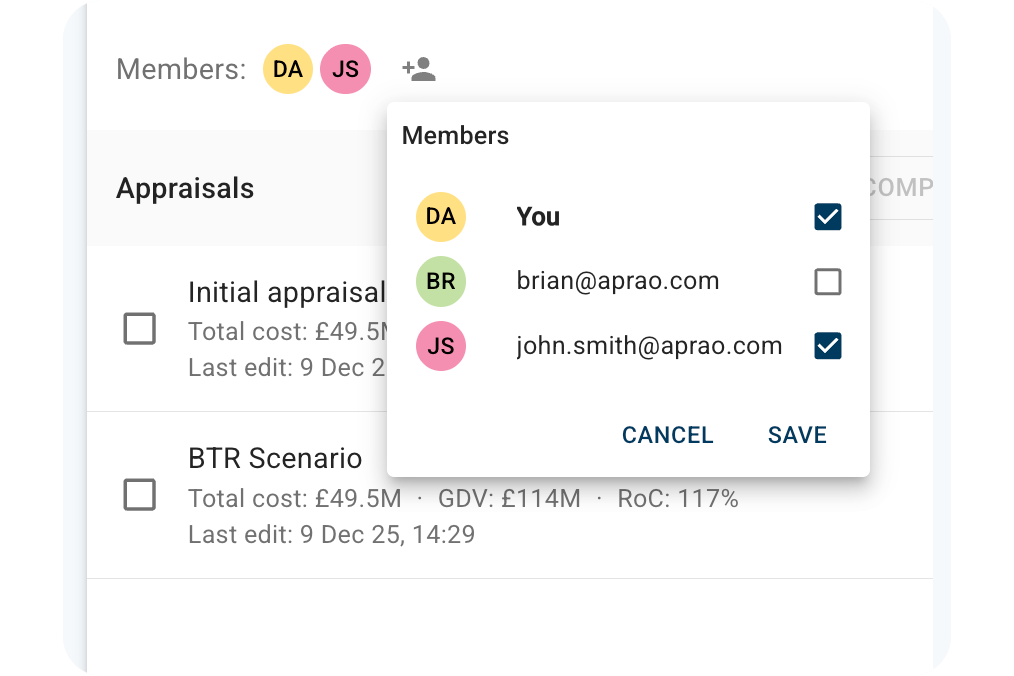

In Aprao, you have the ability to create a comprehensive appraisal for your mixed-tenure development, incorporating both the forward-funded affordable units and the development finance funded open-market units.

Once you have completed the breakdown of units for revenue, you can then proceed to the Build Cost tab and input the construction costs. The forward funding feature becomes relevant when you move on to the Finance tab, where you can input and calculate the debt and equity required for your open-market units. The key point here is not to include affordable units in this calculation, as they will be forward-funded.

