In previous blogs, we've introduced various development finance methods (Senior Debt, Mezzanine Finance, Joint Venture, Bridging Finance) and demonstrated how Aprao can incorporate them into your development feasibility. These development finance methods are often utilized by developers and investors on their relatively large-scale projects. While Aprao is capable of modeling development feasibilities of large-scale commercial projects, it's also suitable for small-scale personal projects that utilize construction and land loans instead.

As Aprao is designed as a tool to allow any person without extensive financial modeling experience to create and manage development feasibilities, the complexity of your development feasibility depends on your input rather than the platform. As long as you input applicable details and information into Aprao, Aprao will always do the job for you, no matter if you're just refurbishing your own house or modeling a multi-million commercial project. In this blog, we'll introduce you to construction and land loans, and demonstrate how Aprao can incorporate them into your development feasibility.

What are construction and land loans?

Construction and land loans are financing methods used to serve the process of buying a plot of land and building a new home on it. These finance products are mainly used in scenarios when an individual wants to build their own house on a plot of land instead of buying an existing property. Semi-custom or custom home builders and contractors will be involved in this process as they'll be responsible for the build. Inputs from all parties involved can then contribute to the budgeting and determine the loan amount needed for the project.

Construction loans and land loans are commonly mentioned together but they're not exactly the same. A Land Loan or a Lot Loan, as stated in its name, is used to purchase vacant land to build new homes on it. A construction loan, as stated in its name, is used to fund the construction of the build. It sounds straightforward but the catch is that sometimes, a construction loan can also be used to fund land purchases.

Why do you need a construction loan or a land loan?

A land loan is suitable for a future homeowner who wants to secure their ideal homesite but is not ready to commence construction of their new home immediately. After purchasing the site, they can take their time to find suitable semi-custom or custom home builders and continue to further plan and design their new home based on the acquired site. Also, people may have circumstances in life pushing their building project out a year or so. A land loan basically gives you more time between land purchase and commencement of construction.

A construction loan is suitable for individuals and home builders who are ready to get right into their construction project. A construction loan is a short-term loan that aims to fund construction right away from the ground up. Some lenders who offer construction loans may also fund the purchase of improved land or so-called ‘shovel-ready’ land. This kind of land is dedicated for a new house to be built on it with planning, permits and roads, electricity and water access already in place. In this scenario, some lenders are willing to fund both the land purchase and construction cost.

How do construction loans and land loans compare to other financing products?

Comparing with mortgages:

As the loan amount of a mortgage is based on the current purchase price of an existing property, you should be aware that the loan amount of a construction or land loan is based on the costs needed to build the development, but not the value of the property at the end of the build.

Banks and mortgage lenders are often wary of issuing construction and land loans. One major reason is that there is a lot of uncertainty about what you intend to do after buying a piece of land, or the quality of the builder or contractor undertaking the construction work. They are lending money for something that is to be constructed, with the assumption that it will have a certain value when it is finished. Therefore, construction and land loans are considered relatively risky compared to mortgages and hence, they usually have higher interest rates.

Comparing with bridging loans:

The nature of bridging loans, and construction and land loans are similar in several ways. They're both short-term loans and they have relatively high-interest rates. However, as discussed in the previous Bridging Finance blog, bridging loans can be used in various financing scenarios and they are often used to cover a percentage of the overall costs or GDV of a project. On the other hand, construction and land loans have a more specific usage - to cover land purchase costs or construction costs, or both in some scenarios.

Why do you need a development feasibility if you are applying for a construction loan or a land loan?

