Prasanna Kannan is the CCO of Native Finance, with a background in financial services as a trader at Goldman Sachs and as an investment portfolio manager. In this interview, Prasanna draws on his experience to predict the investor trends in real estate that developers should be aware of in 2022.

Native Finance is a platform that offers solutions for lenders, borrowers and developers looking for investment, development and bridging finance opportunities. It is the leading tech platform for real estate finance in Europe. Since its launch, the platform has seen £1bn+ in deal flow and over £100m of completions in bridging, development and investment finance. The platform has also won a number of industry awards including the overall Tech category at the 2020 Estates Gazette awards.

What inspired you to set up Native Finance?"Real Estate Finance in the UK consists of almost £60 billion in new loans per annum, depending on the year, and until the last few years, there’s been no digitisation in the industry.

"I used to trade swaps and various other over the counter products: ten years ago people on the trading floor, particularly older hands, would say that these sorts of elements could never go through a tech platform. Now all kinds of products on the trading floor go through tech platforms and that whole sector has been digitised massively in the last decade. It’s going to be interesting to see in the next decade whether we will see something similar in the real estate industry. We set up Native Finance with the aim of helping the property industry become much more tech-enabled."

How do you think sensitivity towards the need for data will evolve in the next few years in our sector?

"The pandemic has been a huge catalyst in changing attitudes towards technology and data in our industry; there is going to be a future where real-time, API-led product updates will be the norm. Right now, we’re nowhere near that stage as an industry.

"It’s often the smaller lenders that are very open-minded about data and conversely, the institutional players are not always as keen to engage. Traditionally, opacity has been the friend to larger loan ticket ranges, where holding back data has a lot of positives, although COVID has dispelled a lot of those perceptions. Prior to COVID, there was a prevailing perception that business in real estate must be done through meeting people and shaking hands.

"However, COVID has meant that you had to meet through Zoom calls and digitised platforms. Even people who were quite sceptical of technology, by having meetings online and using online data sources, have been shown a new way of working and have started to embrace the benefits."

Earlier this year you wrote about how the pandemic has increased lenders’ appetite for growth. Six months on, do you still think that’s true moving into Q1 of 2022?

"What’s interesting in this recent downturn in terms of lending is that growth really depends on which type of lender segment you analyse. This pandemic has been different to the last crisis the UK experienced – the 2007-2009 financial crisis. Prior to the financial crash of that time, about 96% of real estate lending was done by the UK clearing banks; what that phase of crisis did was drop that level to something in the 40% range, leading to an emergence of alternative lenders; from bridging lenders to debt funds coming into the space.

"What was interesting this time around with the pandemic is that the lenders whose volumes dropped dramatically were the banks – both clearing and challenger banks. But “alternative lenders” and pretty much every other lending group outside bank lending stayed pretty constant during this downturn."

"Although there was a sharp reduction in lending, with month-on-month lending down by 46% at one point in 2020 compared to the previous year, the overall level was still higher than even a few years ago. All this shows there’s still room for growth, particularly for alternative lenders, as a lot of the drop in lending was led by the UK clearing banks."

"Although there was a sharp reduction in lending with month-on-month lending down by 46% at one point in 2020, the overall level was still higher than even a few years ago."

– Prasanna Kannan // Native Finance

In terms of the flow of investment, do you see a shift in the kind of investment being pumped into different regional areas in the UK or different product types?

"Although it seems that things have started to feel normal in the city of London, the data is pointing to around 40-50% of pre-pandemic levels in terms of activity in London and commercial areas - the future of the office is therefore still unclear, and this will have knock-on effects on residential development. I think there is definitely a shift towards the regions in terms of growth, with lending data showing that areas such as Yorkshire and in the Northwest are starting to rebound faster than other parts of the country for example.

"Going forward, it will be intriguing to see how retail develops. There could be a Renaissance in terms of reshaping what high streets can and actually should look like in terms of experiential retail development. The pandemic has accelerated an ongoing trend and might hopefully have led to the bottom for the retail sector sooner than anticipated."

