In property development, timing is a critical factor that can significantly impact the success and profitability of a project. In this blog, we will explore the importance of timing through a case study that looks at two development projects — one completed and sold in 12 months, and the other completed and sold in 24 months.

Case Study: Project Timescales

Let's consider a hypothetical property development project, involving the construction and sale of residential apartments in a sought-after neighbourhood. Version 1 of the project is expected to be completed and sold within 12 months, while version 2 of the project is expected to take 24 months to reach completion and sale. Keep in mind that we assume identical total revenue and total build costs in both versions.

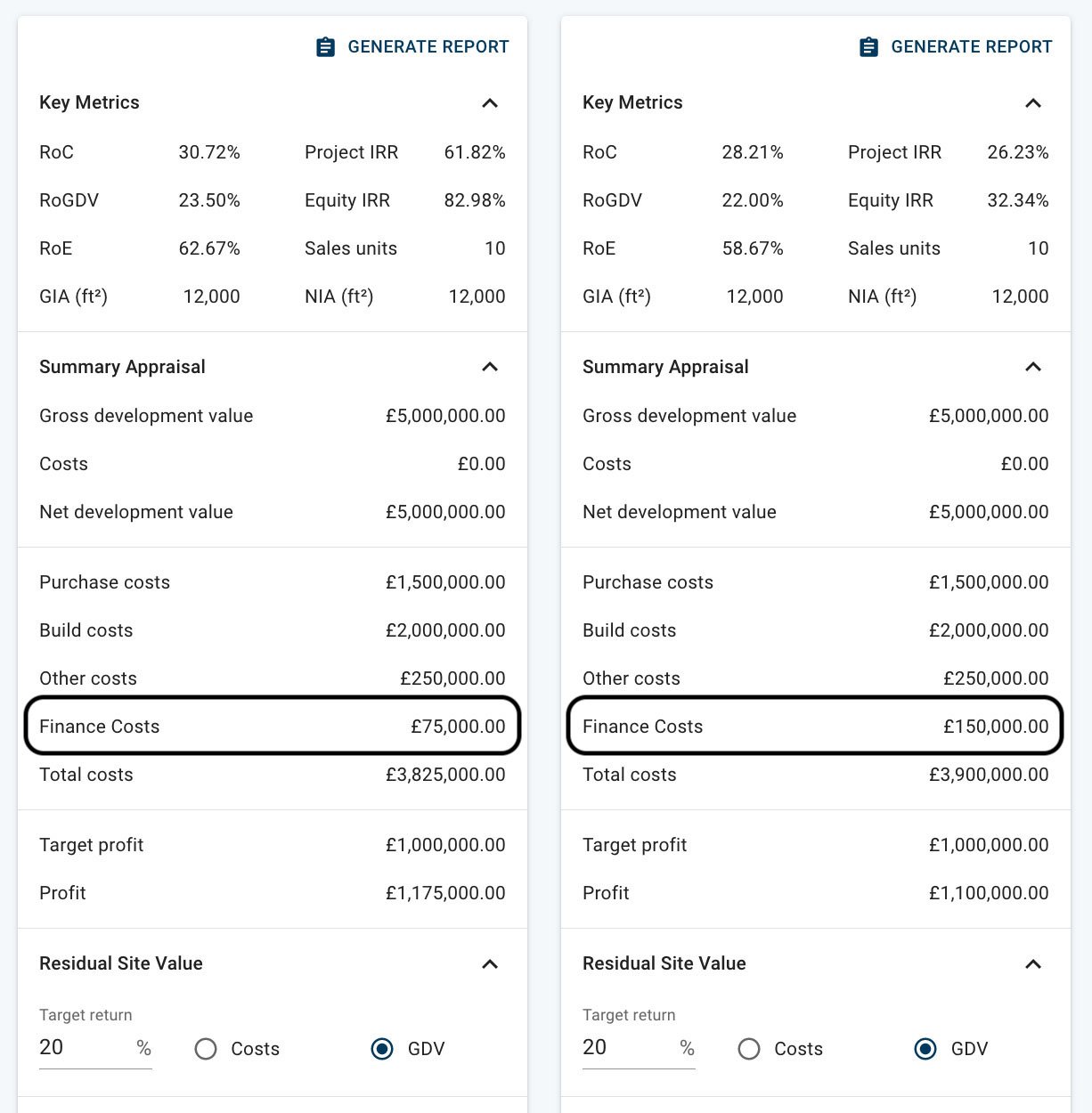

By comparing the appraisal key metrics and summary of both version 1 (left) and version 2 (right), we can see that all revenue and costs are equal except for their finance costs.