For the lender:

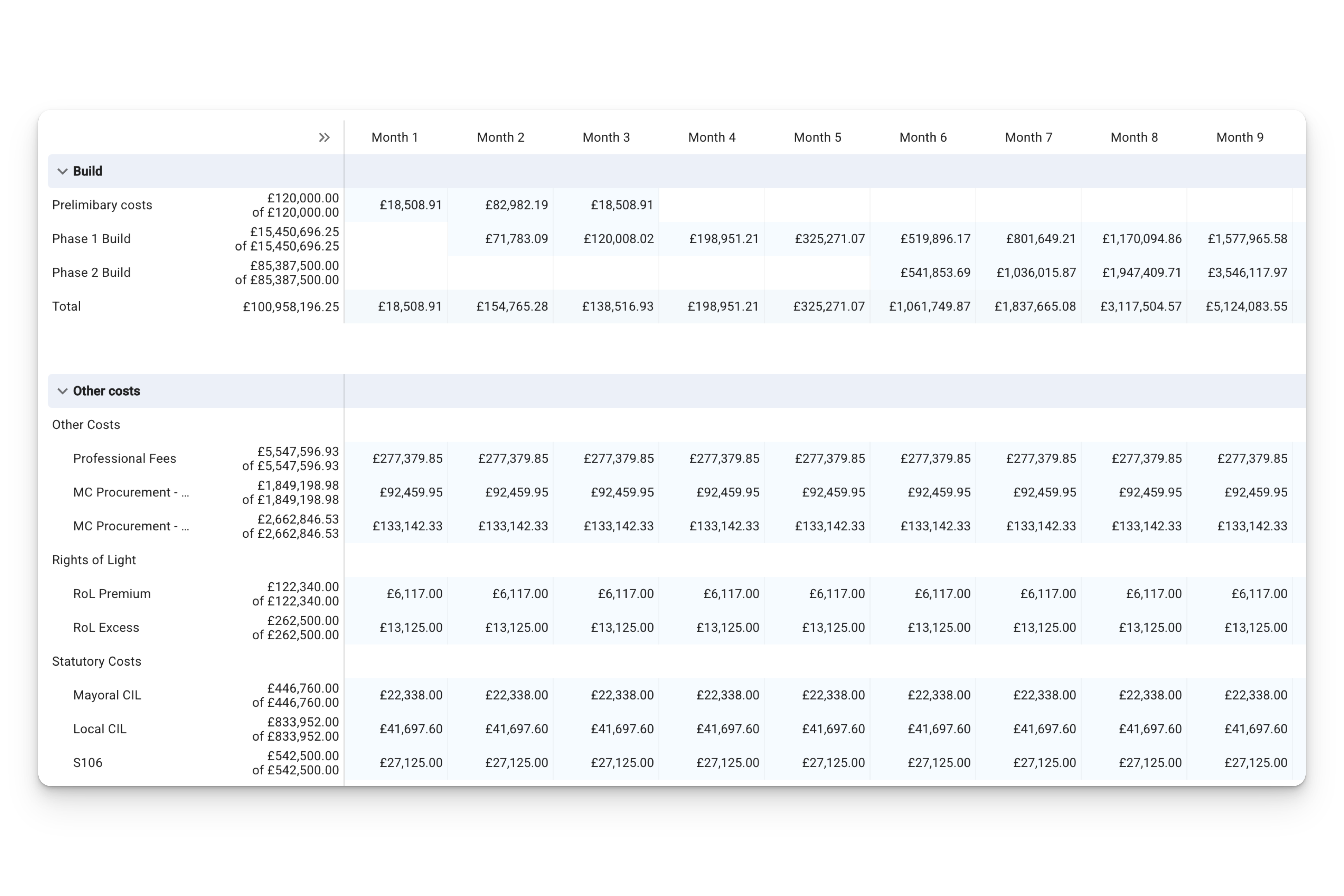

The lender needs detailed specifications of the property you intend to build. This includes floor plans, as well as details about the materials to be used. With all the detail listed, you can then create an evidence-based budget and build the schedule for your project. From this point, you will know the loan amount you need during each month of construction and you can present it clearly to the lender.

