In this 4-part series, Aprao's resident RICS Chartered Surveyor Nick Fisher shares best practice around creating a variety of different property development feasibilities. In Part 4, he provides a detailed analysis of how to calculate the feasibility of a residential apartment scheme with a ground floor retail unit.

The Development Scenario

In this feasibility we are analysing a residential apartment scheme with a ground floor retail unit in a Zone Two London location.

The Gross Development Value

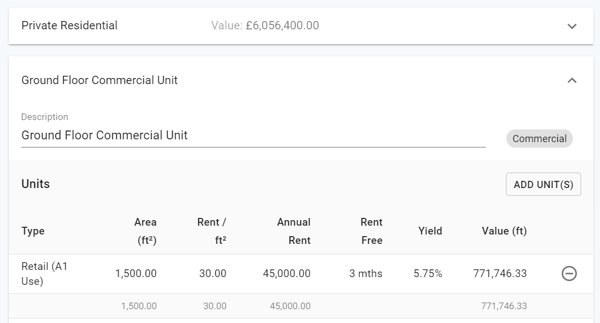

There are 10 private flats on the upper floors and a 1,500 sq ft retail units on the ground floor. The estimated rental value for the unit is £30.00 per square foot which equates to £45,000 per annum.

We have assumed a rent free period of three months to allow the tenant to fit out the unit and have capitalised the rent by 5.75%.

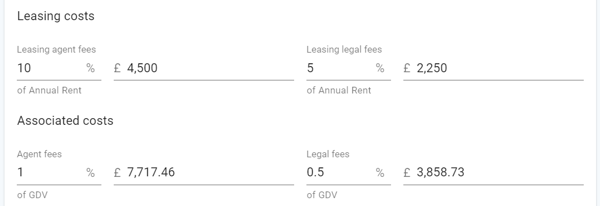

We have assumed leasing costs at 15% of the annual rent, accounting for the leasing and legal fees. Furthermore, there are associated sales costs for both the agents and lawyers.

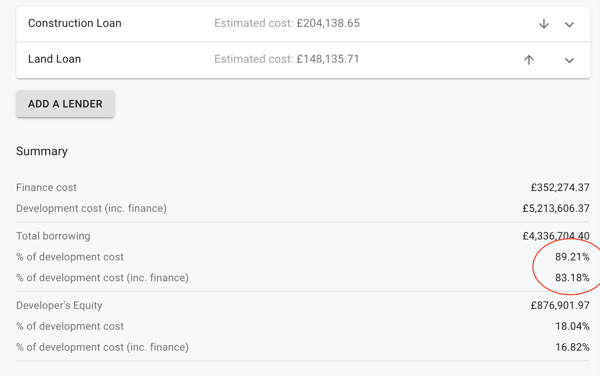

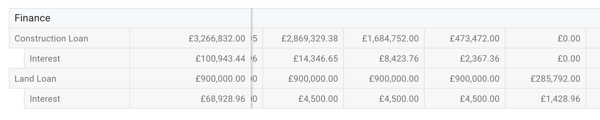

Build and Land Loans

In this example the site is being purchased for 1.5 million so the land loan is 900K. So we have created a lender in our feasibility, called "land loan" for 900K.

- Site Purchase: 1.5mil

- 60% of Purchase: 900K

The construction loan is normally 100% of build and other costs, in this example:

- Build Costs: 3,006,960

- Other Costs: 259,872

- Total: 3.26 mil

We operate on a priority basis - the lowest priority gets used first in the cashflow, and the highest priority gets used last.

In order to make the flow of funds work best, we need to make sure the finance is in this order (highest priority first).

- Construction loan

- Land loan

- Developers equity (this isn't a funder but this is where it sits in order by default)