One significant consequence of a longer project timescale is the increase in interest costs. During the construction phase, developers typically secure financing through construction loans, which accrue interest over time. In the case of the 24-month project, the duration of the loan is extended, resulting in higher cumulative interest expenses.

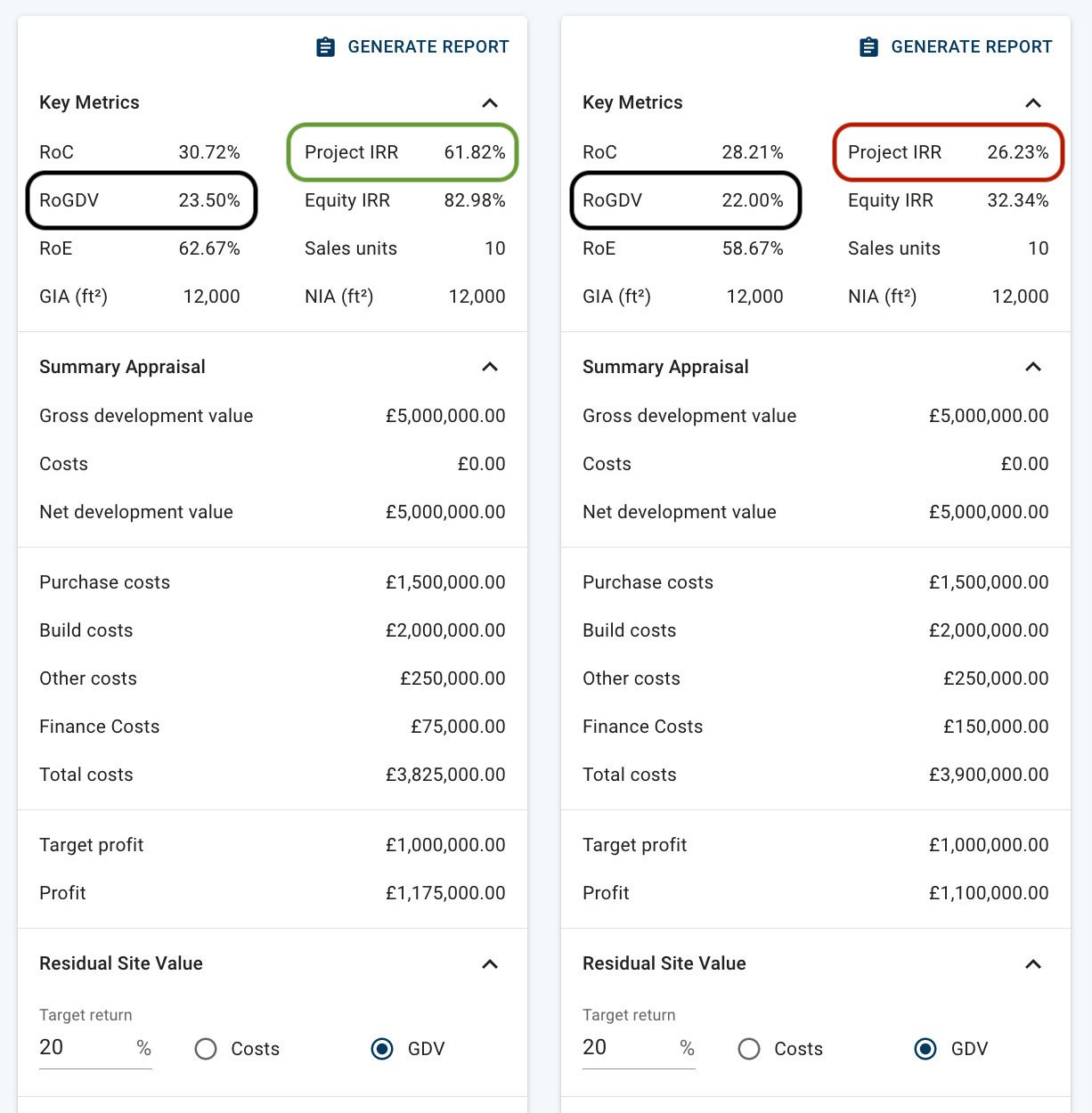

The difference in interest costs between version 1 and version 2 is £75,000 which leads to the same £75,000 difference in profit. Their return on GDV are 23.5% and 22.0% respectively.

The difference between version 1 (left) and version 2 (right) doesn’t look huge by looking at their RoGDV value, just a 1.5% difference. However, if we consider their IRR (Internal Rate of Return) which measures the profitability of an investment that takes into account the time value of money, the IRR of version 1 is more than double of version 2’s IRR, which indicates that version 1 with a shorter project time frame is far superior than version 2 with a longer project time frame.

With the 12-month project, the capital invested is tied up for a shorter duration, allowing for a quicker realization of returns. Conversely, the 24-month project's extended completion and sale timeline delay the receipt of returns, thereby lowering the IRR. This decrease in IRR indicates that the project's profitability is impacted by the additional time taken to generate returns.