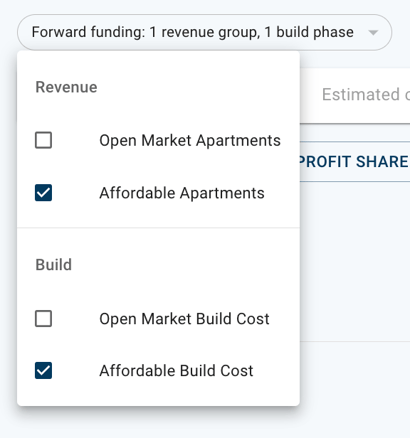

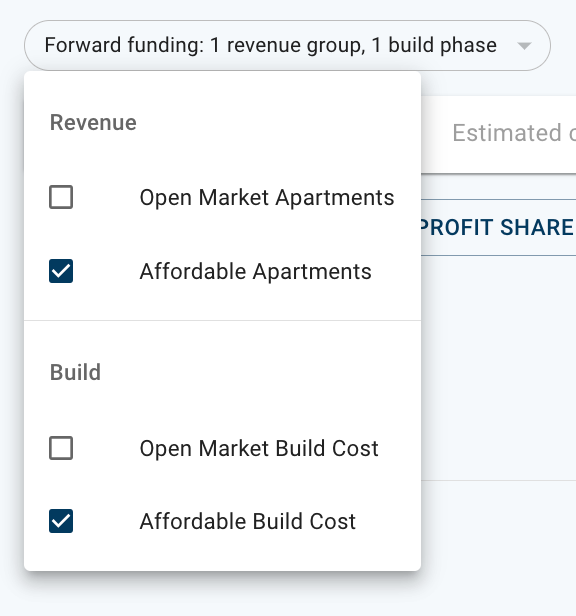

On the finance tab of Aprao, you can now use the forward funding menu to select any elements that are going to be forward funded. This can be either the sale of a particular unit type(s) or any build phase(s).

As you can see from the screenshot below, we have simply selected to exclude the affordable elements as forward funded.

These units will now be excluded from the finance calculations allowing us to continue with our development finance in the normal way.

