What is Mezzanine Finance and how does it fit into your development appraisal? In this piece, we delve into how it compares to other finance methods and how you can use Aprao to make accurate calculations and share this information with your lenders.

What is mezzanine finance?Mezzanine finance is commonly used to fill the gap between a developer’s equity and senior debt. For example, a senior debt lender is able to lend 70% of the cost of a project, but the developer may only want to put 10% of their own equity into the project. The remaining 20% can be provided by a mezzanine lender.

Why do you need mezzanine finance?

Some development professionals think that mezzanine finance is a form of last resort lending when a developer is short of funds. Deployed correctly and in a well-structured way, developers can use mezzanine facilities to better their returns, even when they have substantial cash reserves.

Similar to senior debt, using a mezzanine loan can reduce the equity put into a project by the developer. It increases the loan to cost ratio, which leads to higher leverage. It can allow the developer to commit to more projects simultaneously, opt for larger-scale projects, and further improve return on equity in general.

How does mezzanine finance compare to other development finance methods?

Mezzanine finance is less common than senior debt and it is usually provided by specialised mezzanine lenders. Bank lending (senior debt) to the property development sector has become more cautious over the years and the amount of loans approved may not meet a developer’s expectation. Mezzanine funding can therefore help developers overcome this lending shortfall of a profitable project.

Compared to the senior debt lender, which has the first position claim, the mezzanine lender is the second in line. If there is a drop in revenue, the cash available to service debt may not be sufficient to cover all debt services. In some situations, revenue drops to a level where the borrower can still make repayments on the senior mortgage, but there is not enough to make payments on the mezzanine debt. Due to the riskier nature of mezzanine finance, its interest rate is higher than senior debt, and its range varies according to the risk assessment of each individual project. In addition, as there is more risk associated with it, mezzanine loan lenders often restrict their lending to experienced property developers with a strong portfolio of successful projects.

Even though a mezzanine loan may have an interest rate from 10% to 30%, which is relatively high, it offers several advantages over funding via third party equity. As a mezzanine loan is still a type of loan, the developer keeps full control of their project. However, if equity partners are involved in the project, they will have a say in how the development should be run. As a result, it may cause stress, conflict, and delay in some situations.

How does mezzanine finance work?

The funder lends the money at a fixed interest rate on a fixed period agreed by the two parties. Unlike senior debt, the interest of a mezzanine loan is calculated from the total loan amount on day one. The reason is that, as the mezzanine loan is used to ‘top up’ the senior debt facility, the borrower will most likely draw out the full loan amount and use it at the beginning of the project.

Concerning interest payment, rolled up interest is the most common way that mezzanine finance operates. Rolled up interest is calculated throughout the development project but only paid from the sale or refinance proceeds. Thus, the full gross loan amount is advanced to the borrower, and no money is set aside to cover the interest.

Given the relatively high-interest rate of a mezzanine loan, how do I know whether it will improve my project’s performance metrics? This is when a development appraisal that allows the incorporation of different financing structures would come into place.

How is mezzanine finance incorporated in a development appraisal?