The property industry contributes significantly to greenhouse gases, with upward of 40% for the global energy use of carbon emissions, and 6 in 10 CFOs now prioritise investor grade reporting metrics (PwC) and sustainability within real estate.

How authentic is the push for ESG going into 2022?

"There has been a big shift towards this topic in recent years. I think in terms of ESG the biggest question is, which assets are lenders willing to back as a result of this shift? Unfortunately, the data shows that a lot of the activity is ‘greenwashing’, so I don’t know how well ESG criteria yet applies to our sector in practicality.

"I think there is definitely a shift towards the regions in terms of growth."

– Prasanna Kannan // Native Finance

"There are lenders out there implementing genuine policies towards sustainability so this is not a criticism of the real estate industry but ESG reporting overall; some studies show that over 90% of ESG funds have at least one or more investments in oil, tobacco or other similar companies.

"However, it is ultimately good that the real estate industry narrative is shifting and that there is a lot of interest in discussing the issue. As a sector, we are waking up to the level of the scale of the issue, particularly because of successes elsewhere in other sectors (such as cars and manufacturing) making improvements. I believe there is a realisation that our industry is not necessarily pulling its weight – I think it will become more of an issue this next decade for real estate."

Did you enjoy this piece? It was originally part of our recent Winter Market Report, which you can read here.

