Advantages and Disadvantages of Excel in Real Estate Development

Advantage 1: Flexibility

Development feasibilities are constantly changing in-line with the real estate market. New sub-sectors such as Student accommodation and the Private Rented Sector (PRS) have established themselves as mainstream asset classes in recent years. To calculate the GDV of one of these schemes is fundamentally different from how you would analyse another kind of scheme, like a residential build-to-sell.

This is one of the key reasons Excel is still the tool of choice in real estate development. Software solutions have failed to keep pace with the ever-changing market. We have spoken to developers who use a combination of softwares and Excel to calculate their GDV - and this is a significant topic we will cover in more detail at a later date. Suffice to say, there is no reason for developers to invest in paid software solutions that fail to match Excel - which we all have access to at no additional cost. Speaking of cost...

Advantage 2: Cost & Accessibility

Excel is essentially free, given most people have access to Microsoft Office. There is a wealth of content on YouTube and Google that show how to build a model - and for those who are happy to pay for it, you can pay a professional fee to a consultant who will build the document for you, or join a training course.

Disadvantage 1: Training

Excel is an incredibly comprehensive tool, but its complex features require training and only a select few qualified professionals truly understand how to fully maximise these tools. Nick is a Chartered Surveyor who works for Aprao, and received minimal Excel training when it comes to reporting valuations to property developers and investors. When training to qualify as a Surveyor, there is no formal training requirement for operating Excel.

The free nature of the solution is offset by the complexity of the tool. Very few (if any) industry participants require the full functionality of Excel, and only a small proportion of the real estate industry have had formal training on its use. In-depth Excel training can cost thousands, both for the course itself, and the business cost of taking external training days away from the office. Larger organisations employ analysts to run complex feasibility models, and even these organisations are not immune from human error.

Disadvantage 2: Errors

Research suggests that 88% of spreadsheets contain some kind of error. Our CEO Daniel, whilst working at a bank, spent prolonged periods of time trying to break down property developers feasibilities as each one came in a different format. This was one of the reasons he founded Aprao - large amounts of his time was spent checking for mistakes.

Some research even goes a step further and suggests Excel “might be the most dangerous software on the planet," like this article written by Tim Worstall for Forbes in 2013. Tim makes reference to an article by James Kwak, “The Importance of Excel”. James details a mistake in an Excel spreadsheet that cost a large US bank a lot of money.

The very appeal of Excel - its flexibility - can also be its downfall in allowing unchecked margins for human error.

Disadvantage 3: Inconsistency & Lost Efficiencies

The much-lauded flexibility of Excel creates another disadvantage: there is a huge spread of differently-formatted feasibilities creating inconsistencies that result in mistakes, time lost, and general inefficiency.

We have seen hundreds of different development feasibilities, all in different formats. These are often shared with various parties involved in the development process, be it the developer, financing parties, or surveyors. Short of checking the formulas, the recipient has to trust that the feasibility is correct.

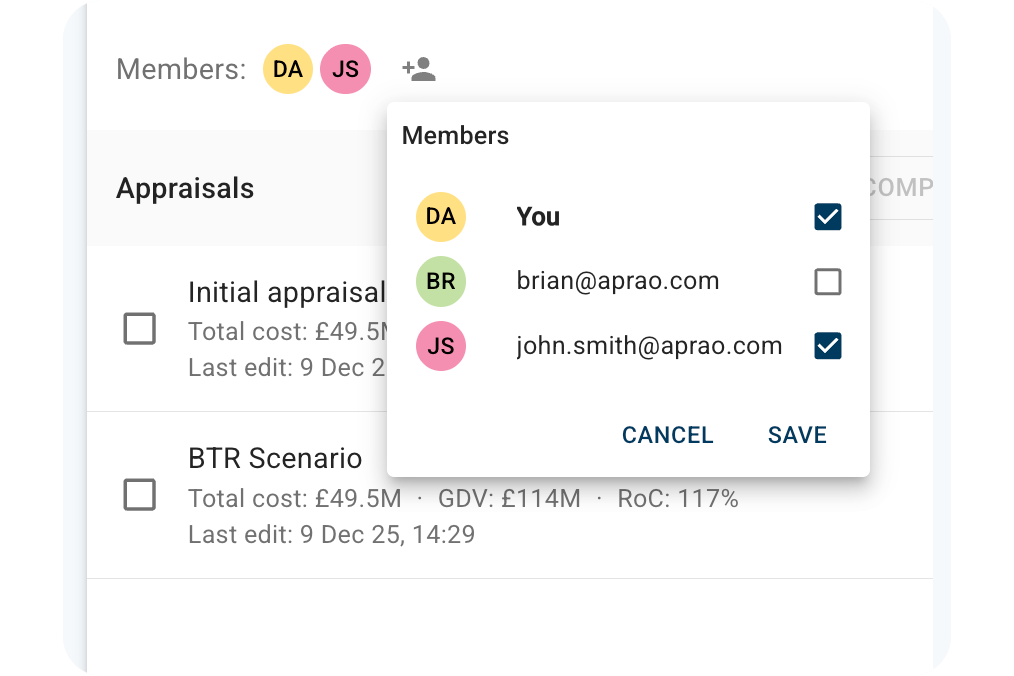

This was one of the key reasons Daniel founded Aprao. Working for a bank he would receive numerous feasibilities each week in varied formats. (Many with mistakes, as we mentioned above.) With many participants contributing to the creation of a development feasibility - all operating under different assumptions and with potentially differing models - one feasibility can end up becoming a virtual Frankenstein's Monster of a document! Standardised feasibilities are preferred by lenders for this very reason, which is why multiple lenders have endorsed the Aprao model.

Leave a comment