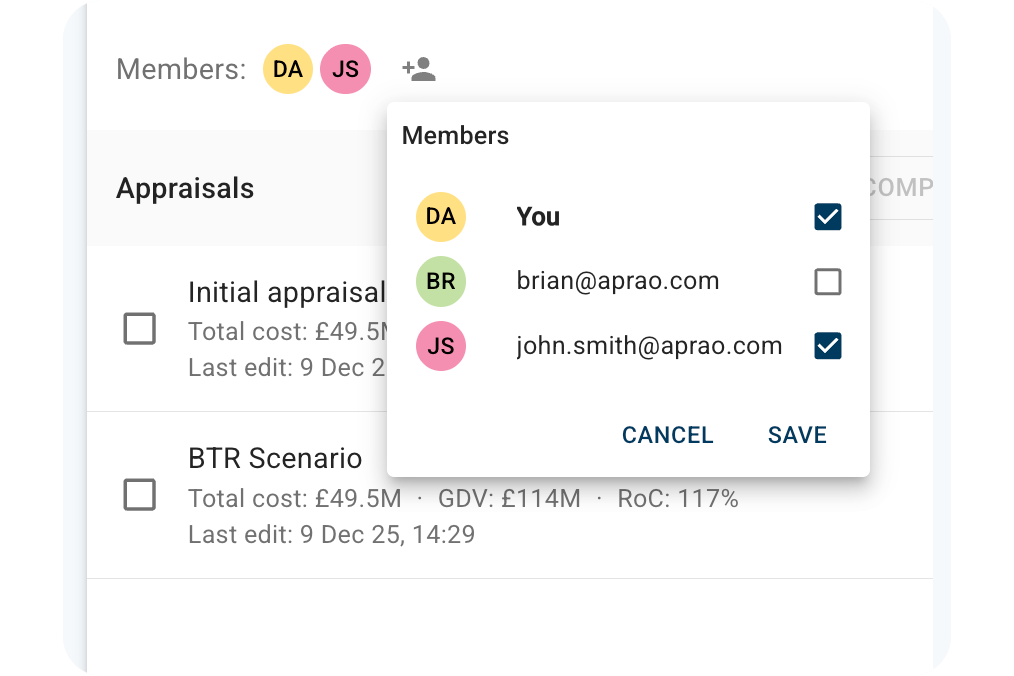

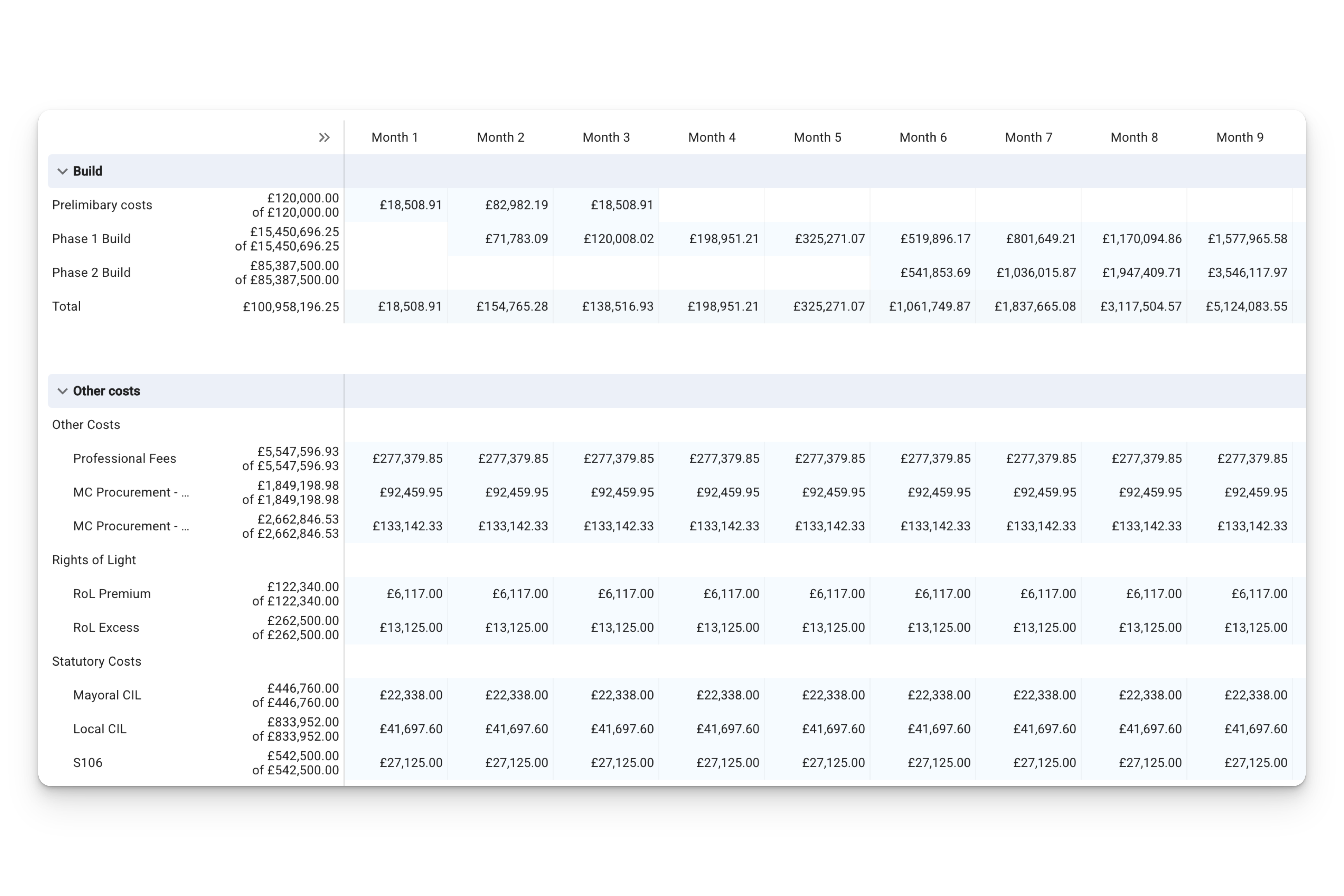

Aprao has a built-in cashflow feature with an automated spread tool that allows you to create a cashflow and calculate IRRs in no time (I guarantee it is much faster than Excel). Watch this video for a quick demo. Having both return on GDV/Costs and IRR metrics allows you to have a thorough understanding of your project and helps you make better-informed decisions.

