We have released an update which adds new functionality to the finance section of Aprao. This release has been designed to give you more flexibility and detail when calculating development finance costs.

We have introduced gross and net development loans, improved how we handle finance fees, and also introduced different interest payment types. So now you can factor in retained interest, rolled up interest and serviced interest.

Not sure what they all mean? Read on to find out.

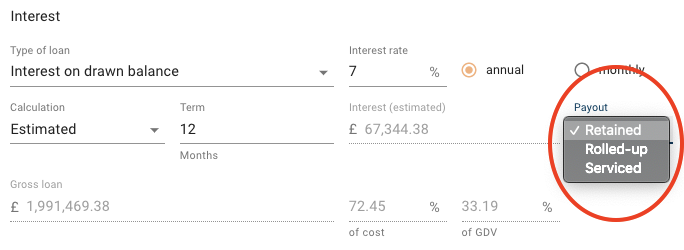

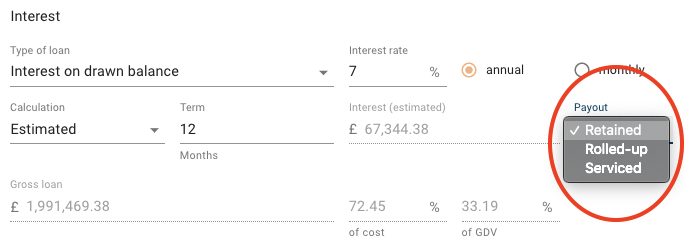

Interest Payment Type

We have now introduced three different ways that interest is treated:

Retained

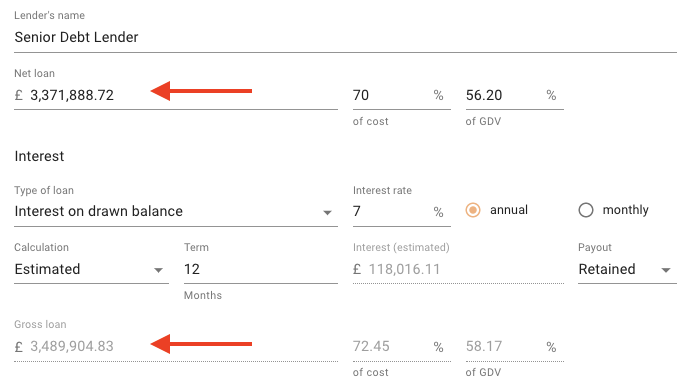

Retained interest is where the lender will calculate the interest cost at the beginning of the project and hold back (retain) the interest amount from the loan. This results in a lower Net Loan because the interest amount is deducted from the Gross Loan to cover interest payments throughout the project.

This is the most common way that senior debt lenders operate.

Example: Gross Loan £1,000,000 - Retained Interest £100,000 = Net Loan £900,000

Rolled Up

Rolled up interest is where the interest is calculated throughout the development project but only paid from the sale or refinance proceeds. The full gross loan amount is advanced to the borrower and no money is set aside to cover interest.

This is the most common structure for mezzanine finance.

Example: Gross Loan £1,000,000 = Net Loan £1,000,000 + Rolled Up Interest £100,000 paid at the end of the project from sales or refinance proceeds.

Serviced

Serviced interest is where the borrower pays (services) the interest payments throughout the project. This is usually the case for income-producing assets, such as a commercial unit, generating cashflow to ensure there is money to cover these interest payments.

Again, the Net Loan is the same as the Gross Loan because no interest payments are retained.

Example: Gross Loan £1,000,000 = Net Loan £1,000,000 + Serviced Interest for 10 months 10 x £10,000 = £100,000

Change to how we calculate fees

We now calculate fees based on the Gross Loan amount. This is important because previously this was calculated using a figure we call 'Available Balance' which was the same as the 'Net Loan'.

If you had previously calculated your finance fees based on the loan amount, this will automatically update to the same percentage, but is now calculated on the Gross Loan.

Gross and Net Loan Amounts

As you can see, we wanted to create more consistent names for the loan amounts - so we've updated these to Gross Loan and Net Loan.

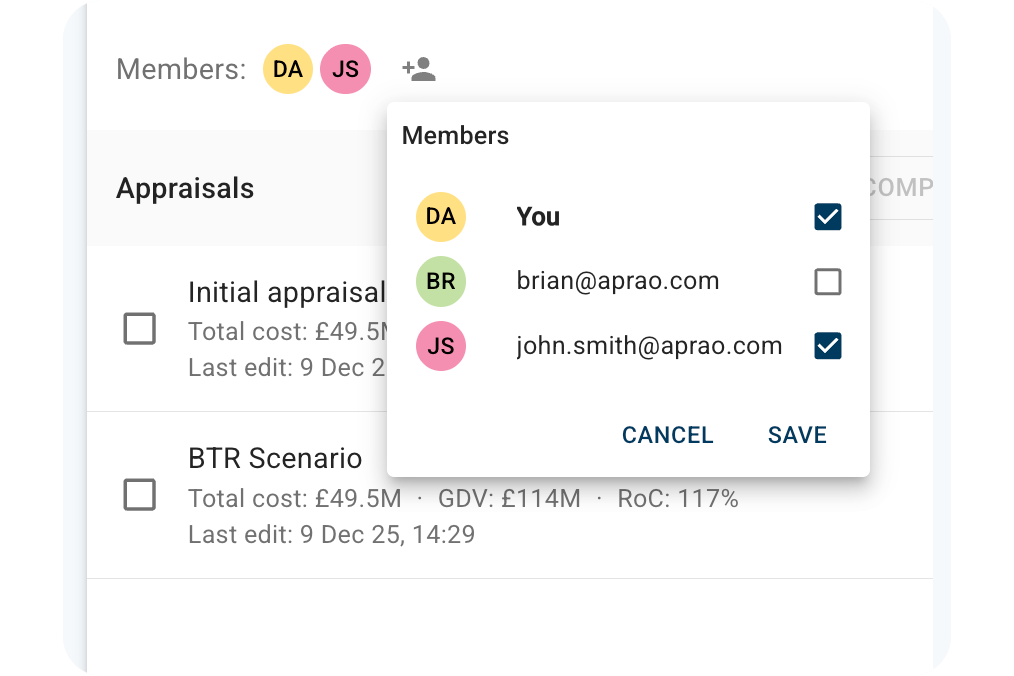

We hope you find these updates useful. As always, if you have questions or feedback please don't hesitate to contact support@aprao.com.

You can also watch these changes in action in the video below:

Leave a comment