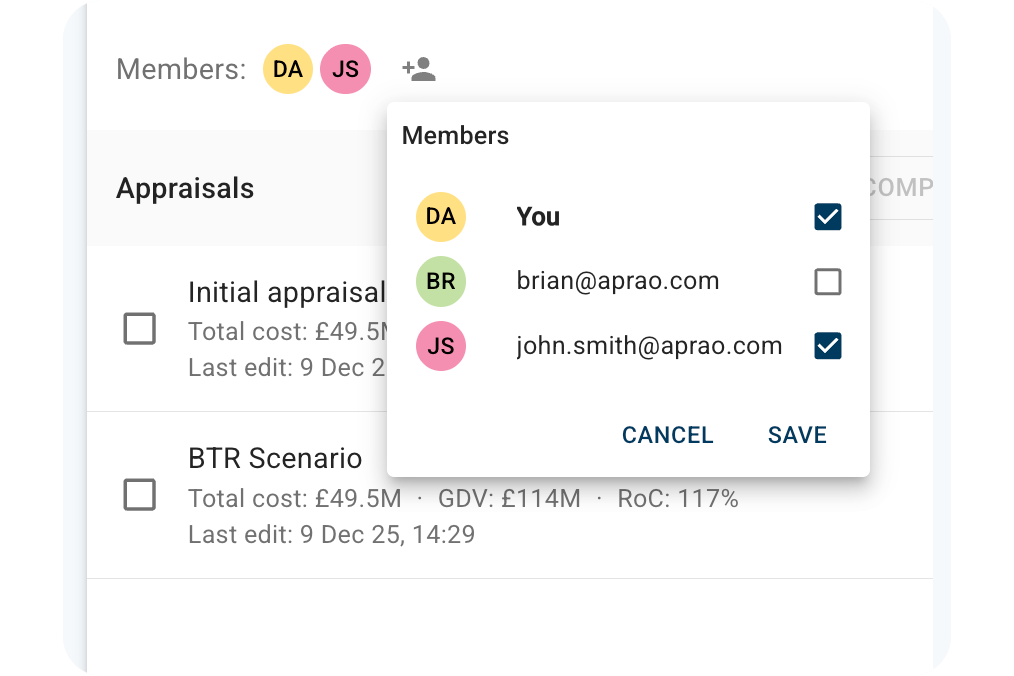

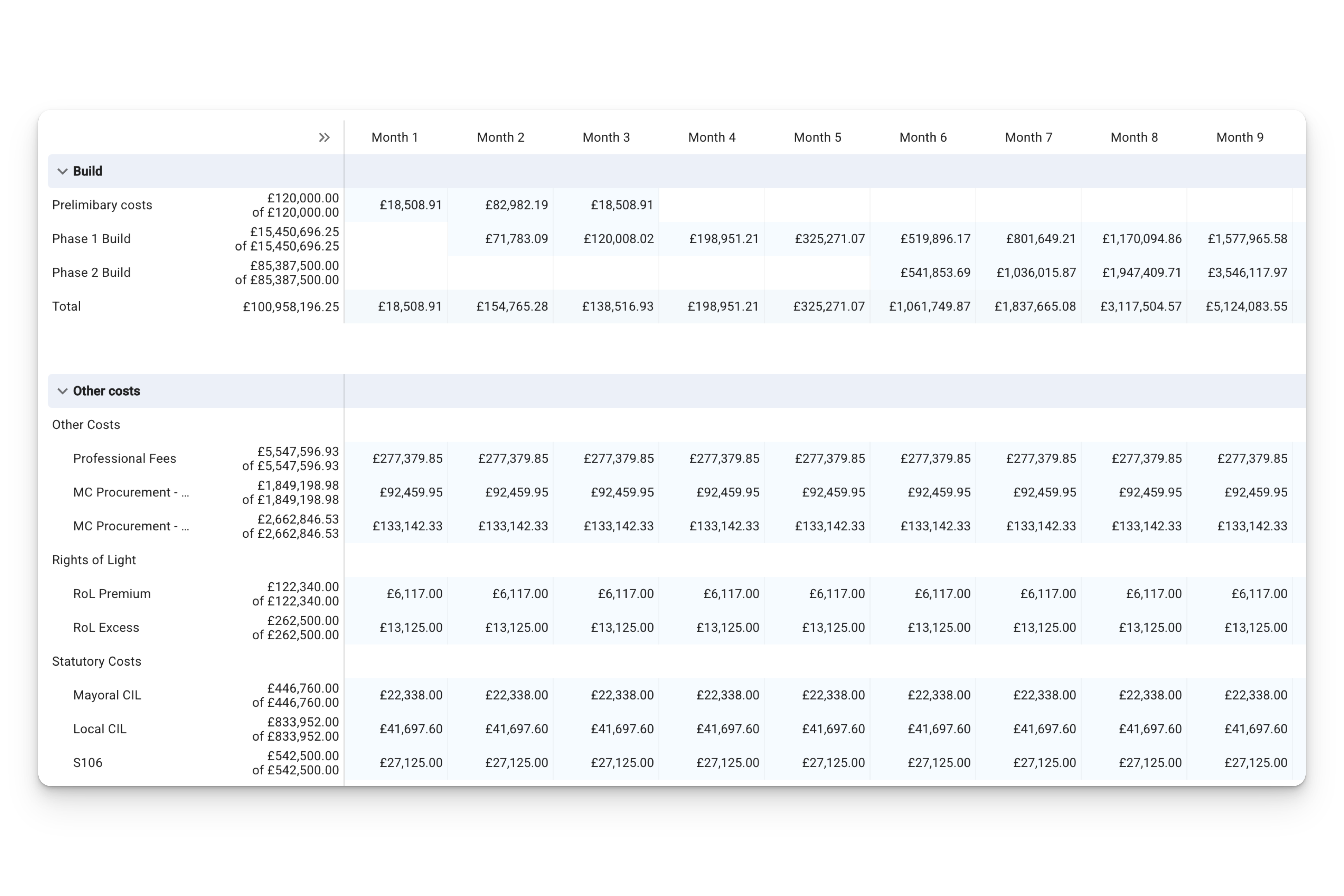

Did you know that you can use Aprao to improve your reporting for your investors through more accurate appraisals? Learn more here.

.jpg)

Leave a comment