When you start the project, the funds will be drawn against the agreed build schedule and monitored at each stage to ensure the project is on track and within budget for successful completion. Therefore, a development feasibility or financial model is essential to provide the lender with the cash flow information they need to approve your loan application. It is also helpful for both you and the lender to monitor the cash flow of your project and keep track of what the loan is being used on each month.

For yourself:

If you are starting your own project, one of the initial questions that you may ask yourself is: is it worth it?

Creating a development feasibility can quickly answer your questions and allow you to assess the costs and values of your proposed build. Even if you do not have all the information, working on your project alongside a constantly adaptable financial model can help you compare various scenarios and help you make better evidence-based decisions.

💡 "Even if you do not have all the information, working on your project alongside a constantly adaptable financial model can help you compare various scenarios and help you make better evidence-based decisions."

Even though the lender will constantly monitor your fund drawdown, a financial model will benefit you by helping you to understand what is currently going on in your project, and help you predict if there will be cash flow problems in the future. Showcasing such awareness and presenting a clear cash flow projection to the lenders will definitely increase your chance of loan approval.

I understand what construction and land loans are and how a development feasibility can help. What should I do now?

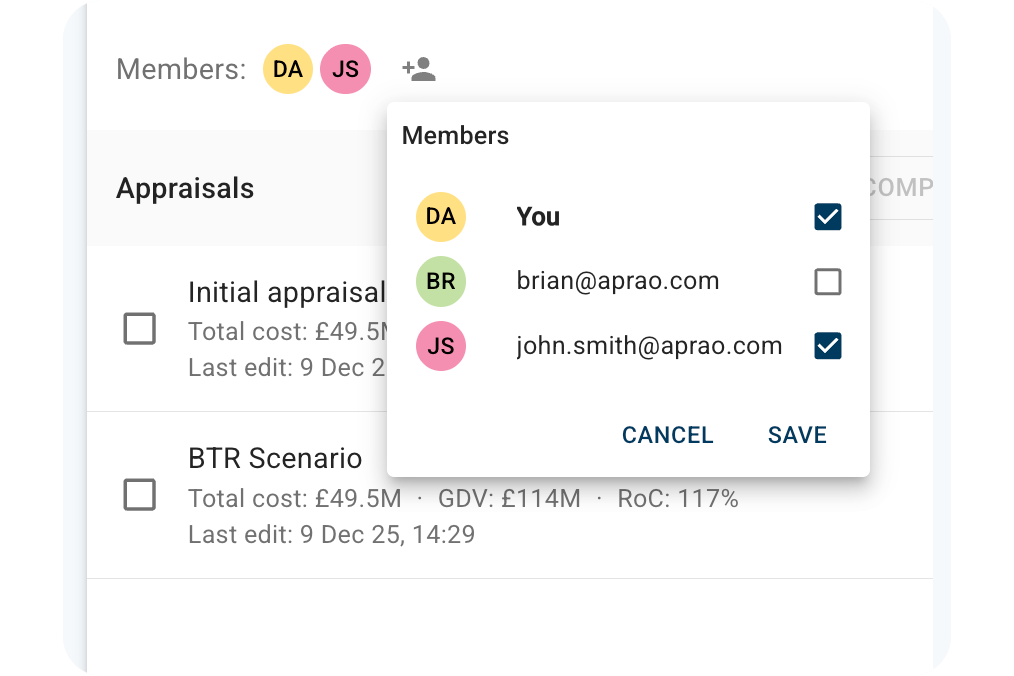

Aprao is a cloud-based financial modeling tool that provides you with a solution to appraise and model your development project. First, you can create a few initial high-level feasibilities to get an idea about the financials of your proposed project. Then, you can collaborate with a builder or contractor by using the same platform and formulate a more detailed development feasibility. When you're ready to apply for a loan, share your financial model in Aprao's format with your lender easily with a quick link, or by generating a report for them to view.

Ready to try Aprao for yourself? Click the link below – it's completely free to get started, no credit card required.

Leave a comment