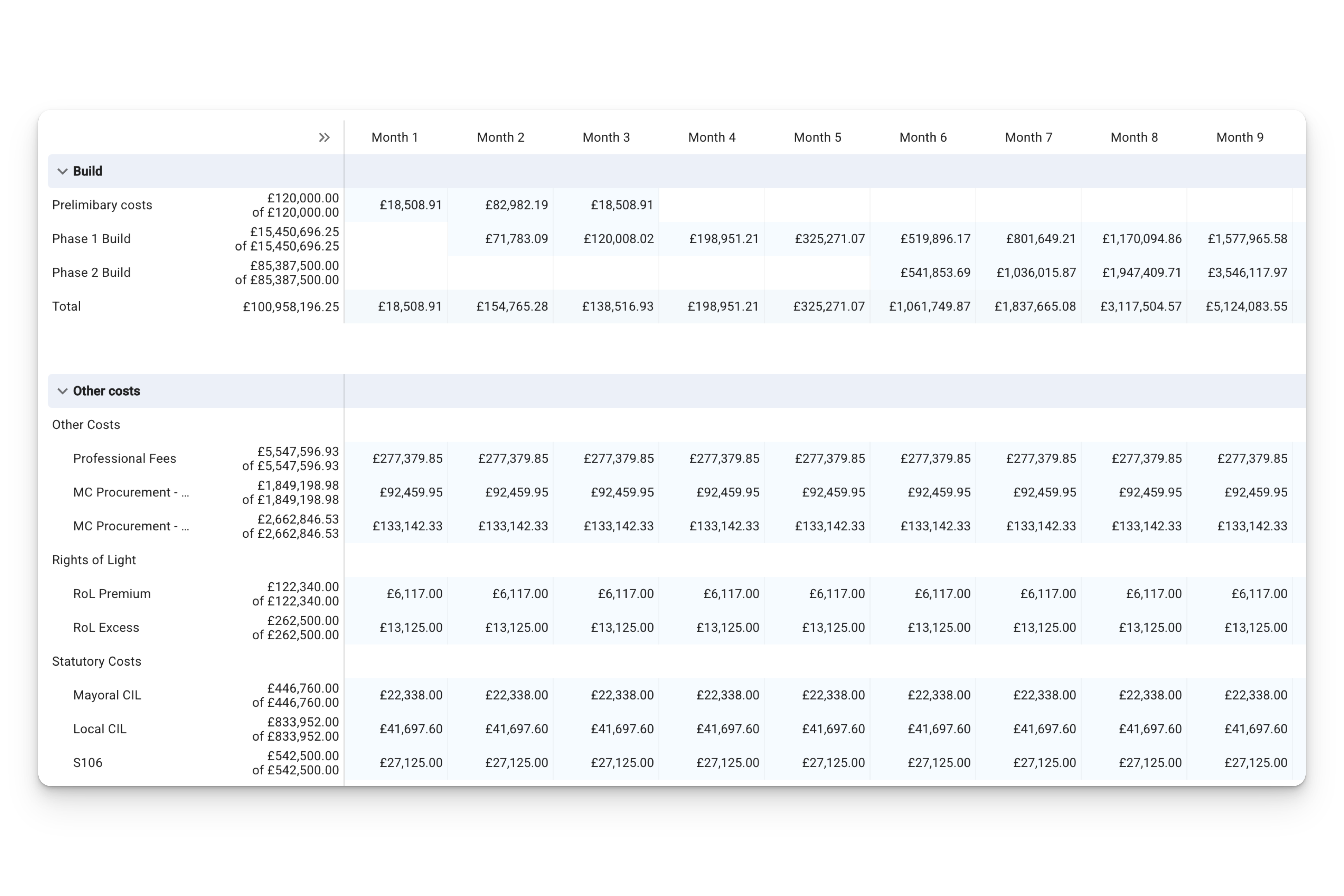

Traditionally, a development appraisal can be done on a spreadsheet. However, incorporating more than one financing method with different structures requires manual input of formulas, formatting and a good level of spreadsheet modelling knowledge. In this section, we will show you how Aprao can replace this complex process with a simple tool.

A development appraisal in Aprao includes a ‘Finance’ tab, which allows you to incorporate various development financing into your financial model. Suppose you have already incorporated senior debt into the appraisal, you can add a mezzanine loan on top of that by clicking ‘add interest lender’ and naming it for example, ‘Mezzanine Finance’.

You can then enter an estimated loan amount. It can be a pre-determined amount, or it can be a percentage of cost or GDV. In this example, we assume to borrow 10% of the cost.

Then choose ‘rolled-up’ under payout as your mezzanine loan will most likely operate with a structure of rolled-up interest. Afterwards, choose ‘interest on full loan amount’ as the mezzanine loan is normally used right at the beginning of a project.