Bonus: Cashflow Interest Calculations

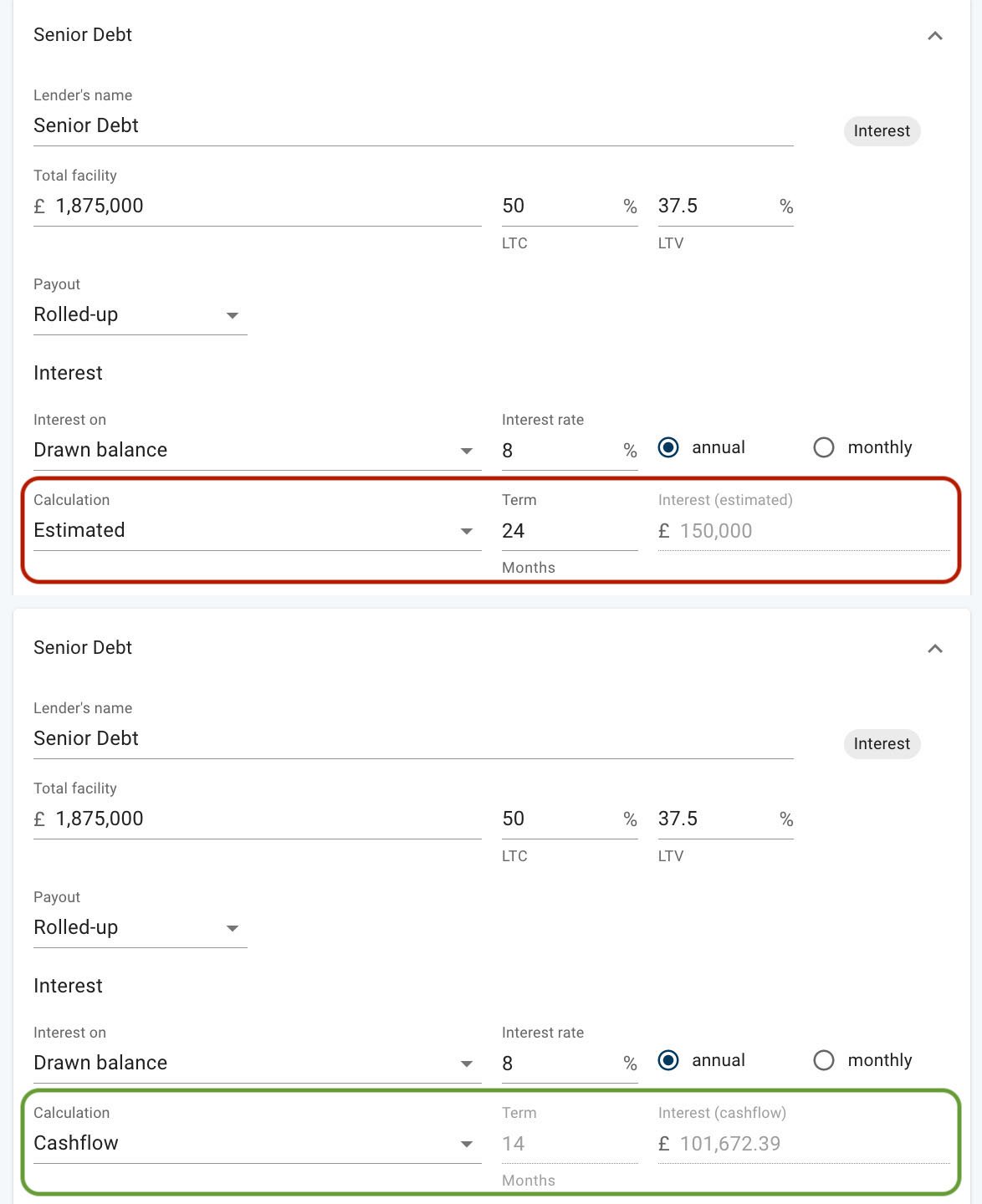

Normally, the interest calculation is estimated based on halving the total facility times the interest rate, and then factoring in the loan term — a practice commonly used in the residual method of valuation.