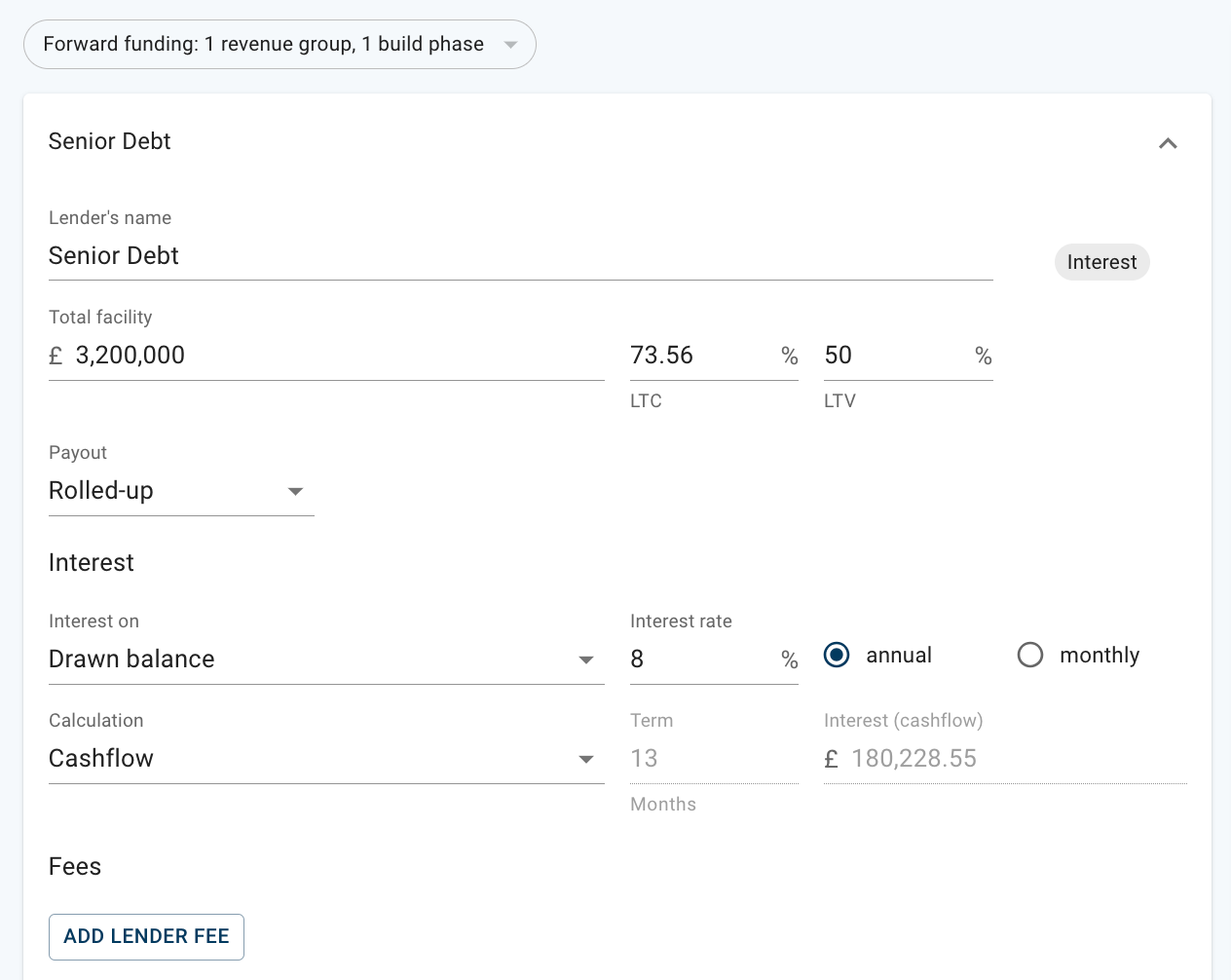

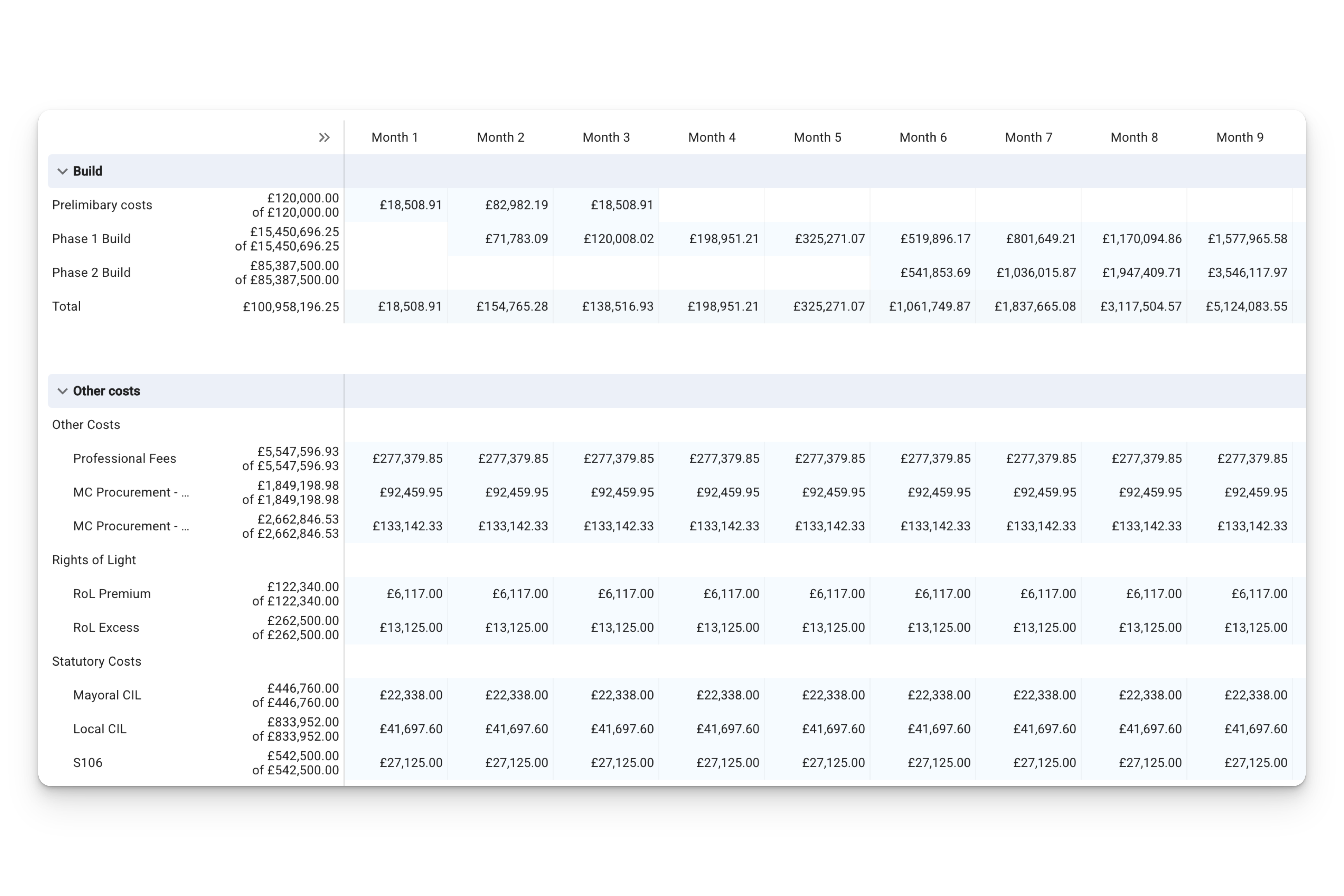

In the example below, I have set the senior debt development finance at 50% of GDV (gross development value). With the affordable element excluded, the debt facility is now 50% of the open market GDV.

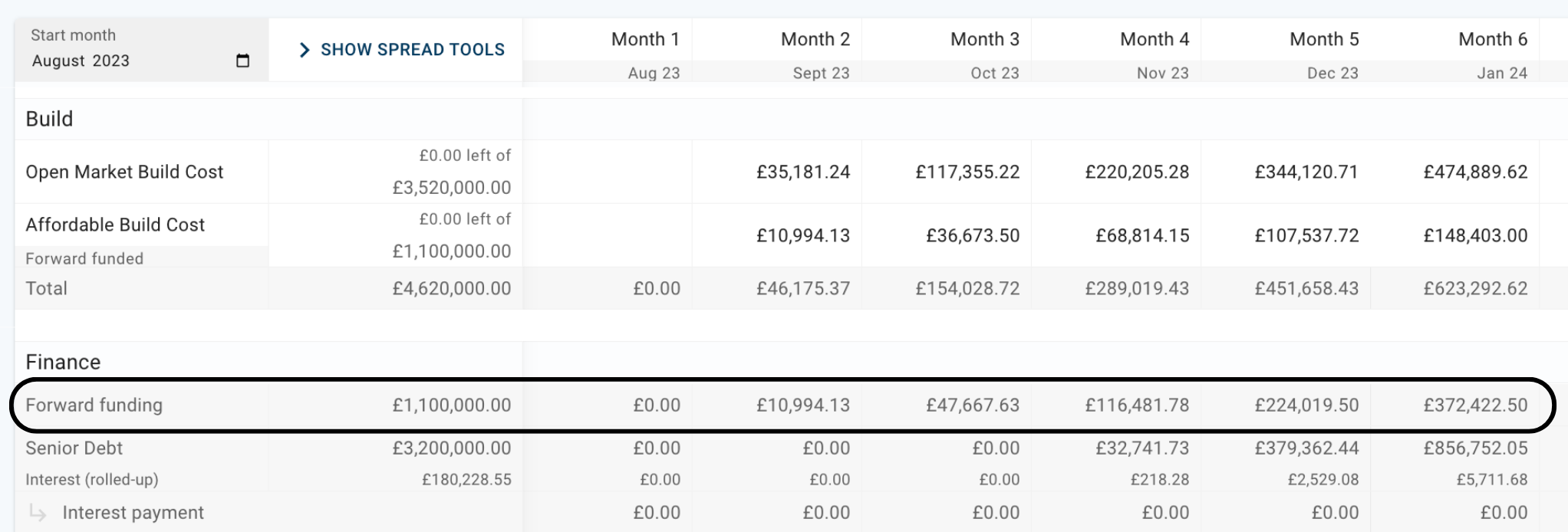

When it comes to the development cash flow forecast, you can clearly see the amount that is forward funded right alongside the senior debt development finance for open-market units.

Want to create an Aprao appraisal and give this forward funding feature a go? Existing customers can log in here and new customers can click here to sign up for a free 14 day trial of Aprao.

Leave a comment