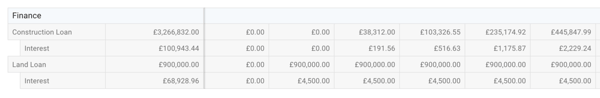

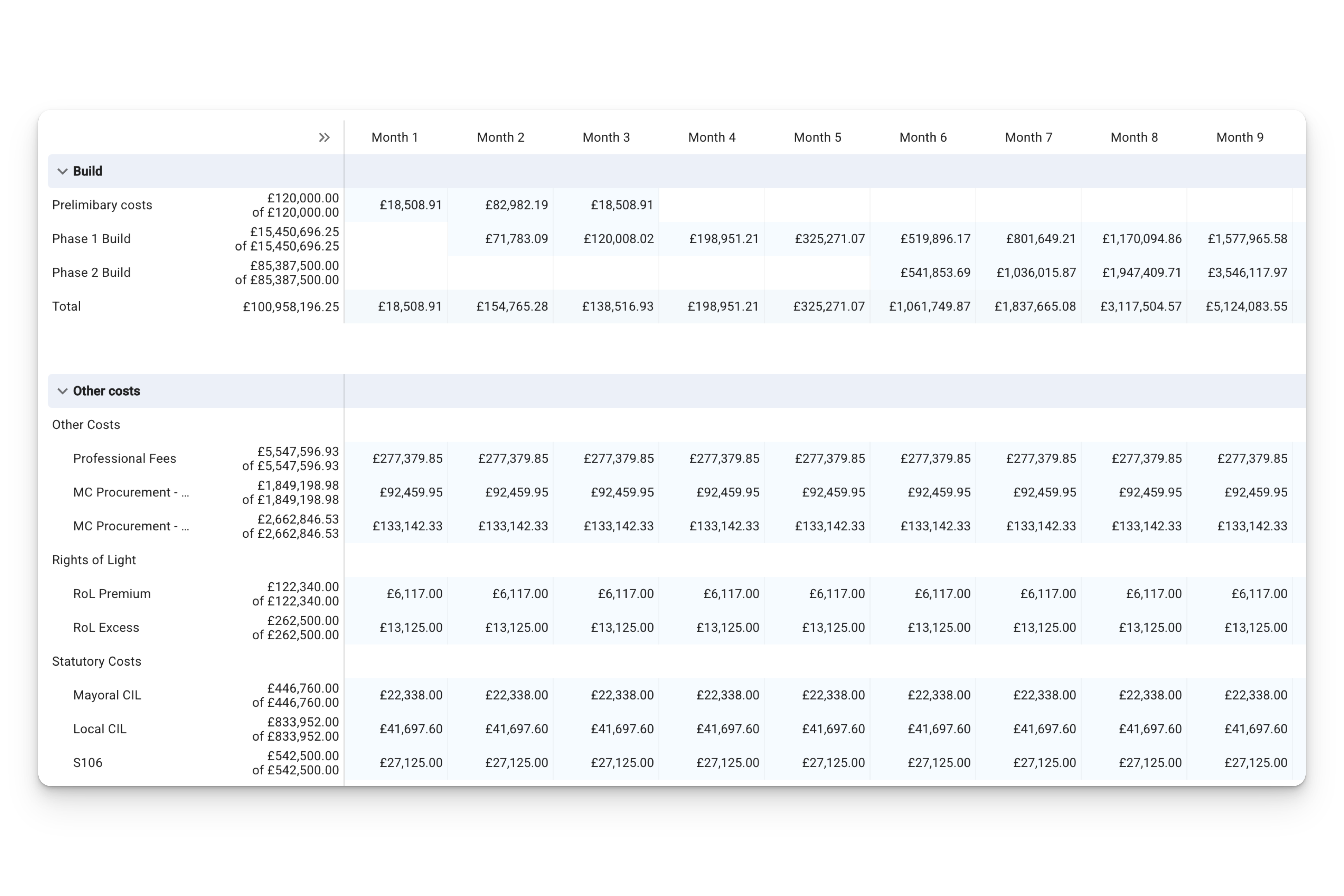

Here is a snippet from the first few months of the cashflow. You can see that the equity and land loan are used first:

And at the end of the project, when the sales are repaying the debt, the construction loan gets repaid.

Would you like to view the final feasibility? You can see it here.

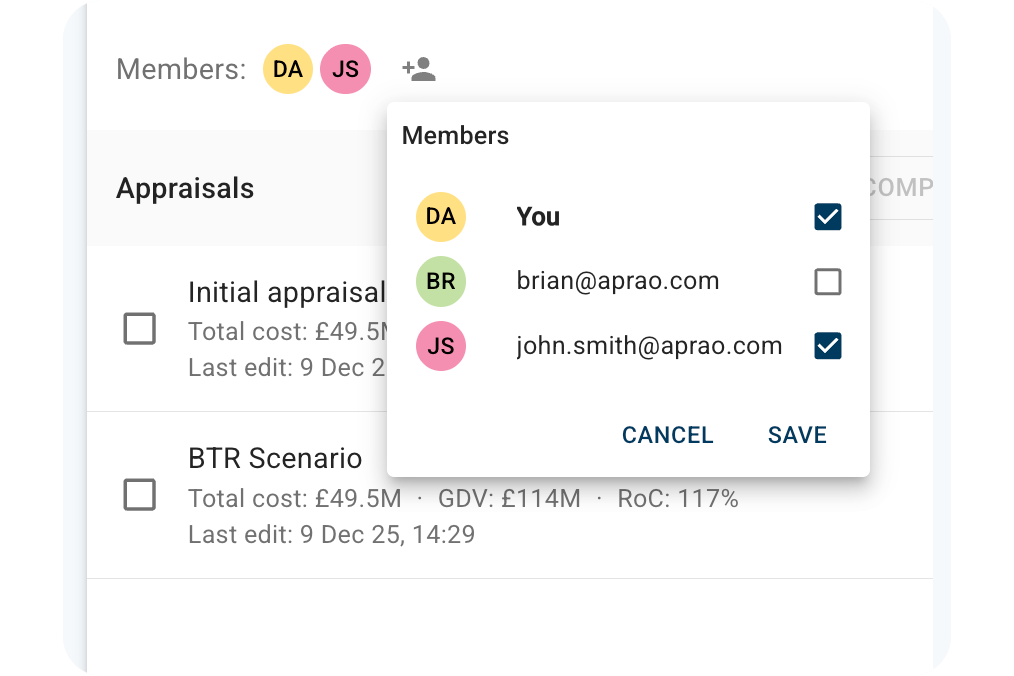

If you're an Aprao user, you can add this feasibility to your dashboard and use it as a template for your own feasibilities! Just open the link and click the "Copy to your dashboard" button.

Not an Aprao user yet? Get started for free, no credit card required, and we will activate your account immediately - then you can log in, and add this appraisal to your new dashboard!

Leave a comment