Next, select ‘estimated’ under calculation. Then, enter the interest rate of the loan and the number of months for your whole development period under ‘Term’. In this example, we assume a 15% interest rate and a 12-month term. Aprao will then automatically calculate the interest for you and update the performance metrics of your project when a mezzanine loan is used.

Finally, include other fees as specified by the lenders into the appraisal. In this example, we assume a 1% commitment fee and a 1% exit fee.

Now, you can check your project key metrics and understand how the mezzanine finance would change the performance of the project.

Where can you find a mezzanine finance provider, and how can you get the best deal?

‘A robust development appraisal is the foundation of getting development finance.’

- Daniel Norman, founder of Aprao with 10 years of development finance experience.

A robust and concise development appraisal allows the lenders to better assess your project, which increases the speed of the application and the chance of a successful application. Financial appraisals created using Aprao are well-recognised by lenders across the UK as their preferred appraisal format. Check out our ‘Learning from Lenders’ video series to listen to what lenders are really looking for when assessing deals and what they think about Aprao.

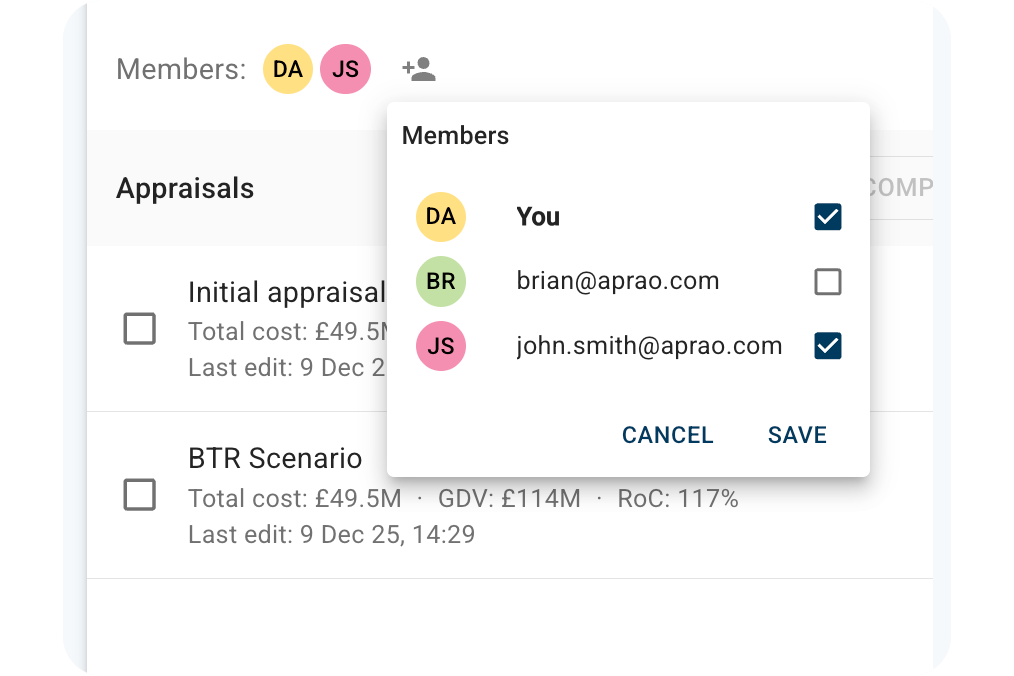

Normally, you would tentatively approach both lenders when you incorporate both senior debt and mezzanine loans into your project. Both sides will need to know your capital stack to assess your project. You may be getting quotes and head of terms from multiple senior debt lenders and mezzanine loan lenders, respectively. Alternatively, online platforms such as Native Finance, Findango Loans, and Brick Flow are increasingly popular options for borrowers who opt for tech-enabled solutions to source deals from multiple development finance providers.

With Aprao, you can create multiple development appraisals incorporating different combinations of senior debt and mezzanine loan deals and export reports for each of them. Then, you can easily compare the key metrics of each combination and find your desired deals. Click below to get started free with Aprao, no credit card required.

.png)

Leave a comment