However, if we consider the S-Curve distribution of costs incurred during the construction period and also the sale period in which funds are coming in earlier, calculating interest based on the cashflow better resembles the actual fund drawdown it gives you a more accurate estimation of finance costs.

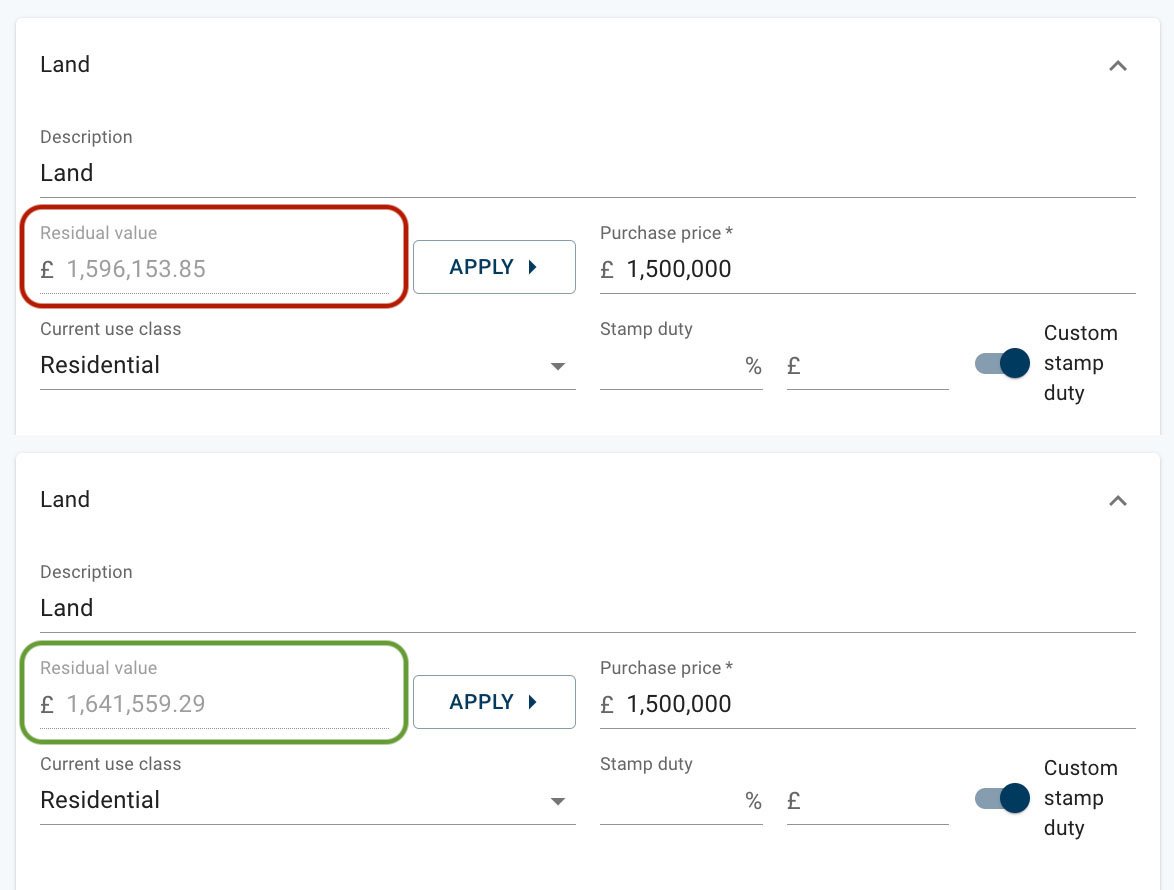

Using the interest cost calculated based on the cashflow, we find that the land residual value is £1,641,559.29 instead of £1,596,153.85 when the target return is set as 20% on GDV.

The more accurate interest calculation provides you with a more accurate land residual value (usually higher) which allows you to better justify your margins and help you win bids.

Also, check out our new sensitivity features that further your understanding of your project risks and potentials.

Want to give it a go yourself? Existing customers can log in here and new customers can click here to sign up for a free 14 day trial of Aprao.

Leave a comment